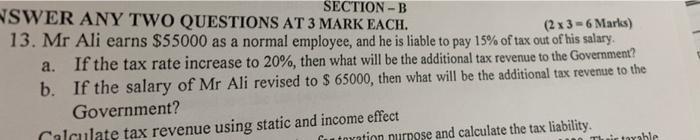

Question: SECTION-B NSWER ANY TWO QUESTIONS AT 3 MARK EACH. (2 x 3-6 Marks) 13. Mr Ali earns $55000 as a normal employee, and he

SECTION-B NSWER ANY TWO QUESTIONS AT 3 MARK EACH. (2 x 3-6 Marks) 13. Mr Ali earns $55000 as a normal employee, and he is liable to pay 15% of tax out of his salary. If the tax rate increase to 20%, then what will be the additional tax revenue to the Government? If the salary of Mr Ali revised to $ 65000, then what will be the additional tax revenue to the Government? a. b. Calculate tax revenue using static and income effect utoration purpose and calculate the tax liability. Their tarable

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

a If the tax rate increase to 20 then what will be the additional tax revenue to the Government a... View full answer

Get step-by-step solutions from verified subject matter experts