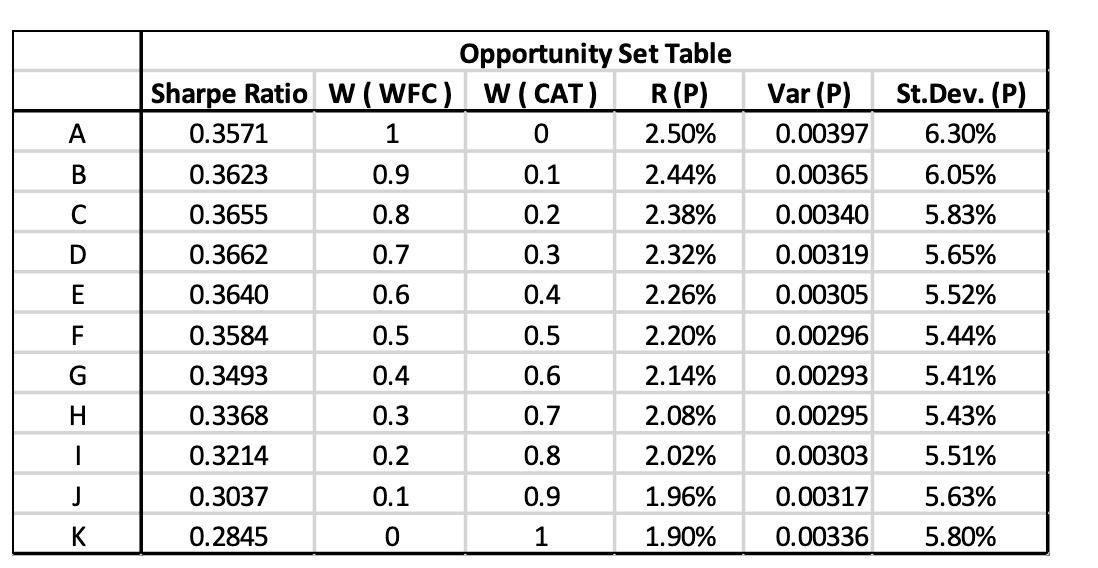

Question: Based on the table above, if your client decides to invest 60% of their money into ORP and 40% into Rf security, what would be

Based on the table above, if your client decides to invest 60% of their money into ORP and 40% into Rf security, what would be the standard deviation of that combination (Rf = 0.25%)? a. 6.30% b. 5.65% c. 5.52% d. 4.28% e. 3.39% f. 2.26%

please show all steps!

Var (P) 0.00397 St.Dev. (P) 6.30% A B 0.00365 0.00340 6.05% 5.83% 5.65% 5.52% D 0.00319 Opportunity Set Table Sharpe Ratio W (WFC) W (CAT) R(P) 0.3571 1 0 2.50% 0.3623 0.9 0.1 2.44% 0.3655 0.8 0.2 2.38% 0.3662 0.7 0.3 2.32% 0.3640 0.6 0.4 2.26% 0.3584 0.5 0.5 2.20% 0.3493 0.4 0.6 2.14% 0.3368 0.3 0.7 2.08% 0.3214 0.2 0.8 2.02% 0.3037 0.1 0.9 1.96% 0.2845 0 1 1.90% E 0.00305 F 0.00296 G U I 0.00293 0.00295 H 5.44% 5.41% 5.43% 5.51% 5.63% 5.80% 1 0.00303 J 0.00317 0.00336 K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts