Question: Please write the solution out. We don't use excel in this class. 4. Your company was formed to develop virus killing soap during the pandemic.

Please write the solution out. We don't use excel in this class.

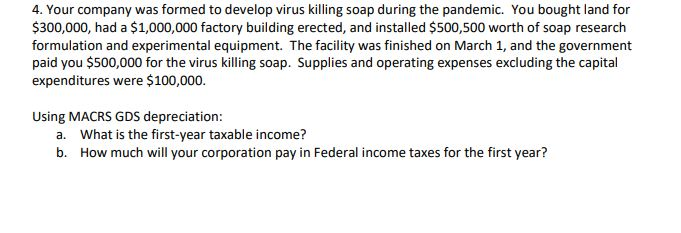

4. Your company was formed to develop virus killing soap during the pandemic. You bought land for $300,000, had a $1,000,000 factory building erected, and installed $500,500 worth of soap research formulation and experimental equipment. The facility was finished on March 1, and the government paid you $500,000 for the virus killing soap. Supplies and operating expenses excluding the capital expenditures were $100,000. Using MACRS GDS depreciation: a. What is the first-year taxable income? b. How much will your corporation pay in Federal income taxes for the first year? 4. Your company was formed to develop virus killing soap during the pandemic. You bought land for $300,000, had a $1,000,000 factory building erected, and installed $500,500 worth of soap research formulation and experimental equipment. The facility was finished on March 1, and the government paid you $500,000 for the virus killing soap. Supplies and operating expenses excluding the capital expenditures were $100,000. Using MACRS GDS depreciation: a. What is the first-year taxable income? b. How much will your corporation pay in Federal income taxes for the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts