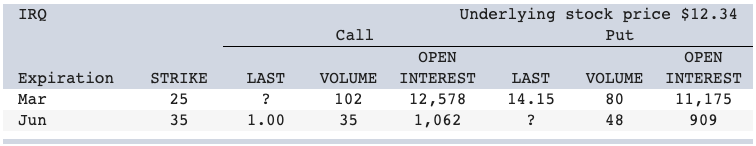

Question: Based on the option quote, the March call should cost: I. less than $12.66, but more than zero. II. less than $22.66, but more than

Based on the option quote, the March call should cost:

- I. less than $12.66, but more than zero.

- II. less than $22.66, but more than $12.56

- III. nothing, as the intrinsic value is negative.

- IV. more than the March 25 put.

IRO Call Underlying stock price $12.34 Put OPEN OPEN INTEREST LAST VOLUME INTEREST 12,578 14.15 80 11,175 1,062 ? 909 Expiration Mar Jun STRIKE 25 LAST ? 1.00 VOLUME 102 35 35 48 Multiple Choice I only I, II, and IV only I, II, and Ill only I and Ill only Ill only

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock