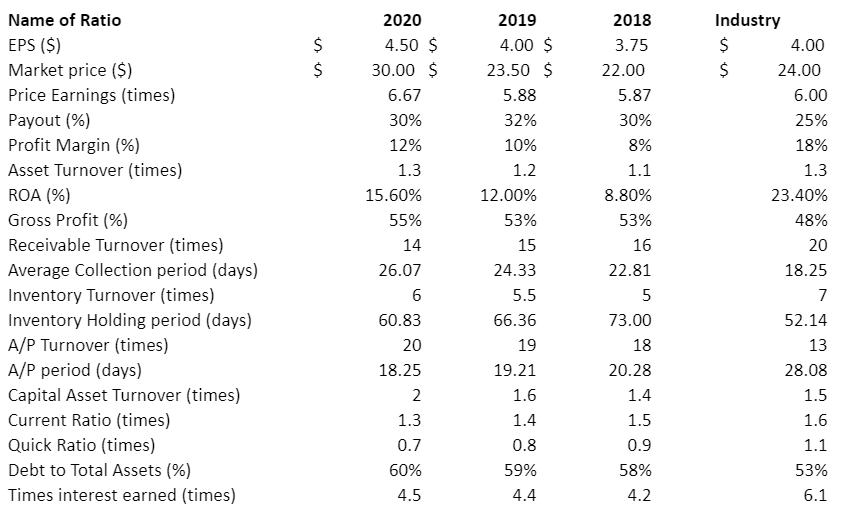

Question: Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You

Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You will only select and comment on the following:

Any 2 Profitability ratios

Any 2 Asset Utilization ratios

Any 1 Liquidity ratio

Any 1 Debt Utilization ratio

To recap, you will comment on a total of 6 ratios only. Not all of them. Would you invest in this organization? Explain. Bullet form is fine.

2018 3.75 22.00 5.87 2019 4.00 $ 23.50 $ 5.88 32% 10% 1.2 12.00% 30% 2020 4.50 $ 30.00 $ 6.67 30% 12% 1.3 15.60% 55% 14 26.07 6 60.83 Industry 4.00 $ 24.00 6.00 25% 18% 1.3 23.40% 48% 53% Name of Ratio EPS ($) Market price ($) Price Earnings (times) Payout (%) Profit Margin (%) Asset Turnover (times) ROA (%) Gross Profit (%) Receivable Turnover (times) Average Collection period (days) Inventory Turnover (times) Inventory Holding period (days) A/P Turnover (times) A/P period (days) Capital Asset Turnover (times) Current Ratio (times) Quick Ratio (times) Debt to Total Assets (%) | Times interest earned (times) 20 8% 1.1 8.80% 53% 16 22.81 5 73.00 18 20.28 1.4 15 24.33 5.5 66.36 19 19.21 18.25 52.14 20 13 18.25 28.08 1.5 2 1. 1.3 1.5 1.6 | 0.7 0.9 1.4 0.8 59% 4.4 58% 60% 4.5 1.1 53% 6.1 4.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts