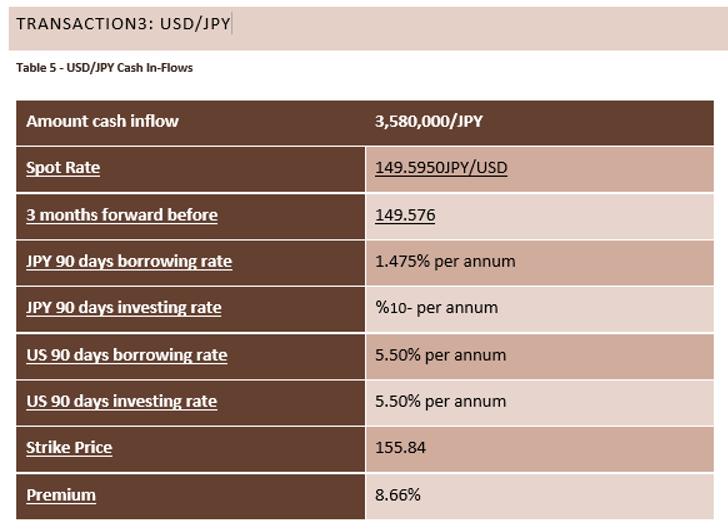

Question: Based on this table. Calculate the hedging strategy used to hedge against the exchange rate risk which is to calculate(remain unhedge, forward hedge, money market

TRANSACTION3: USD/JPY Table 5 - USD/JPY Cash In-Flows Amount cash inflow Spot Rate 3 months forward before JPY 90 days borrowing rate JPY 90 days investing rate US 90 days borrowing rate US 90 days investing rate Strike Price Premium 3,580,000/JPY 149.5950JPY/USD 149.576 1.475% per annum %10- per annum 5.50% per annum 5.50% per annum 155.84 8.66%

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the different hedging strategies lets go step by step 1 Forward Hedge In a forward hedge you enter into a forward contract to lock in a future exchange rate In this case the spot ... View full answer

Get step-by-step solutions from verified subject matter experts