Question: Based on your analysis on Lab 1, Mr. Coffee has decided to place its new factory in Beijing China, and is exploring how to deliver

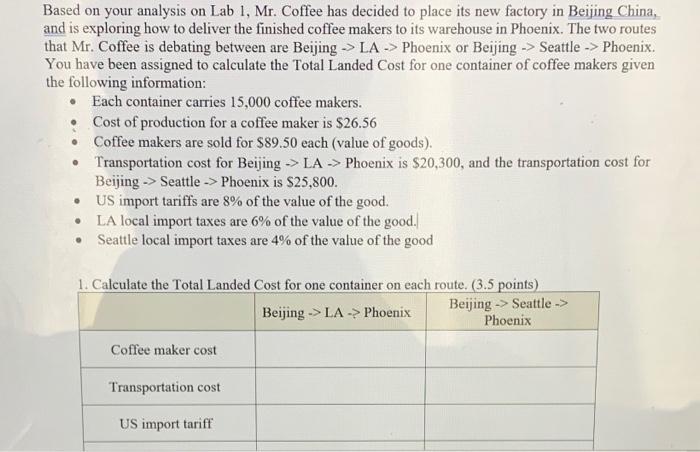

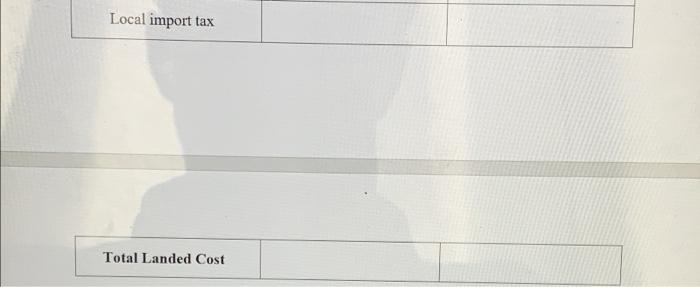

Based on your analysis on Lab 1, Mr. Coffee has decided to place its new factory in Beijing China, and is exploring how to deliver the finished coffee makers to its warehouse in Phoenix. The two routes that Mr. Coffee is debating between are Beijing -> LA -> Phoenix or Beijing -> Seattle -> Phoenix. You have been assigned to calculate the Total Landed Cost for one container of coffee makers given the following information: Each container carries 15,000 coffee makers. Cost of production for a coffee maker is $26.56 Coffee makers are sold for $89.50 each (value of goods). Transportation cost for Beijing -> LA -> Phoenix is $20,300, and the transportation cost for Beijing -> Seattle -> Phoenix is $25,800. US import tariffs are 8% of the value of the good. LA local import taxes are 6% of the value of the good. Seattle local import taxes are 4% of the value of the good . -> . 1. Calculate the Total Landed Cost for one container on each route. (3.5 points) Beijing -> Seattle -> Beijing -> LA -> Phoenix Phoenix Coffee maker cost Transportation cost US import tariff Local import tax Total Landed Cost Based on your analysis on Lab 1, Mr. Coffee has decided to place its new factory in Beijing China, and is exploring how to deliver the finished coffee makers to its warehouse in Phoenix. The two routes that Mr. Coffee is debating between are Beijing -> LA -> Phoenix or Beijing -> Seattle -> Phoenix. You have been assigned to calculate the Total Landed Cost for one container of coffee makers given the following information: Each container carries 15,000 coffee makers. Cost of production for a coffee maker is $26.56 Coffee makers are sold for $89.50 each (value of goods). Transportation cost for Beijing -> LA -> Phoenix is $20,300, and the transportation cost for Beijing -> Seattle -> Phoenix is $25,800. US import tariffs are 8% of the value of the good. LA local import taxes are 6% of the value of the good. Seattle local import taxes are 4% of the value of the good . -> . 1. Calculate the Total Landed Cost for one container on each route. (3.5 points) Beijing -> Seattle -> Beijing -> LA -> Phoenix Phoenix Coffee maker cost Transportation cost US import tariff Local import tax Total Landed Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts