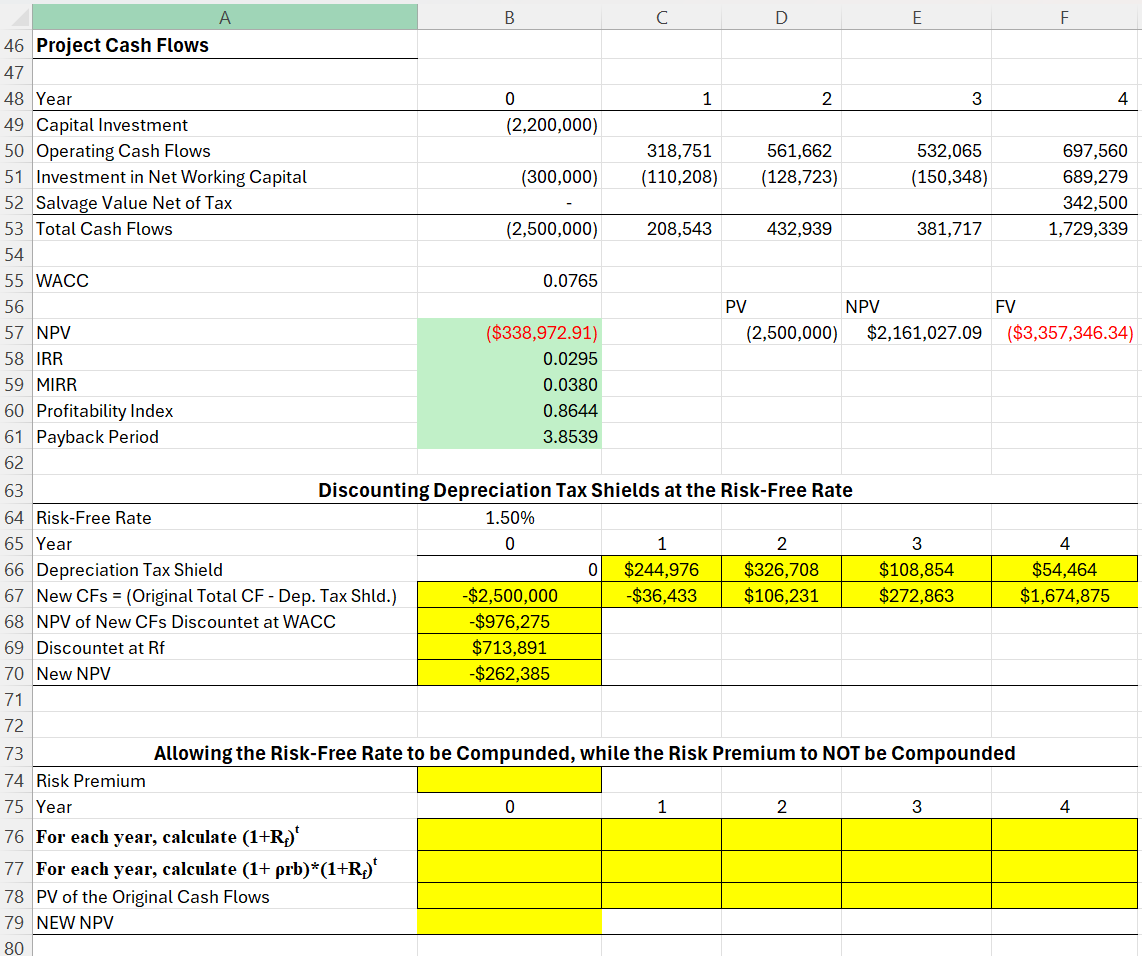

Question: Based on the sample data, Calculate the Risk Premium (?rb) as WACC-RiskFreeRate in Cell B74, using excel formula A B C D E F 46

Based on the sample data, Calculate the Risk Premium (?rb) as WACC-RiskFreeRate in Cell B74, using excel formula

A B C D E F 46 Project Cash Flows 47 48 Year 0 1 2 3 4 49 Capital Investment (2,200,000) 50 Operating Cash Flows 318,751 561,662 532,065 697,560 51 Investment in Net Working Capital (300,000) (110,208) (128,723) (150,348) 689,279 52 Salvage Value Net of Tax 342,500 53 Total Cash Flows (2,500,000) 208,543 432,939 381,717 1,729,339 54 55 WACC 0.0765 56 PV NPV FV 57 NPV ($338,972.91) (2,500,000) $2,161,027.09 ($3,357,346.34) 58 IRR 0.0295 59 MIRR 0.0380 60 Profitability Index 0.8644 61 Payback Period 3.8539 62 63 Discounting Depreciation Tax Shields at the Risk-Free Rate 64 Risk-Free Rate 1.50% 65 Year 0 1 2 3 4 66 Depreciation Tax Shield 0 $244,976 $326,708 $108,854 $54,464 67 New CFs = (Original Total CF - Dep. Tax Shld.) -$2,500,000 $36,433 $106,231 $272,863 $1,674,875 68 NPV of New CFs Discountet at WACC -$976,275 69 Discountet at Rf $713,891 70 New NPV $262,385 71 72 73 Allowing the Risk-Free Rate to be Compunded, while the Risk Premium to NOT be Compounded 74 Risk Premium 75 Year 0 1 2 3 4 76 For each year, calculate (1+R.)* 77 For each year, calculate (1+ prb)*(1+R.* 78 PV of the Original Cash Flows 79 NEW NPV 80