Question: Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You

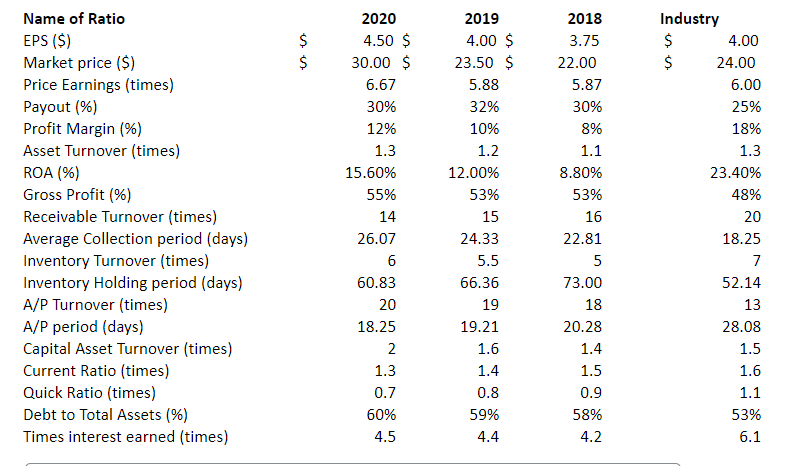

Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You will only select and comment on the following: Any 2 Profitability ratios Any 2 Asset Utilization ratios Any 1 Liquidity ratio Any 1 Debt Utilization ratio To recap, you will comment on a total of 6 ratios only. Not all of them. Would you invest in this organization? Explain. Bullet form is fine. 2019 4.00 $ 23.50 $ $ 5.88 2020 4.50 $ 30.00 $ 6.67 30% 126 1.3 15.60% 55% 14 26.07 32% 10% 1.2 12.00% 53% 2018 3,75 22.00 5.87 30% 8% 1.1 8.80% 53% Industry 4.00 24.00 6.00 256 18% 1.3 23.40% 486 15 16 Name of Ratio EPS ($) Market price ($) Price Earnings (times) Payout (%) Profit Margin (%) Asset Turnover (times) ROA (%) Gross Profit (%) Receivable Turnover (times) Average Collection period (days) Inventory Turnover (times) Inventory Holding period (days) A/P Turnover (times) A/P period (days) Capital Asset Turnover (times) Current Ratio (times) Quick Ratio (times) Debt to Total Assets (%) Times interest earned (times) 20 24.33 22.81 18.25 5.5 60.83 73.00 66.36 19 19.21 1.6 20.28 1.4 52.14 13 28.08 1.5 1.6 1.1 53% 18.25 2 1.3 0.7 60% 4.5 1.4 0.8 59% 4.4 1.5 0.9 58% 4.2 6.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts