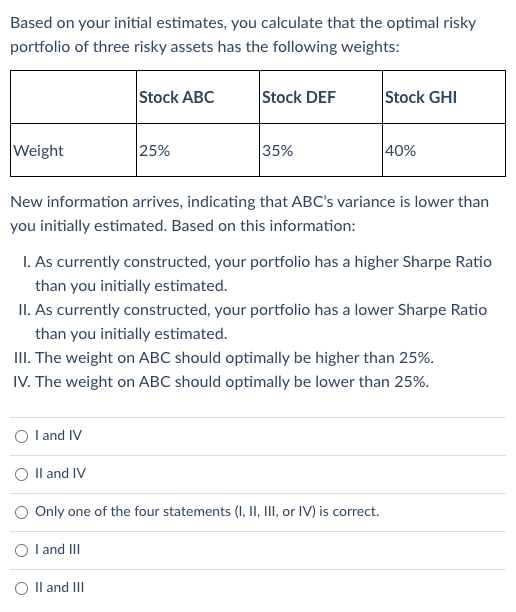

Question: Based on your initial estimates, you calculate that the optimal risky portfolio of three risky assets has the following weights: Stock ABC Stock DEF Stock

Based on your initial estimates, you calculate that the optimal risky portfolio of three risky assets has the following weights: Stock ABC Stock DEF Stock GHI Weight 25% 35% |40% New information arrives, indicating that ABC's variance is lower than you initially estimated. Based on this information: 1. As currently constructed, your portfolio has a higher Sharpe Ratio than you initially estimated. II. As currently constructed, your portfolio has a lower Sharpe Ratio than you initially estimated. III. The weight on ABC should optimally be higher than 25%. IV. The weight on ABC should optimally be lower than 25%. O I and IV O II and IV Only one of the four statements (I, II, III, or IV) is correct. O I and III O II and III Based on your initial estimates, you calculate that the optimal risky portfolio of three risky assets has the following weights: Stock ABC Stock DEF Stock GHI Weight 25% 35% |40% New information arrives, indicating that ABC's variance is lower than you initially estimated. Based on this information: 1. As currently constructed, your portfolio has a higher Sharpe Ratio than you initially estimated. II. As currently constructed, your portfolio has a lower Sharpe Ratio than you initially estimated. III. The weight on ABC should optimally be higher than 25%. IV. The weight on ABC should optimally be lower than 25%. O I and IV O II and IV Only one of the four statements (I, II, III, or IV) is correct. O I and III O II and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts