Question: Based on the information below, please answer Question 1 1 and Question 1 2 : Company C has one note receivable outstanding from Not Going

Based on the information below, please answer Question and Question :

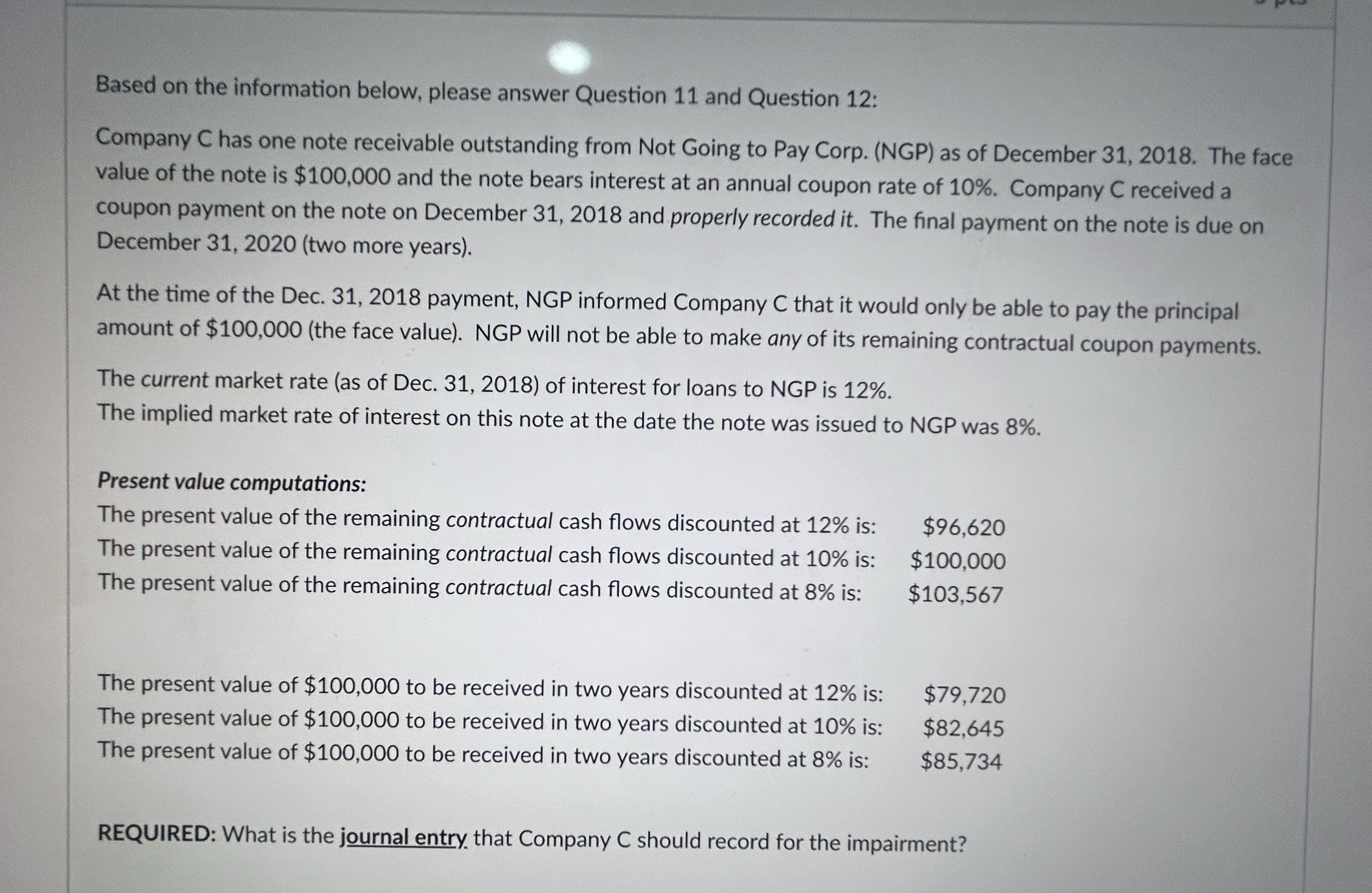

Company C has one note receivable outstanding from Not Going to Pay Corp. NGP as of December The face value of the note is $ and the note bears interest at an annual coupon rate of Company C received a coupon payment on the note on December and properly recorded it The final payment on the note is due on December two more years

At the time of the Dec. payment, NGP informed Company that it would only be able to pay the principal amount of $the face value NGP will not be able to make any of its remaining contractual coupon payments.

The current market rate as of Dec. of interest for loans to NGP is

The implied market rate of interest on this note at the date the note was issued to NGP was

Present value computations:

The present value of the remaining contractual cash flows discounted at is: $

The present value of the remaining contractual cash flows discounted at is: $

The present value of the remaining contractual cash flows discounted at is: $

The present value of $ to be received in two years discounted at is:

The present value of $ to be received in two years discounted at is:

$

The present value of $ to be received in two years discounted at is:

$

$

REQUIRED: What is the journal entry that Company C should record for the impairment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock