Question: Based on this info: 1- Identify those items or accounts in which there is evidence of a significant change from 2016 to 2017. Present reasons

Based on this info: 1- Identify those items or accounts in which there is evidence of a significant change from 2016 to 2017. Present reasons that explain the change. 2. Explain the results of the financial indicators and compare 2017 with the results obtained in 2016. 3-. Taking into consideration the results obtained, what should the manager and his team do to improve the situation and pursue growth?

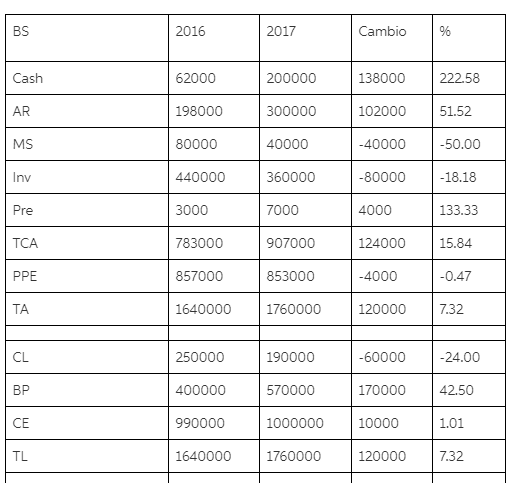

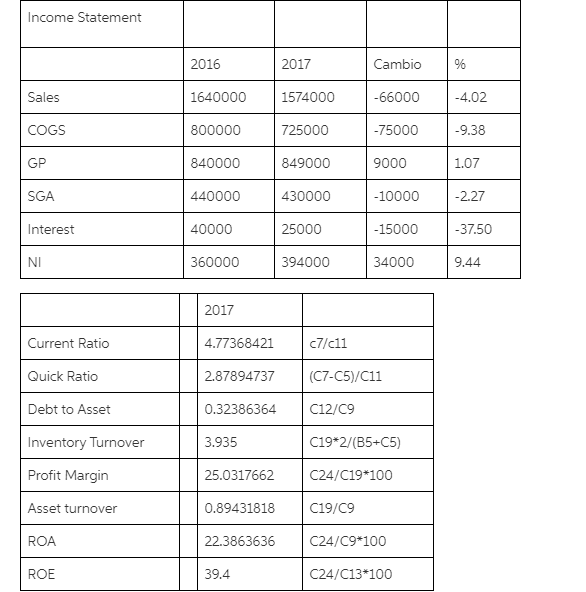

BS 2016 2017 Cambio % Cash 62000 200000 138000 222.58 AR 198000 300000 102000 51.52 MS 80000 40000 -40000 -50.00 Inv 440000 360000 -80000 -18.18 Pre 3000 7000 4000 133.33 TCA 783000 907000 124000 15.84 PPE 857000 853000 -4000 -0.47 TA 1640000 1760000 120000 7.32 CL 250000 190000 -60000 -24.00 BP 400000 570000 170000 42.50 CE 990000 1000000 10000 1.01 TL 1640000 1760000 120000 7.32 Income Statement 2016 2017 Cambio % Sales 1640000 1574000 -66000 -4.02 COGS 800000 725000 -75000 -9.38 GP 840000 849000 9000 1.07 SGA 440000 430000 -10000 -2.27 Interest 40000 25000 -15000 -37.50 NI 360000 394000 34000 9.44 2017 Current Ratio 4.77368421 c7/c11 Quick Ratio 2.87894737 (C7-C5)/C11 Debt to Asset 0.32386364 C12/C9 Inventory Turnover 3.935 C19*2/(B5+C5) Profit Margin 25.0317662 C24/C19*100 Asset turnover 0.89431818 C19/09 ROA 22.3863636 C24/C9*100 ROE 39.4 C24/C13*100 BS 2016 2017 Cambio % Cash 62000 200000 138000 222.58 AR 198000 300000 102000 51.52 MS 80000 40000 -40000 -50.00 Inv 440000 360000 -80000 -18.18 Pre 3000 7000 4000 133.33 TCA 783000 907000 124000 15.84 PPE 857000 853000 -4000 -0.47 TA 1640000 1760000 120000 7.32 CL 250000 190000 -60000 -24.00 BP 400000 570000 170000 42.50 CE 990000 1000000 10000 1.01 TL 1640000 1760000 120000 7.32 Income Statement 2016 2017 Cambio % Sales 1640000 1574000 -66000 -4.02 COGS 800000 725000 -75000 -9.38 GP 840000 849000 9000 1.07 SGA 440000 430000 -10000 -2.27 Interest 40000 25000 -15000 -37.50 NI 360000 394000 34000 9.44 2017 Current Ratio 4.77368421 c7/c11 Quick Ratio 2.87894737 (C7-C5)/C11 Debt to Asset 0.32386364 C12/C9 Inventory Turnover 3.935 C19*2/(B5+C5) Profit Margin 25.0317662 C24/C19*100 Asset turnover 0.89431818 C19/09 ROA 22.3863636 C24/C9*100 ROE 39.4 C24/C13*100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts