Question: Based on the information in Exhibit 1 , Month 2 base returns are closest to: Case Scenario A B C[ Case Scenario Nicola Bancroft, a

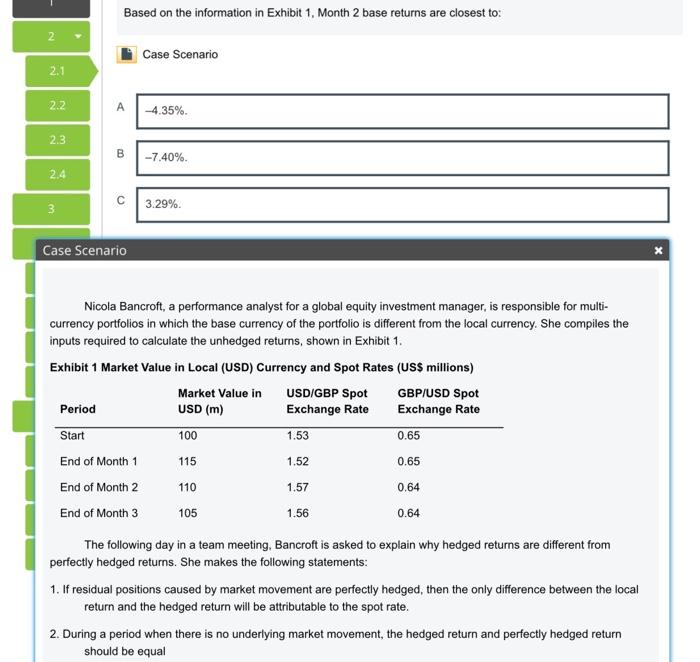

Based on the information in Exhibit 1 , Month 2 base returns are closest to: Case Scenario A B C[ Case Scenario Nicola Bancroft, a performance analyst for a global equity investment manager, is responsible for multicurrency portfolios in which the base currency of the portfolio is different from the local currency. She compiles the inputs required to calculate the unhedged returns, shown in Exhibit 1. Exhibit 1 Market Value in Local (USD) Currency and Spot Rates (US\$ millions) The following day in a team meeting. Bancroft is asked to explain why hedged returns are different from perfectly hedged returns. She makes the following statements: 1. If residual positions caused by market movement are perfectly hedged, then the only difference between the local return and the hedged return will be attributable to the spot rate. 2. During a period when there is no underlying market movement, the hedged return and perfectly hedged return should be equal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts