Question: Based on your Net Present Value (NPV) and Internal Rate of Return (IRR) calculations, would this be a good investment for Ms. Jants? Answer Yes,

Based on your Net Present Value (NPV) and Internal Rate of Return (IRR) calculations, would this be a good investment for Ms. Jants? Answer "Yes", "No" or "Uncertain" in "a)" below. Provide a justification for your recommendation in "b)".

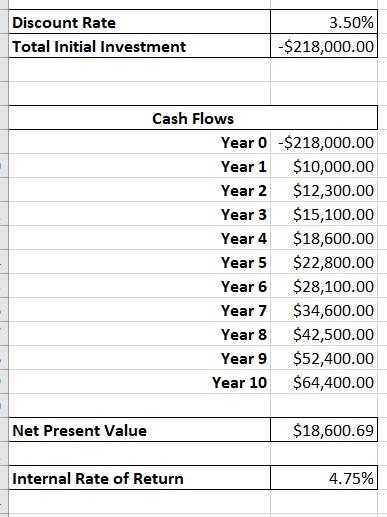

Discount Rate Total Initial Investment 3.50% -$218,000.00 Cash Flows Year 0 -$218,000.00 Year 1 $10,000.00 Year 2 $12,300.00 Year 3 $15,100.00 Year 4 $18,600.00 Year 5 $22,800.00 Year 6 $28,100.00 Year 7 $34,600.00 Year 8 $42,500.00 Year 9 $52,400.00 Year 10 $64,400.00 Net Present Value $18,600.69 Internal Rate of Return 4.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts