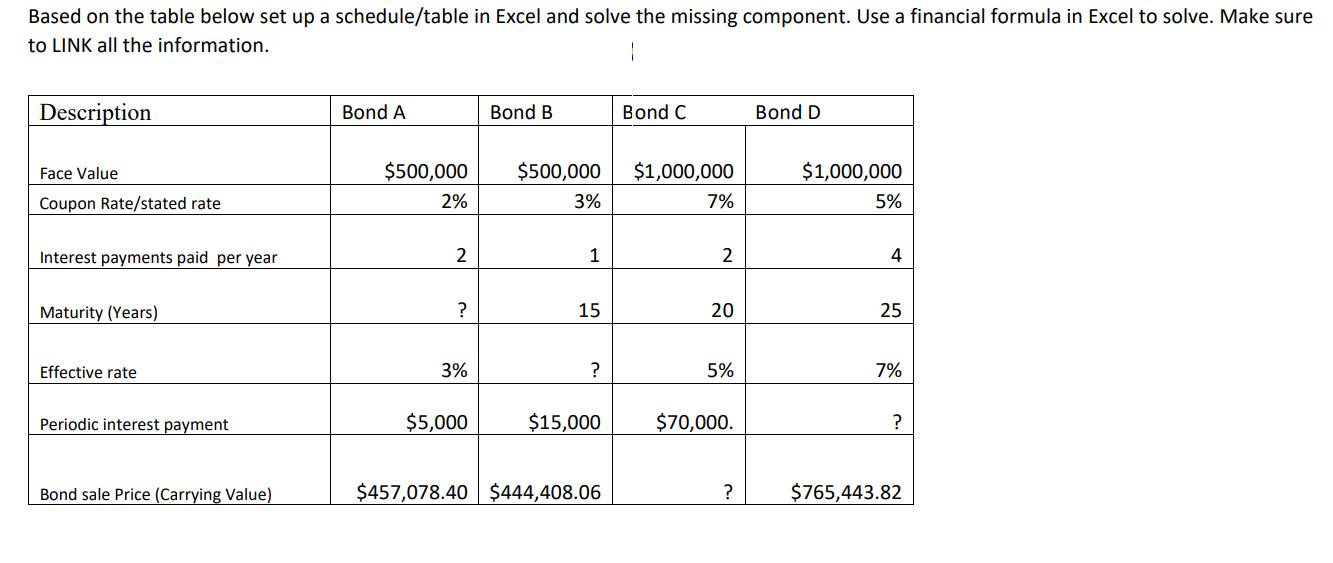

Question: Based on the table below set up a schedule/table in Excel and solve the missing component. Use a financial formula in Excel to solve.

Based on the table below set up a schedule/table in Excel and solve the missing component. Use a financial formula in Excel to solve. Make sure to LINK all the information. 1 Description Face Value Coupon Rate/stated rate Interest payments paid per year Maturity (Years) Effective rate Periodic interest payment Bond sale Price (Carrying Value) Bond A $500,000 2% 2 ? 3% $5,000 Bond B $500,000 3% 1 15 ? $15,000 $457,078.40 $444,408.06 Bond C $1,000,000 7% 2 20 5% $70,000. ? Bond D $1,000,000 5% 4 25 7% ? $765,443.82

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

To solve the missing components in the table using Excel financial formulas follow these steps 1 Bond A Calculate Maturity Years Data for Bond A Face ... View full answer

Get step-by-step solutions from verified subject matter experts