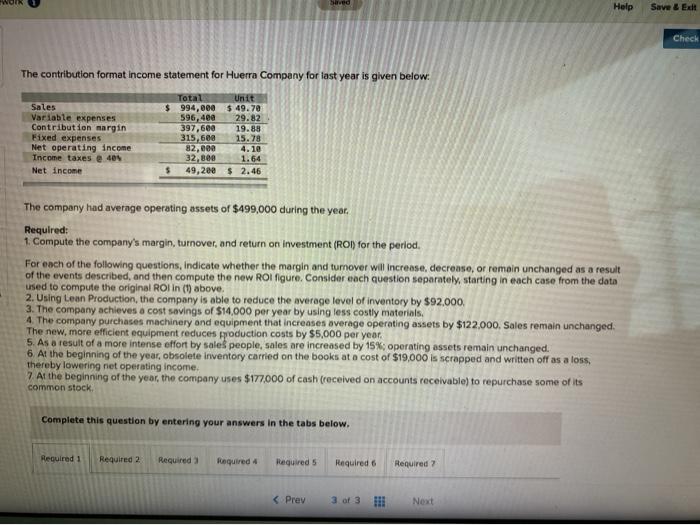

Question: WOLK wed Help Save & Exht Check The contribution format income statement for Huerra Company for last year is given below: Sales Variable expenses Contribution

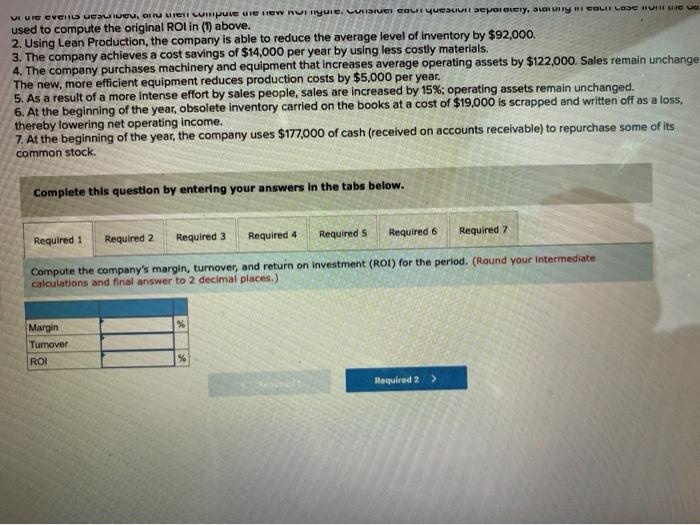

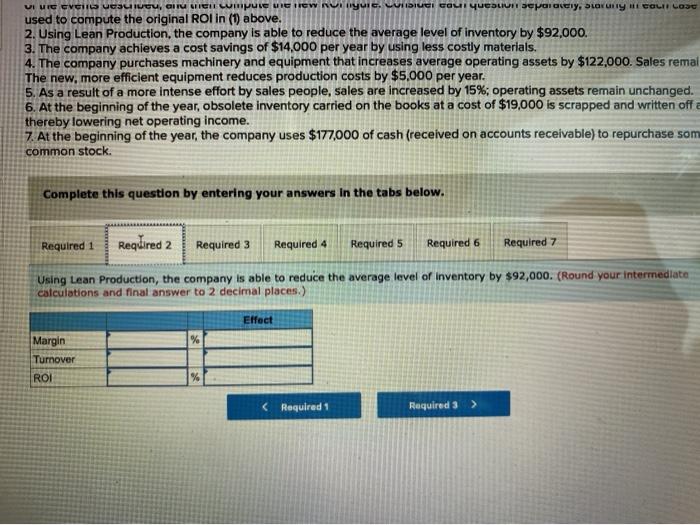

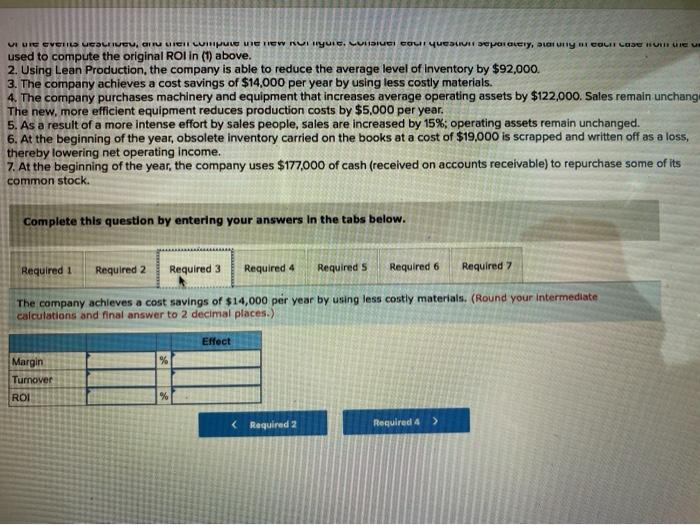

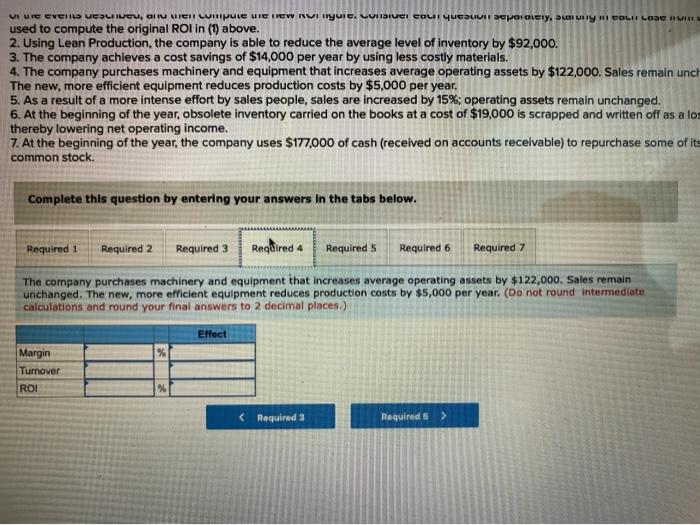

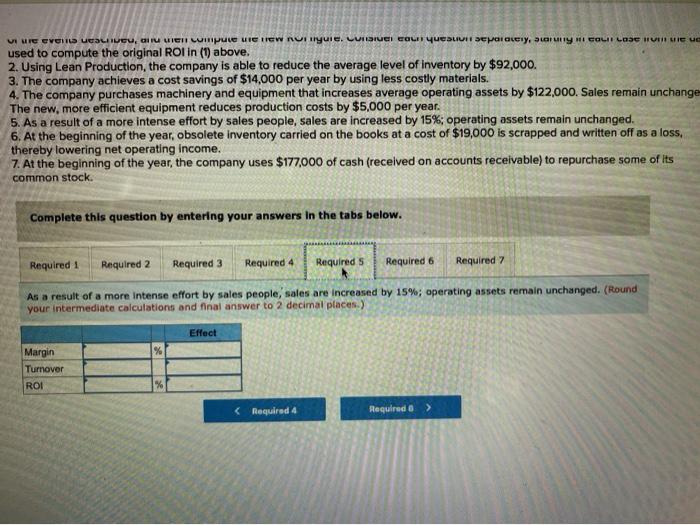

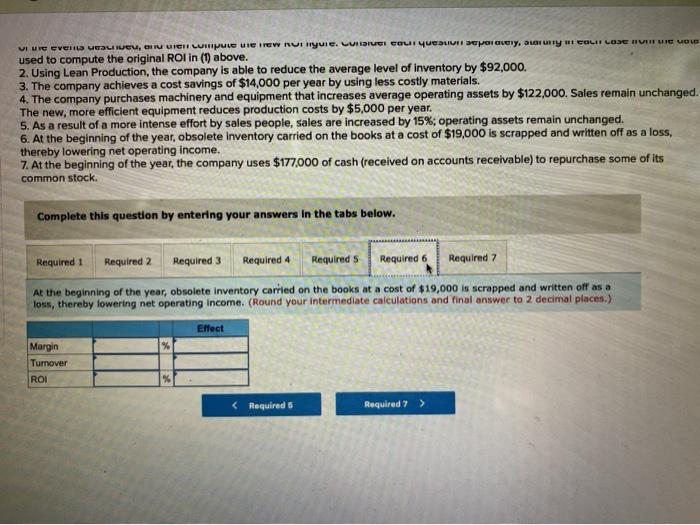

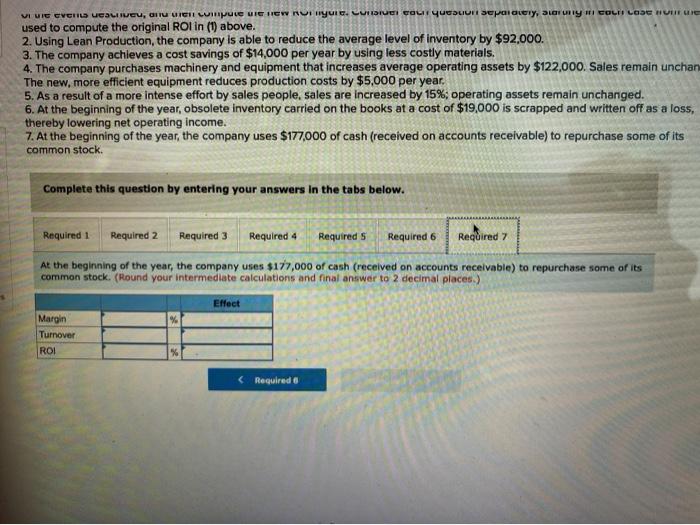

WOLK wed Help Save & Exht Check The contribution format income statement for Huerra Company for last year is given below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes 404 Net income Total Unit $ 994,000 $ 49.70 596,400 29.82 397,600 19.88 315,600 15.78 82,000 4.10 32,800 1.64 $ 49,200 $ 2.46 The company had average operating assets of $499,000 during the year. Required: 1. Compute the company's margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000, 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000, Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%, operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering niet operating income. 7 At the beginning of the year, the company uses $177000 of cash received on accounts receivable) to repurchase some of its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Required 5 Required 6 Required 7 VI WIE EVCHILD UCIUCU, GIU CEI LUmpuve UIE CW RUBYuic. LUIDIUEI COLI YUEDLI SEPOTONE, Sauny HI COLII LDC used to compute the original Rolin (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remai The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase som common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Using Lean Production, the company is able to reduce the average level of inventory by $92,000. (Round your intermediate calculations and final answer to 2 decimal places.) Effect % Margin Turnover ROI UT UTE EVCHILD UCIUCU, TU LEI Luv ME TIEW RUI Hui. LUISUEI Cour questi separately, Loung MI COLII CODE HUMICU used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchang The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 The company achieves a cost savings of $14,000 per year by using less costly materials. (Round your intermediate calculations and final answer to 2 decimal places.) Effect % Margin Turnover ROI % VI UE Eventuesve, I ICHI Lumpule UIC NEW NI Yule. LUNDI EI EDL quesuun separately. Lory I COLII LASER used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unch The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a los thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reqdired 4 Required 5 Required 6 Required 7 The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. (Do not round Intermediate calculations and round your final answers to 2 decimal places.) Effect Margin Turnover ROI % VINIC EVENDUESLI IVCU, GIULIET Lumpule ule HEW RUI ryuie. CURSEI Cour quesuu DEPOI Gey, Y MI COLII LOSE WU Wie we used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchange The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete Inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required Required 6 Required 7 As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. (Round your intermediate calculations and final answer to 2 decimal places.) Effect % Margin Turnover ROI % VIURE Events ESL EU, U LIETILPuue une EW RUI HYUIE. LUDIUEI COLI DEI DOIVE, LAUGHI COLIFLOJE VEUTE VOLO used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92,000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, obsolete Inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering net operating income. (Round your intermediate calculations and final answer to 2 decimal places.) Effect Margin Turnover ROI VI MIE CVETLO UGLIEU, I WICII Lumpure WIE HEWRUHU. LUISIVE Courque sur SepaidCry, SIGURTY HI COLII LODHUR used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $92.000. 3. The company achieves a cost savings of $14,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchan The new, more efficient equipment reduces production costs by $5,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, the company uses $177,000 of cash (received on accounts receivable) to repurchase some of its common stock. (Round your intermediate calculations and final answer to 2 decimal places.) Effect % Margin Turnover ROI %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts