Question: Johnson Products is considering purchasing a new milling machine that costs $100,000. The machine's Installation and shipping costs will total $1,000. If accepted, the milling

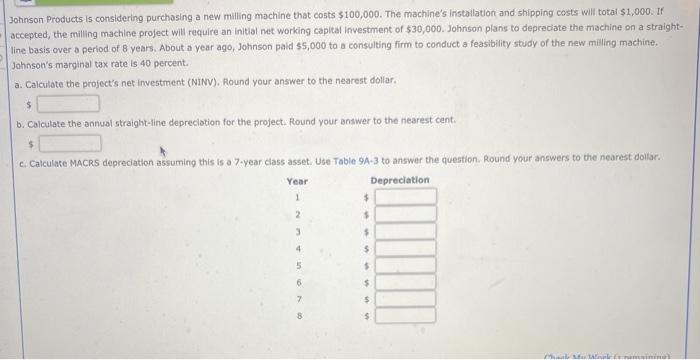

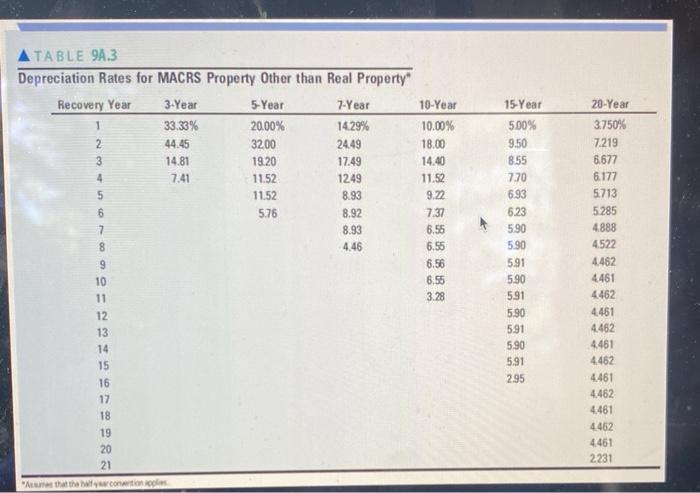

Johnson Products is considering purchasing a new milling machine that costs $100,000. The machine's Installation and shipping costs will total $1,000. If accepted, the milling machine project will require an initial networking capital investment of $30,000. Johnson plans to depreciate the machine on a straight- line basis over a period of 8 years. About a year ago, Johnson paid $5,000 to a consulting firm to conduct a feasibility study of the new milling machine. Johnson's marginal tax rate is 40 percent. a. Calculate the project's net investment (NIN). Round your answer to the nearest dollar. b. Calculate the annual straight-line depreciation for the project. Round your answer to the nearest cent. $ c. Calculate MACRs depreciation assuming this is a 7-year class asset. Use Table 9A-3 to answer the question. Round your answers to the nearest dollar Depreciation Year 1 $ $ 2 $ $ $ $ $ ATABLE 98.3 Depreciation Rates for MACRS Property Other than Real Property" Recovery Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 1429% 2 44.45 3200 24.49 3 14.81 19.20 17.49 4 7.41 11.52 1249 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 9 10 11 12 13 14 15 16 17 18 19 20 21 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00% 9.50 8.55 7.70 6.93 623 5.90 5.90 5.91 5.90 591 5.90 591 5.90 5.91 2.95 20-Year 3.750% 7.219 6.677 6.177 5713 5285 4.888 4522 4.462 4461 4462 4461 4462 4.461 4462 4.461 4.462 4.461 4.462 4461 2231 At that the control

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts