Question: Based on the information below, please answer Question 15 and Question 16: Company C sells BAD (biodegradable and dull) knives. At the beginning of

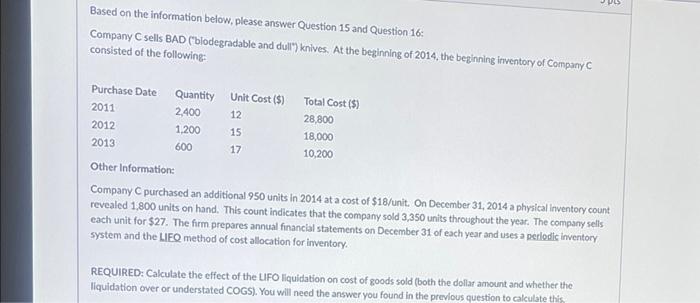

Based on the information below, please answer Question 15 and Question 16: Company C sells BAD ("biodegradable and dull") knives. At the beginning of 2014, the beginning inventory of Company C consisted of the following: Purchase Date Quantity Unit Cost ($) Total Cost ($) 2011 2,400 12 28,800 2012 1,200 15 18,000 2013 600 17 10,200 Other Information: Company C purchased an additional 950 units in 2014 at a cost of $18/unit. On December 31, 2014 a physical inventory count revealed 1,800 units on hand. This count indicates that the company sold 3,350 units throughout the year. The company sells each unit for $27. The firm prepares annual financial statements on December 31 of each year and uses a periodic inventory system and the LIEQ method of cost allocation for inventory. REQUIRED: Calculate the effect of the LIFO liquidation on cost of goods sold (both the dollar amount and whether the liquidation over or understated COGS). You will need the answer you found in the previous question to calculate this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts