Question: Based on the table suppose you have sold all 30 shares of WFC on February 1, 2022, and kept the proceeds in cash for

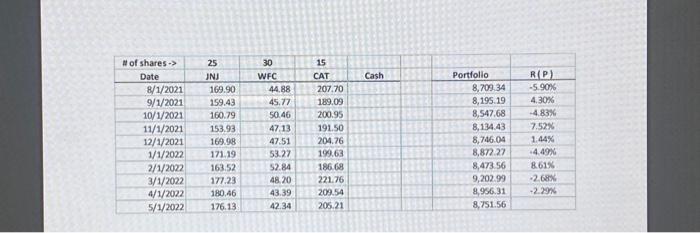

Based on the table suppose you have sold all 30 shares of WFC on February 1, 2022, and kept the proceeds in cash for the rest of the time period. Make the adjustment to the Portfolio returns evaluation and calculate Total Geometric Return over this time period that reflects WFC shares sale. (note: you have 2 tables in excel with the same set up, so you can keep one table for the original portfolio performance and one for the portfolio with the trade). # of shares-> Date 8/1/2021 9/1/2021 10/1/2021 25 JNJ 169.90 159.43 160.79 11/1/2021 153.93 12/1/2021 169.98 1/1/2022 171.19 2/1/2022 3/1/2022 4/1/2022 5/1/2022 163.52 177.23 180.46 176.13 30 WFC 44.88 45.77 50.46 47.13 47.51 53.27 52.84 48.20 43.39 42.34 15 CAT 207.70 189.09 200.95 191.50 204.76 199.63 186.68 221.76 209.54 205.21 Cash Portfolio 8,709.34 8,195.19 8,547.68 8,134.43 8,746.04 8,872.27 8,473.56 9,202.99 8,956.31 8,751.56 R(P) -5.90% 4.30% -4.83% 7.52% 1.44% -4.49% 8.61% -2.68% -2.29%

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

To calculate the adjusted portfolio returns and the total geometric return after selling all 30 shar... View full answer

Get step-by-step solutions from verified subject matter experts