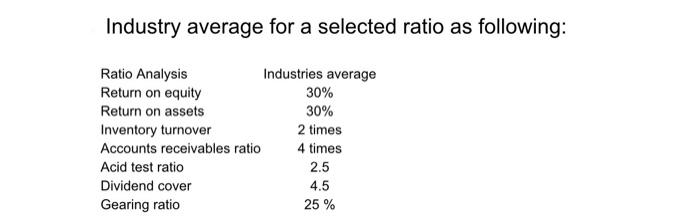

Question: based on the question compare with the industry average in terms of profitability, efficiency and capital structure . Industry average for a selected ratio as

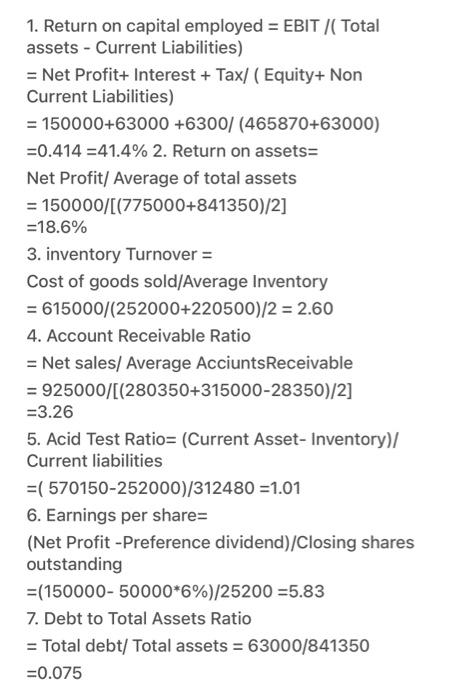

Industry average for a selected ratio as following: Ratio Analysis Return on equity Industries average 30% Return on assets 30% 2 times 4 times Inventory turnover Accounts receivables ratio Acid test ratio Dividend cover Gearing ratio 2.5 4.5 25 % 1. Return on capital employed = EBIT /( Total assets - Current Liabilities) = Net Profit+ Interest + Tax/ (Equity+ Non Current Liabilities) = 150000+63000 +6300/ (465870+63000) =0.414 = 41.4% 2. Return on assets= Net Profit/ Average of total assets = 150000/[(775000+841350)/2] =18.6% 3. inventory Turnover = Cost of goods sold/Average Inventory = 615000/(252000+220500)/2 = 2.60 4. Account Receivable Ratio = Net sales/ Average Acciunts Receivable = 925000/[(280350+315000-28350)/2] = 3.26 5. Acid Test Ratio= (Current Asset- Inventory)/ Current liabilities =(570150-252000)/312480=1.01 6. Earnings per share= (Net Profit -Preference dividend)/Closing shares outstanding =(150000-50000*6%)/25200 =5.83 7. Debt to Total Assets Ratio = Total debt/ Total assets = 63000/841350 = 0.075

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts