Question: Based on your Ratio Analysis, what steps would you advise your new client to take due to their company's current performance? Please give as detailed

Based on your Ratio Analysis, what steps would you advise your new client to take due to their company's current performance? Please give as detailed an answer as possible.

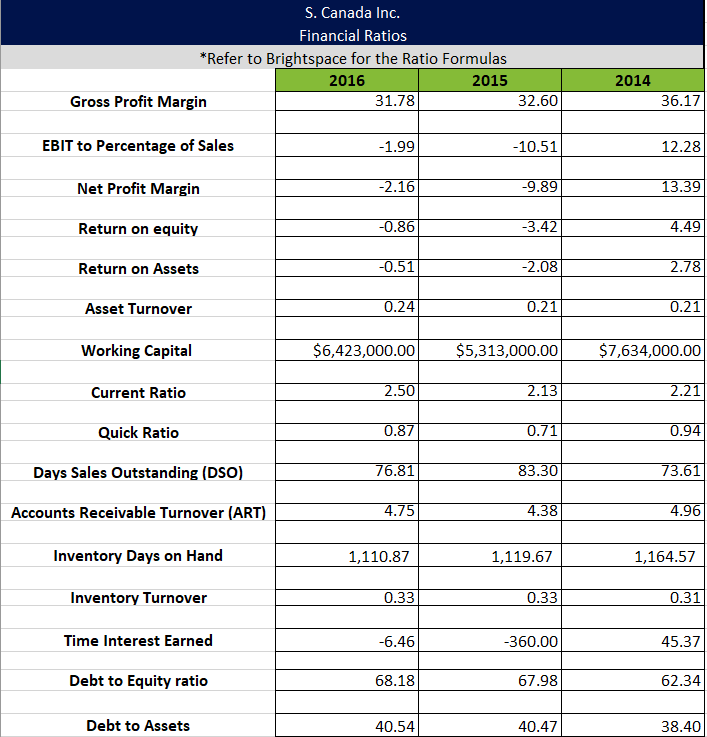

S. Canada Inc. Financial Ratios *Refer to Brightspace for the Ratio Formulas Gross Profit Margin EBIT to Percentage of Sales Net Profit Margin Return on equity Return on Assets Asset Turnover Working Capital Current Ratio Quick Ratio Days Sales Outstanding (DSO) Accounts Receivable Turnover (ART) Inventory Days on Hand Inventory Turnover Time Interest Earned Debt to Equity ratio Debt to Assets \begin{tabular}{|c|c|c|} \hline 2016 & 2015 & 2014 \\ \hline 31.78 & 32.60 & 36.17 \\ \hline-1.99 & -10.51 & 12.28 \\ \hline-2.16 & -9.89 & 13.39 \\ \hline-0.86 & -3.42 & 4.49 \\ \hline-0.51 & -2.08 & 2.78 \\ \hline 0.24 & 0.21 & 0.21 \\ \hline$6,423,000.00 & $5,313,000.00 & $7,634,000.00 \\ \hline 2.50 & 2.13 & 2.21 \\ \hline 0.87 & 0.71 & 0.94 \\ \hline 76.81 & 83.30 & 73.61 \\ \hline 4.75 & 4.38 & 4.96 \\ \hline 1,110.87 & 1,119.67 & 1,164.57 \\ \hline \begin{tabular}{l|l|} 0.33 \\ \end{tabular} & 0.33 & 0.31 \\ \hline-6.46 & -360.00 & 45.37 \\ \hline 68.18 & 67.98 & 62.34 \\ \hline 40.54 & 40.47 & 38.40 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts