Question: Based on the management team expectations in the previous phase; they have decided to reduce their exposure to credit risk. But first, they need to

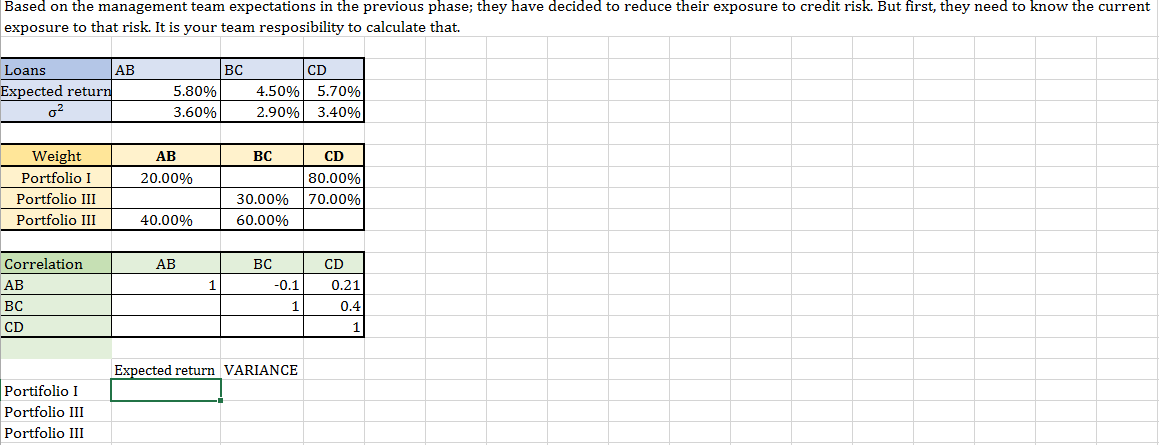

Based on the management team expectations in the previous phase; they have decided to reduce their exposure to credit risk. But first, they need to know the current exposure to that risk. It is your team resposibility to calculate that.

Based on the management team expectations in the previous phase; they have decided to reduce their exposure to credit risk. But first, they need to know the current exposure to that risk. It is your team resposibility to calculate that. BC Loans AB Expected return 02 5.809% 3.60% CD 4.50% 5.70% 2.90% 3.40% BC CD AB 20.00% Weight Portfolio I Portfolio III Portfolio III 80.00% 70.00% 30.00% 60.00% 40.00% AB CD BC -0.1 Correlation AB BC CD 1 0.21 0.4 1 Expected return VARIANCE Portifolio I Portfolio III Portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts