Question: Based on the given information, please answer Q3 to make it complete. Thanks. 6 The equity section from the December 31, 2020 balance sheet of

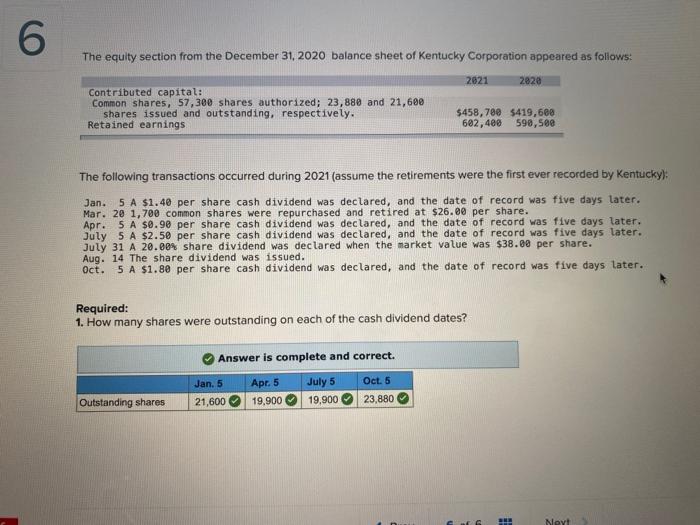

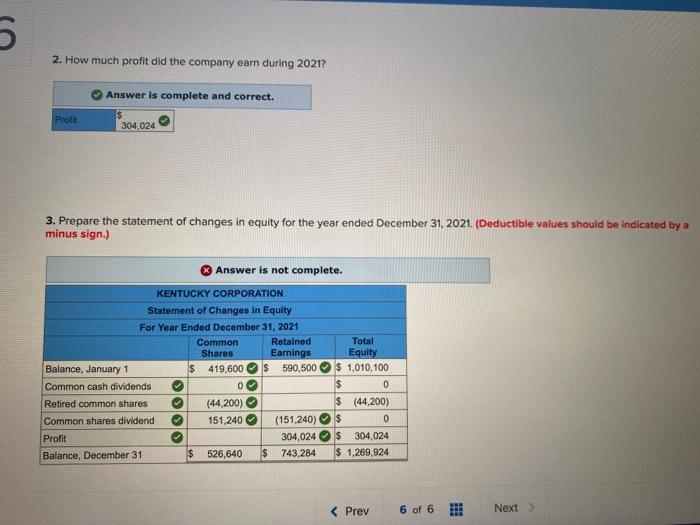

6 The equity section from the December 31, 2020 balance sheet of Kentucky Corporation appeared as follows: 2821 2820 Contributed capital: Common shares, 57,300 shares authorized; 23,880 and 21,600 shares issued and outstanding, respectively. Retained earnings $458,780 $419,688 602,400 590,580 The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Kentucky): Jan. 5 A $1.40 per share cash dividend was declared, and the date of record was five days later. Mar. 20 1,700 common shares were repurchased and retired at $26.00 per share. Apr. 5 A $0.90 per share cash dividend was declared, and the date of record was five days later. July 5 A $2.50 per share cash dividend was declared, and the date of record was five days later. July 31 A 20.00% share dividend was declared when the market value was $38.00 per share. Aug. 14 The share dividend was issued. Oct. 5 A $1.80 per share cash dividend was declared, and the date of record was five days later. Required: 1. How many shares were outstanding on each of the cash dividend dates? Answer is complete and correct. Jan. 5 Apr. 5 July 5 Oct. 5 21,600 19.900 19,900 23,880 Outstanding shares # Neyt 5 2. How much profit did the company earn during 2021? Answer is complete and correct. $ 304,024 Profit 3. Prepare the statement of changes in equity for the year ended December 31, 2021. (Deductible values should be indicated by a minus sign.) Answer is not complete. KENTUCKY CORPORATION Statement of Changes in Equity For Year Ended December 31, 2021 Common Retained Shares Earnings Balance, January 1 S 419,600 $ 590,500 Common cash dividends 0 Retired common shares (44,200) Common shares dividend 151,240 (151,240) Profit 304,024 Balance, December 31 $ 526,640 $ 743,284 OOOO Total Equity $ 1,010,100 $ 0 $ (44,200) $ 0 $ 304,024 1,269,924

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts