Question: Based on the problem below, answer the questions in this quiz. The questions are independent of one another. Write your answers without decimals and commas,

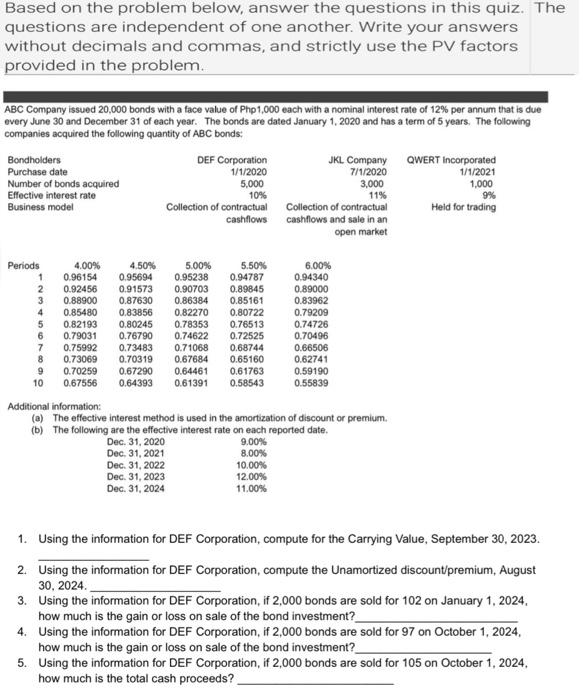

Based on the problem below, answer the questions in this quiz. The questions are independent of one another. Write your answers without decimals and commas, and strictly use the PV factors provided in the problem. ABC Company issued 20,000 bonds with a face value of Php1,000 each with a nominal interest rate of 12% per annum that is due every June 30 and December 31 of each year. The bonds are dated January 1,2020 and has a term of 5 years. The following companies acquired the following quantity of ABC bonds: Additional information: (a) The effective interest mathod is used in the amortization of discount or premium. (b) The following are the effective interest rate on each reported date. 1. Using the information for DEF Corporation, compute for the Carrying Value, September 30, 2023. 2. Using the information for DEF Corporation, compute the Unamortized discount/premium, August 30, 2024. 3. Using the information for DEF Corporation, if 2,000 bonds are sold for 102 on January 1,2024 , how much is the gain or loss on sale of the bond investment? 4. Using the information for DEF Corporation, if 2,000 bonds are sold for 97 on October 1, 2024, how much is the gain or loss on sale of the bond investment? 5. Using the information for DEF Corporation, if 2,000 bonds are sold for 105 on October 1, 2024, how much is the total cash proceeds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts