Question: Based on your calculations in the excel above do you approve Dobrynins plan to recapitalize the company? Why? Answer in 4-5 sentences. No leverage Operating

Based on your calculations in the excel above do you approve Dobrynins plan to recapitalize the company? Why? Answer in 4-5 sentences.

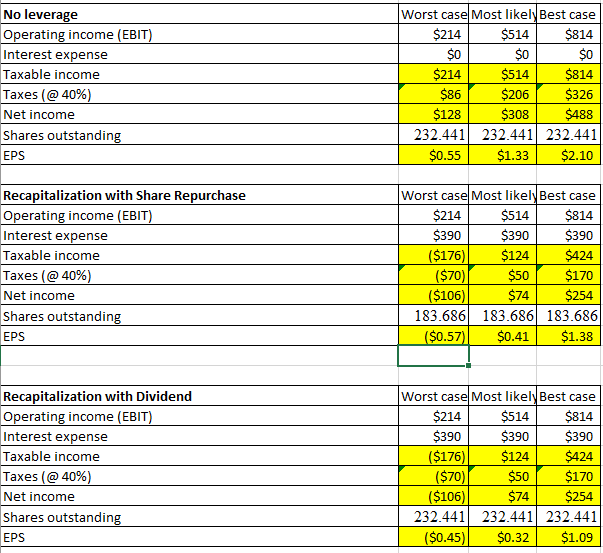

No leverage Operating income (EBIT) Interest expense Taxable income Taxes (@40%) Net income Shares outstanding EPS Worst case Most likely Best case $214 $514 $814 $0 $0 $0 $214 $514 $814 $86 $206 $326 $128 $308 $488 232.441 232.441 232.441 $0.55 $1.33 $2.10 Recapitalization with Share Repurchase Operating income (EBIT) Interest expense Taxable income Taxes (@40%) Net income Shares outstanding EPS Worst case Most likely Best case $214 $514 $814 $390 $390 $390 ($176) $124 $424 ($70) $50 $170 ($106) $74 $254 183.686 183.686 183.686 ($0.57) $0.41 $1.38 Recapitalization with Dividend Operating income (EBIT) Interest expense Taxable income Taxes (@40%) Net income Shares outstanding EPS Worst case Most likely Best case $214 $514 $814 $390 $390 $390 ($176) $124 $424 ($70) $50 $170 ($106) $254 232.441 232.441 232.441 ($0.45) $0.32 $1.09 $74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts