Question: Based on your analyses so far, as John Smith in January 2018, would you buy more Ford stock, continue to hold Ford stock, or sell

Based on your analyses so far, as John Smith in January 2018, would you buy more Ford stock, continue to hold Ford stock, or sell the Ford stock and invest in other auto stocks? Why? Please list your reasons to support your decision.

Based on your analyses so far, as John Smith in January 2018, would you buy more Ford stock, continue to hold Ford stock, or sell the Ford stock and invest in other auto stocks? Why? Please list your reasons to support your decision.

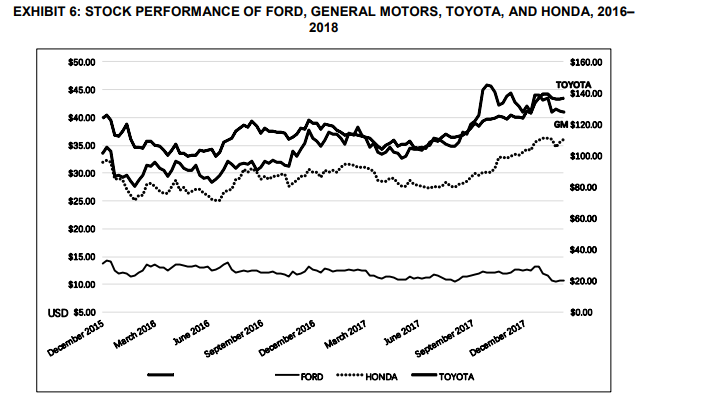

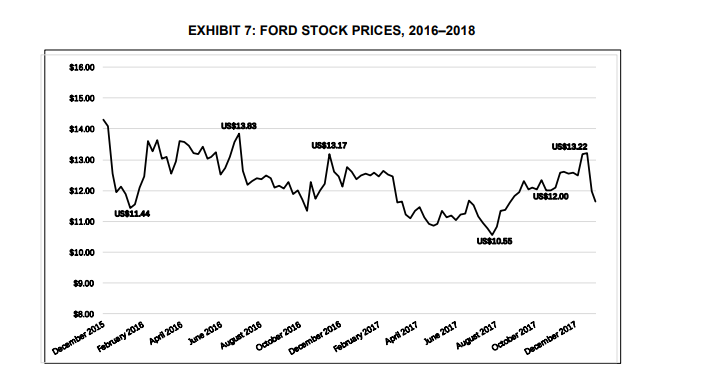

On January 16, 2018, John Smith, a portfolio manager at Uria Investment, was made aware of the Ford Motor Company (Ford) safety recall schedule. Ford announced that it would recall more than one million vehicles worldwide as a result of faulty airbags that had failed to deploy upon collision, causing multiple deaths. It turned out that Ford had been aware of these faulty airbags but had not taken proactive measures to mitigate potential damage. This information was uncovered by the U.S. regulators who were investigating the multiple deaths in Ford vehicles. Because of the investigation, Ford's share price dropped from US$13.10 to US$12.18 per share on January 17, 2018.' Smith was trying to anticipate the future of Ford, as the holding of the Ford equity represented a significant portion of his investment portfolios. Investors had already started contacting him about the future of the company and the state of their investments. Smith anticipated that given the recent announcement, Ford's share value would drop drastically, so he needed to act fast to mitigate the loss of value for his investors. Smith wondered whether Ford could recover from this disaster in the long term and whether its product safety would continue to be an issue and negatively affect its shareholders. While exploring different companies as potential places to reinvest the money, Smith wanted to remain in the automotive industry to maintain the portfolios' diversification. He had thus explored other companies such as Toyota Motor Corporation (Toyota), General Motors Company (GM), and Honda Motor Company Ltd. (Honda) as possible alternatives to Ford. THE ANALYSIS The team at Uria Investment had all of the information available to make their decision. They had the comparative financial informationbalance sheets (see Exhibit 1), income statements (see Exhibit 2), and statements of cash flow (see Exhibit 3)for the four companies, as well as the financial ratios (see Exhibits 4 and 5). Smith had also reviewed Ford's stock price and was taking into consideration analyst forecasts for the stock price, as compared with its competitors (see Exhibits 6 and 7). Ford's stock had EXHIBIT 6: STOCK PERFORMANCE OF FORD, GENERAL MOTORS, TOYOTA, AND HONDA, 2016- 2018 $50.00 $160.00 $45.00 TOYOTA. $140.00 $10.00 GM $120.00 $100.00 $30.00 $80.00 $25.00 $60.00 $20.00 $40.00 $15.00 side $10.00 o n $20.00 USD $5.00 $0.00 TV March 2016 June 2016 December 2015 June 2017 September 2017 December 2017 - FORD ******* HONDA - September 2016 December 2016 March 2017 TOYOTA EXHIBIT 7: FORD STOCK PRICES, 2016-2018 $16.00 $15.00 $14.00 1813 17 $13.00 $12.00 US$11.44 $11.00 US$10.55 $10.00 $9.00 $8.00 December 2015 February 2016 April 2016 June 2016 April 2017 June 2017 August 2016 October 2016 December 2016 February 2017 August 2017 October 2017 December 2017 On January 16, 2018, John Smith, a portfolio manager at Uria Investment, was made aware of the Ford Motor Company (Ford) safety recall schedule. Ford announced that it would recall more than one million vehicles worldwide as a result of faulty airbags that had failed to deploy upon collision, causing multiple deaths. It turned out that Ford had been aware of these faulty airbags but had not taken proactive measures to mitigate potential damage. This information was uncovered by the U.S. regulators who were investigating the multiple deaths in Ford vehicles. Because of the investigation, Ford's share price dropped from US$13.10 to US$12.18 per share on January 17, 2018.' Smith was trying to anticipate the future of Ford, as the holding of the Ford equity represented a significant portion of his investment portfolios. Investors had already started contacting him about the future of the company and the state of their investments. Smith anticipated that given the recent announcement, Ford's share value would drop drastically, so he needed to act fast to mitigate the loss of value for his investors. Smith wondered whether Ford could recover from this disaster in the long term and whether its product safety would continue to be an issue and negatively affect its shareholders. While exploring different companies as potential places to reinvest the money, Smith wanted to remain in the automotive industry to maintain the portfolios' diversification. He had thus explored other companies such as Toyota Motor Corporation (Toyota), General Motors Company (GM), and Honda Motor Company Ltd. (Honda) as possible alternatives to Ford. THE ANALYSIS The team at Uria Investment had all of the information available to make their decision. They had the comparative financial informationbalance sheets (see Exhibit 1), income statements (see Exhibit 2), and statements of cash flow (see Exhibit 3)for the four companies, as well as the financial ratios (see Exhibits 4 and 5). Smith had also reviewed Ford's stock price and was taking into consideration analyst forecasts for the stock price, as compared with its competitors (see Exhibits 6 and 7). Ford's stock had EXHIBIT 6: STOCK PERFORMANCE OF FORD, GENERAL MOTORS, TOYOTA, AND HONDA, 2016- 2018 $50.00 $160.00 $45.00 TOYOTA. $140.00 $10.00 GM $120.00 $100.00 $30.00 $80.00 $25.00 $60.00 $20.00 $40.00 $15.00 side $10.00 o n $20.00 USD $5.00 $0.00 TV March 2016 June 2016 December 2015 June 2017 September 2017 December 2017 - FORD ******* HONDA - September 2016 December 2016 March 2017 TOYOTA EXHIBIT 7: FORD STOCK PRICES, 2016-2018 $16.00 $15.00 $14.00 1813 17 $13.00 $12.00 US$11.44 $11.00 US$10.55 $10.00 $9.00 $8.00 December 2015 February 2016 April 2016 June 2016 April 2017 June 2017 August 2016 October 2016 December 2016 February 2017 August 2017 October 2017 December 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts