Question: Based only on the information given, what questions would an auditor ask a CFO to receive necessary information to complete and correct the financial statements?

Based only on the information given, what questions would an auditor ask a CFO to receive necessary information to complete and correct the financial statements?

You asked Linda how the crew trucks would be depreciated for tax purposes. She indicated that they would be depreciated using the 5-year half year convention Modified Accelerated Cost Recovery System (MACRS) schedule. She also reminded you that the Shop Equipment purchased last year is being depreciated using the 7-year half year convention MACRS schedule. She also noted that she understood that both fixed assets and equipment are depreciated to the nearest full year for book purposes. Linda had a number of questions for you on another client, so you completed your conversation over lunch. Before leaving, she reminded you that the MACRS depreciation schedules can be found on the IRS.gov website.

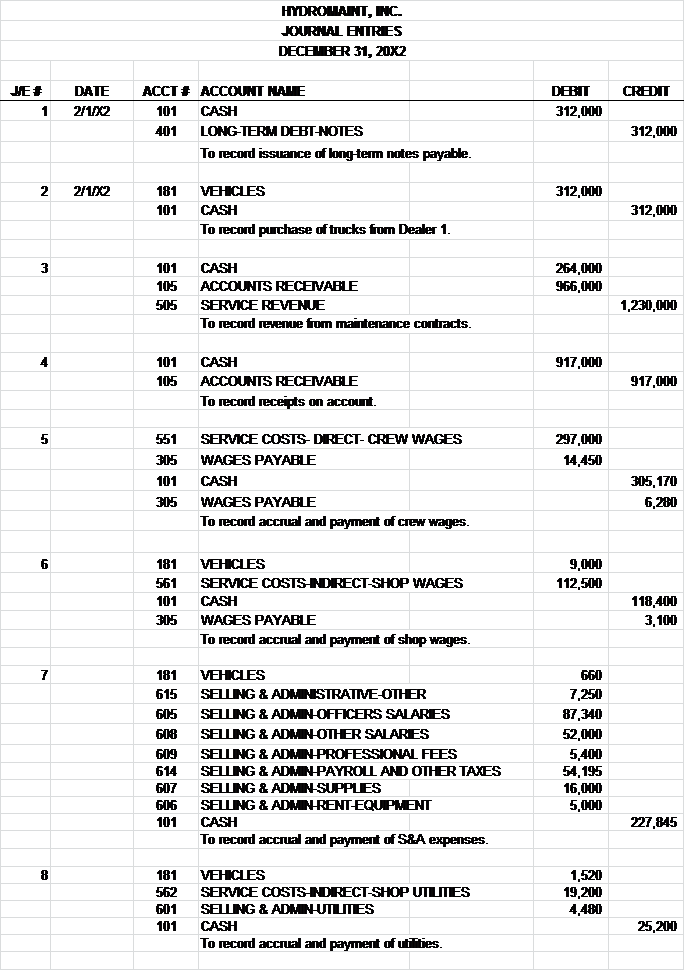

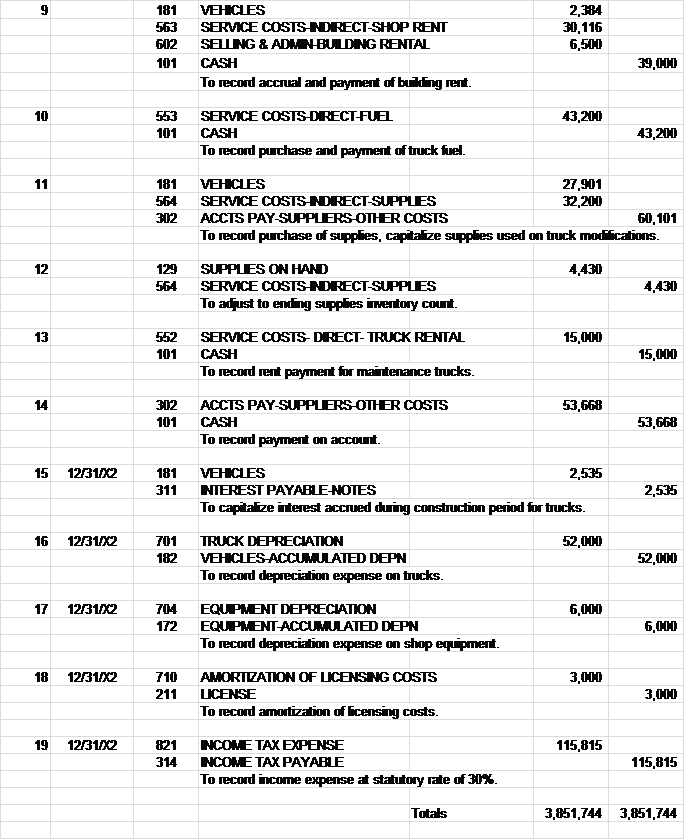

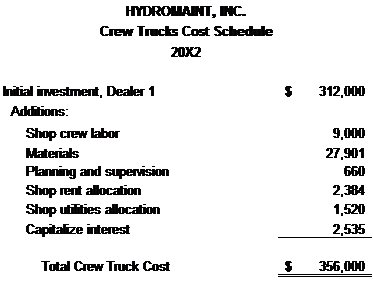

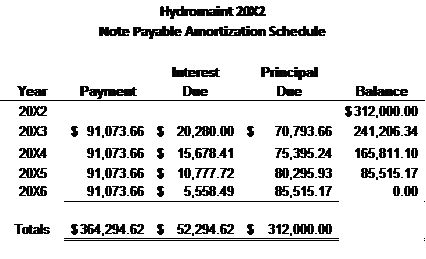

REQUIRED: The journal entries and financial statements prepared by Jerry Loos are attached. Also provided are the crew truck cost schedule you recommended Jerry prepare and the note amortization schedule from the Bank. You will find that it is not at all clear how Jerry calculated the numbers on the crew truck cost schedule. After reviewing the schedule, you briefly discussed the capitalization of interest item with Tom Lockhart. Tom suggested that you review the accounting literature on self-constructed assets. He indicated that interest capitalization is allowed if certain criteria are met. Specifically, he said that if a substantial investment in property exists and an extended time period is spent preparing the property for actual use, some interest may be capitalized.

Review the clients data and prepare a list of additional information items needed from Jerry.

Be sure to include any necessary questions to get the information needed to reconcile each truck schedule number. Be as specific as possible and phrase your requests in the form of questions as they normally would be asked of a client. Be sure to provide a written reason that you are asking each question and also provide a reference to the FASB codification where appropriate. Jerry assured you that the bank account has been reconciled and that outstanding checks account for the only reconciling items. He also indicated that all vendor invoices reflecting business through December 31, 20X2 have been booked.

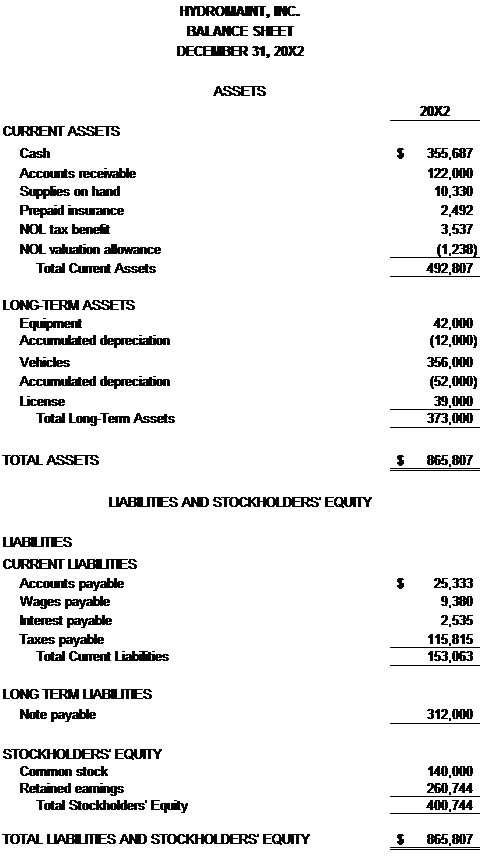

BALANCE SHEET DECHLBER 31, 20x2 20X2 CURRENT ASSETS 5355,687 122.00O 10.330 2492 3,537 Acconnts neceivable Prepad ISaICe NOL tax beneit NOL valaionalowance Total Cument Assets 492,807 LONG-TERM ASSETS 42.0M (12,000) 356.000 (52,000) 3,00O 373000 Vehicles Total LongTem Assets TOTAL ASSETS $865.BOT IAB TES AND STOCKHOLDERS EQUITY Accounts payable 525.333 934 2.535 115,815 153,053 terest payable Total Cument iabiies LONG TERM LABLTES Note payable 312,000 Common stock 140,000 260,744 400,744 Total Stockholders' Eqy TOTAL LIAB TES AND STOCKHOLDERS EQUITY $865.BOT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts