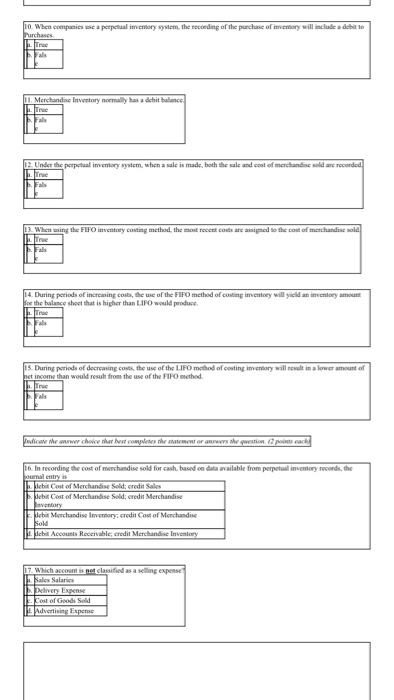

Question: Basic accounting questions When companies use a perceptual system, the recording of the purchase of inventory will include a debit to purchases. Merchandise inventory normally

When companies use a perceptual system, the recording of the purchase of inventory will include a debit to purchases. Merchandise inventory normally have a debit balance Under the inventory system When a sale is made both the sale and cost of merchants sold are recorded. When using the FIFO inventory method, the most recent costs are aligned to the cost of merchandise sold During the periods of increasing costs, the use of the FIFO method of coding inventory will yield an inventory amount for the balance sheet that is higher than LIFO would produce. During the periods of increasing costs, the use of the LIFO method of costing inventory will result in a lower amount pf ne t income than would result from the use of the FIFO method. In recording the cost of merchandise solid for cash, based on data available from inventory records the Which account is no classified as a scaling expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts