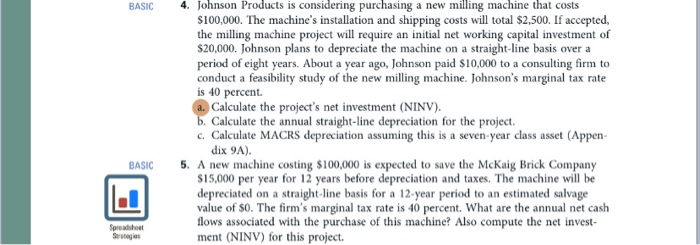

Question: BASIC 4. Johnson Products is considering purchasing a new milling machine that costs $100,000. The machine's installation and shipping costs will total $2,500. If accepted,

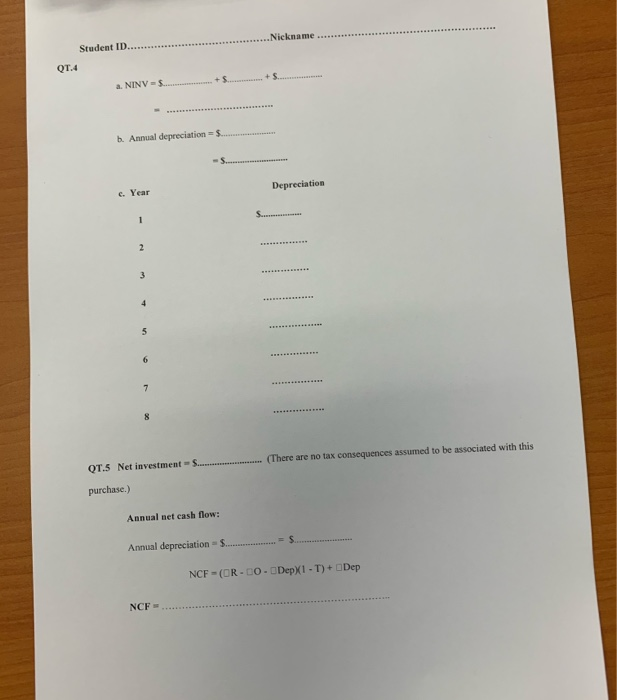

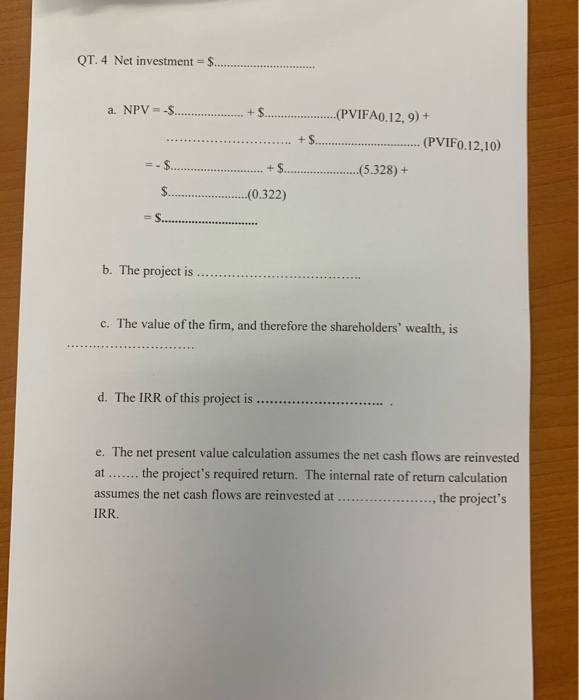

BASIC 4. Johnson Products is considering purchasing a new milling machine that costs $100,000. The machine's installation and shipping costs will total $2,500. If accepted, the milling machine project will require an initial networking capital investment of $20,000. Johnson plans to depreciate the machine on a straight-line basis over a period of eight years. About a year ago, Johnson paid $10,000 to a consulting firm to conduct a feasibility study of the new milling machine. Johnson's marginal tax rate is 40 percent. a. Calculate the project's net investment (NINV). b. Calculate the annual straight-line depreciation for the project. c. Calculate MACRS depreciation assuming this is a seven-year class asset (Appen dix 9A). 5. A new machine costing $100,000 is expected to save the McKaig Brick Company $15,000 per year for 12 years before depreciation and taxes. The machine will be depreciated on a straight-line basis for a 12-year period to an estimated salvage value of SO. The firm's marginal tax rate is 40 percent. What are the annual net cash flows associated with the purchase of this machine? Also compute the net invest- ment (NINV) for this project. BASIC Spreadsheet Strategies Nickname Student ID... QT.4 a. NINV = ..................... b. Annual depreciation = ................... Depreciation OT.5 Net investment ....................... (There are no tax consequences assumed to be associated with this purchase.) Annual net cash flow: Annual depreciation - S....................= NCF -(OR-00-DepX1 - T)+ Dep NCF ... QT. 4 Net investment = $... a. NPV = -S............... (PVIFA0.12.9) + ....... ................. + S.......... ............ (PVIFO.12,10) = - ....................... +$....................(5.328) + ......................(0.322) S.............. b. The project is ..... C. The value of the firm, and therefore the shareholders' wealth, is d. The IRR of this project is ... e. The net present value calculation assumes the net cash flows are reinvested at ....... the project's required return. The internal rate of return calculation assumes the net cash flows are reinvested at ... ..............., the project's IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts