Question: LEARNING COMPETENCY WITH CODE Complete the accounting cycle of a merchandising business (ABM_FABM11-IVe-j-40). ACTIVITY COMPLETE THE ACCOUNTING CYCLE: PERIODIC INVENTORY SYSTEM DIRECTIONS: Read and analyze

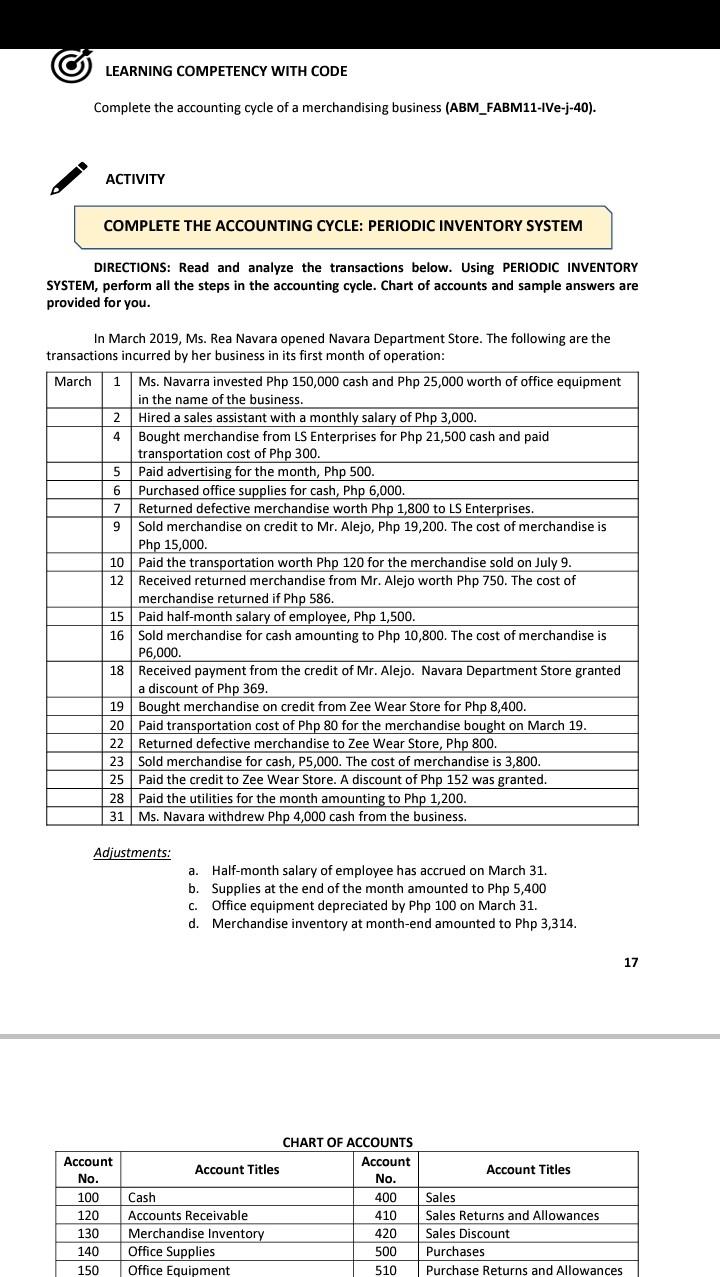

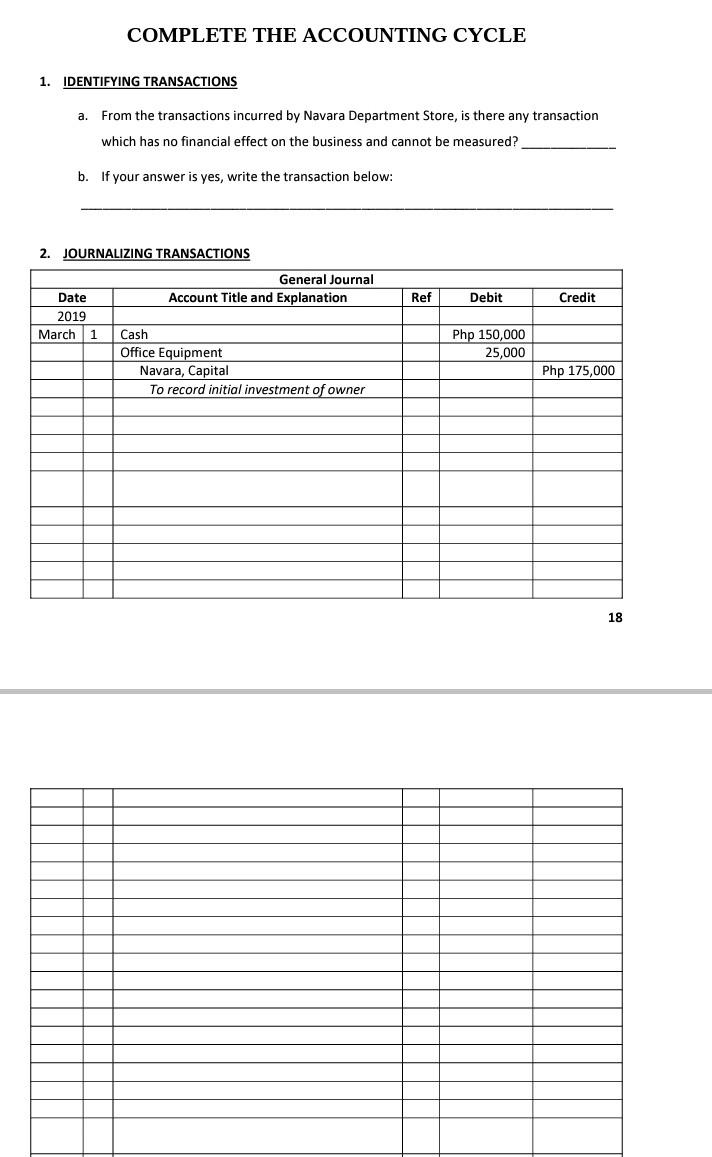

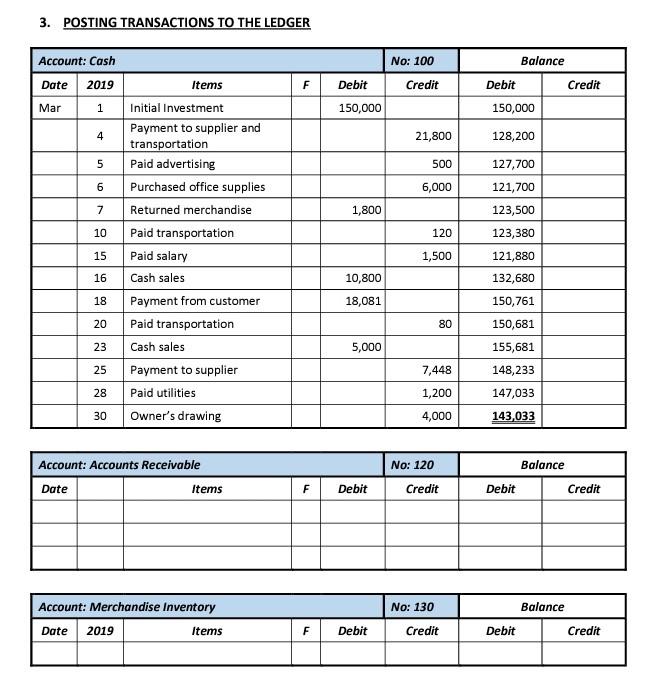

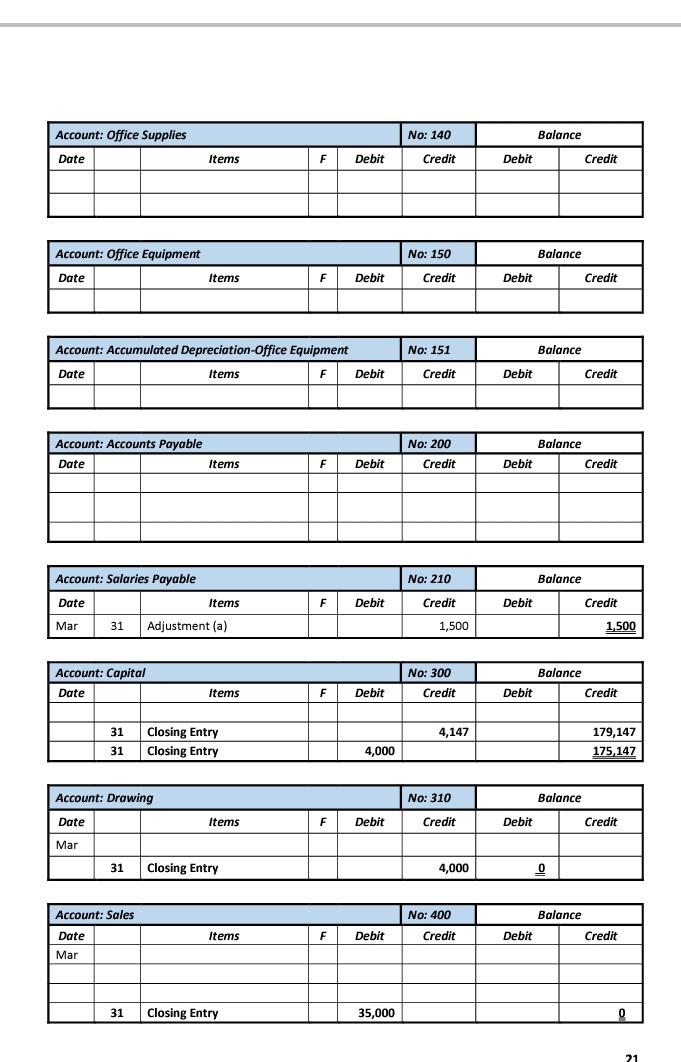

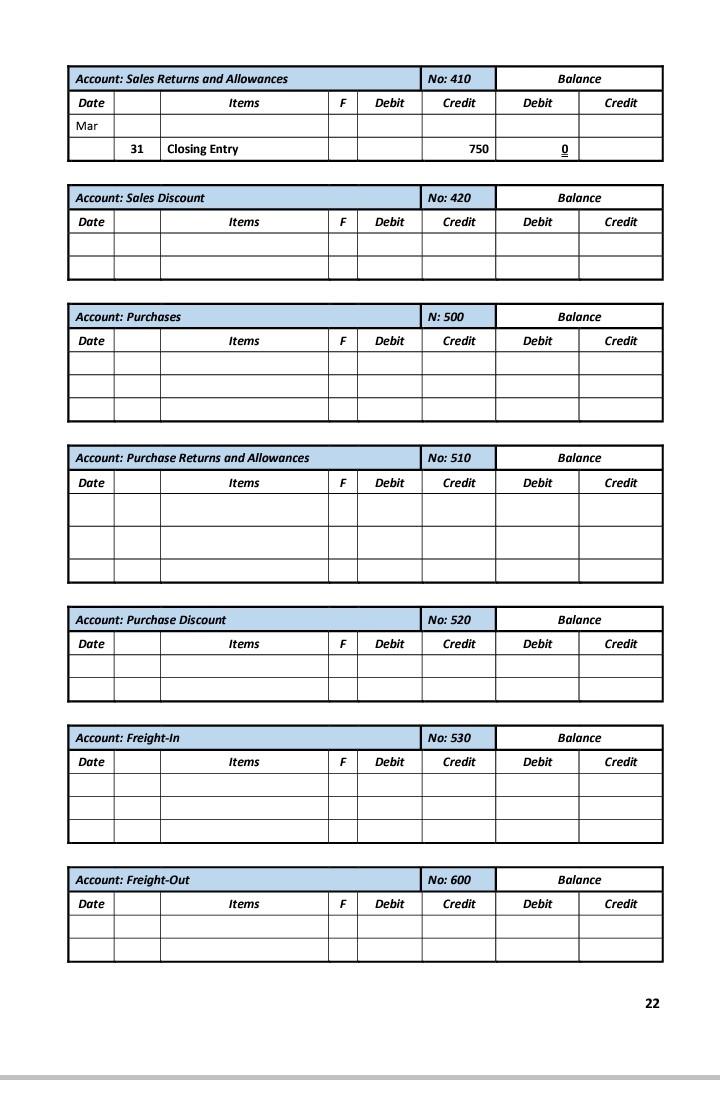

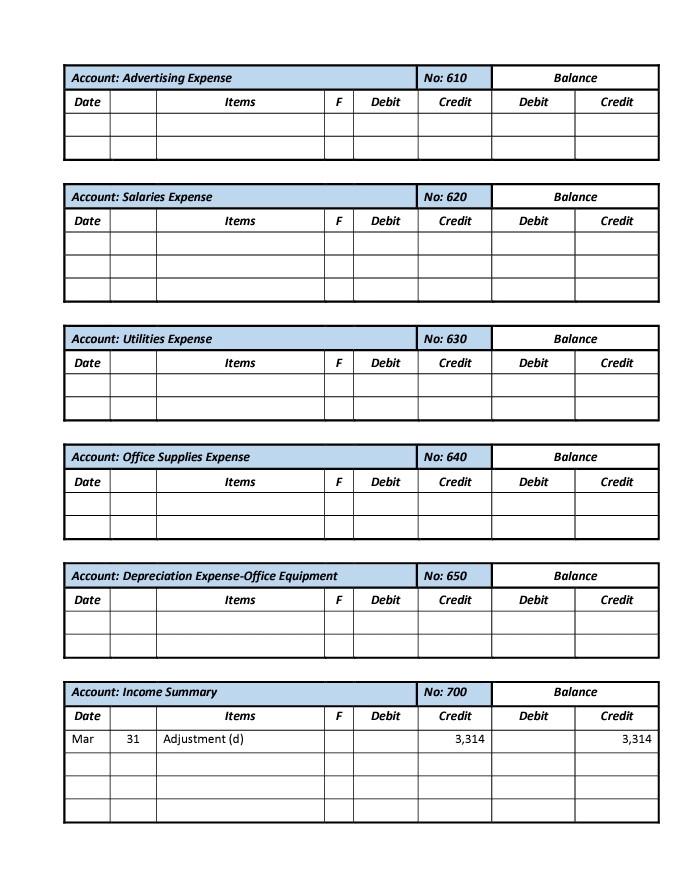

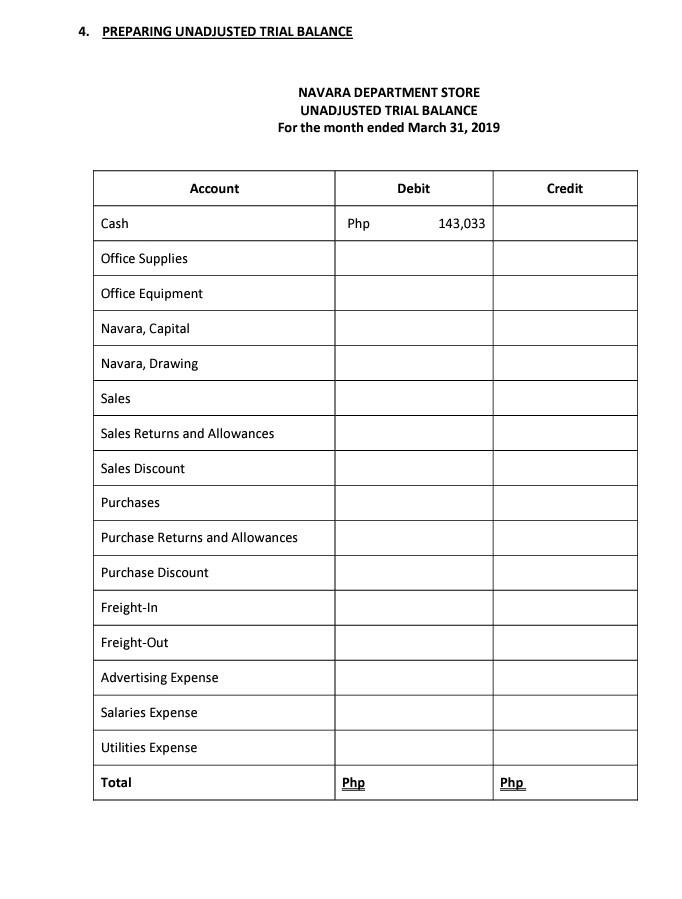

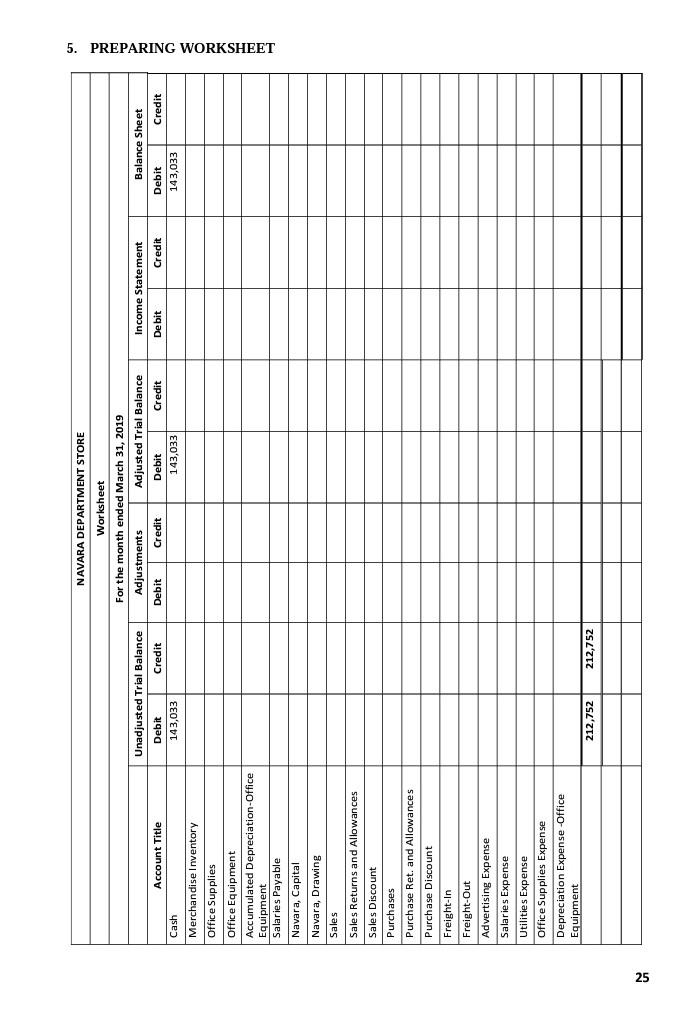

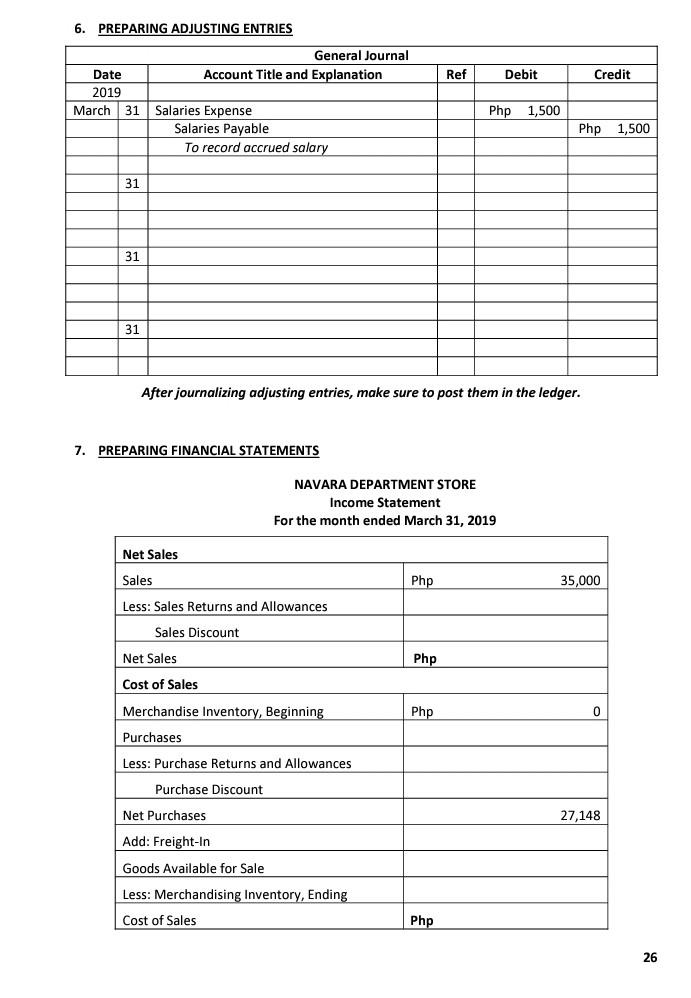

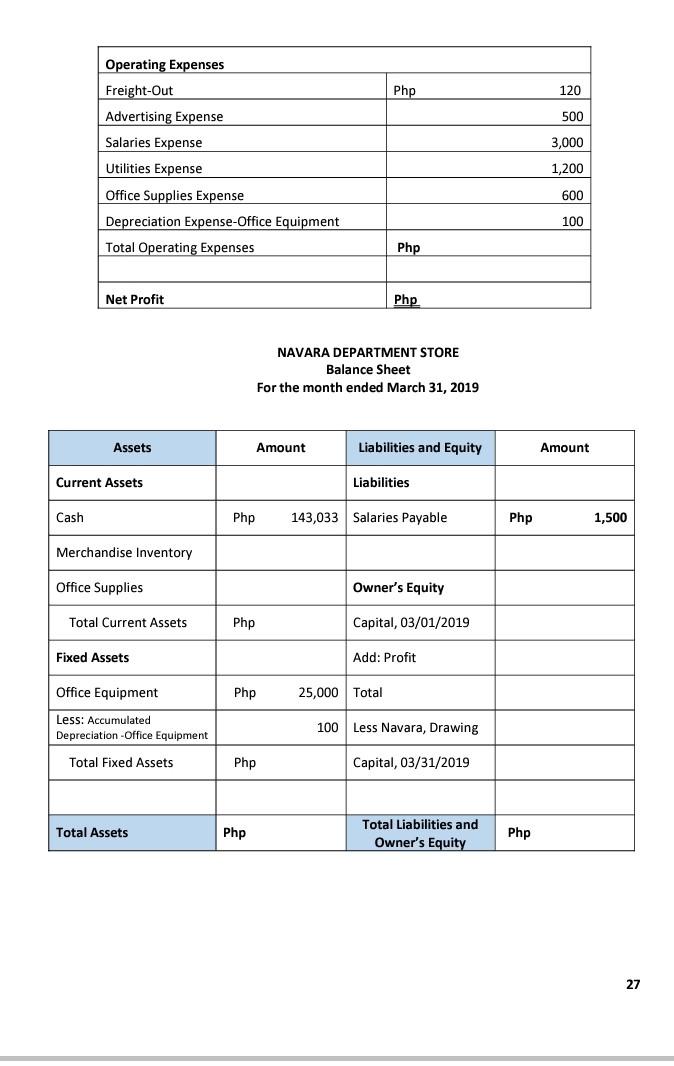

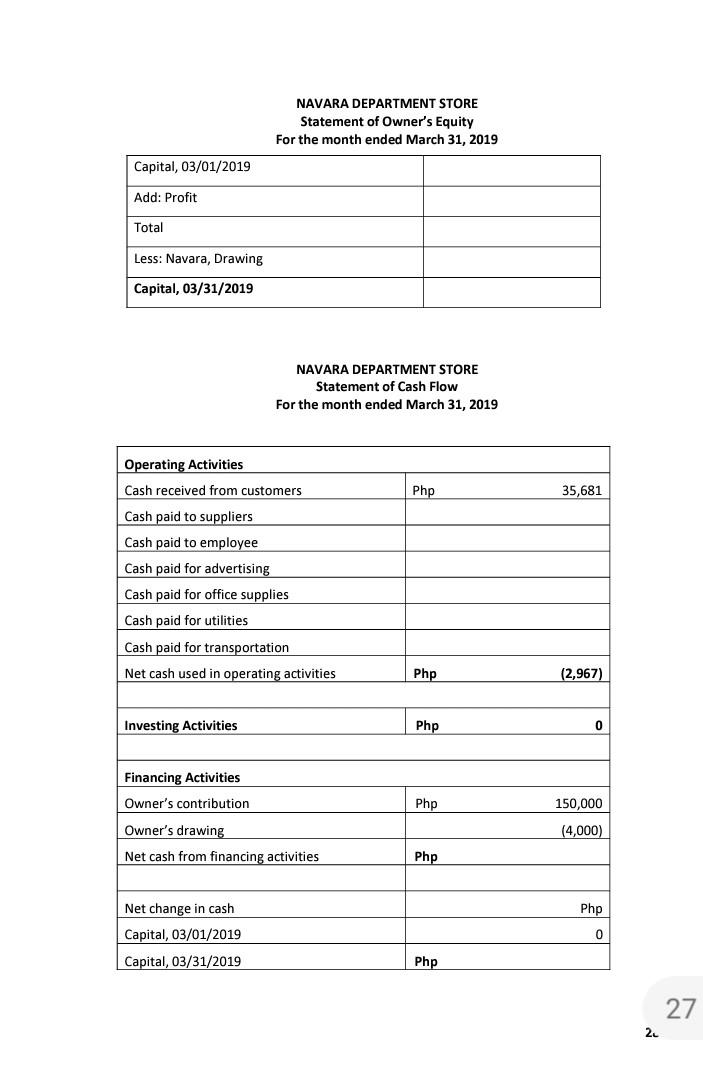

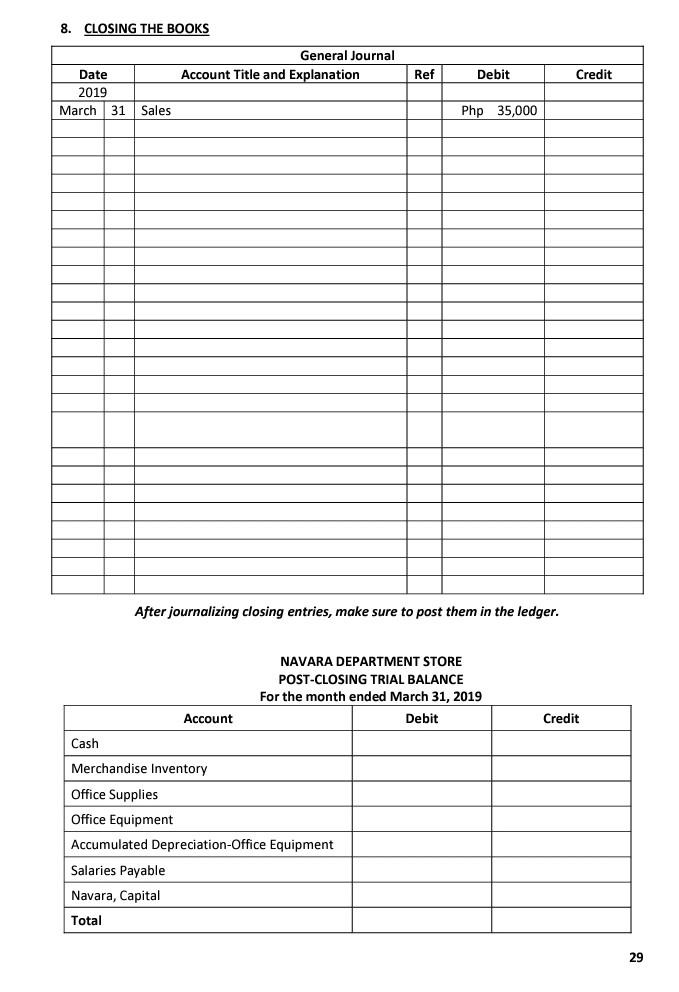

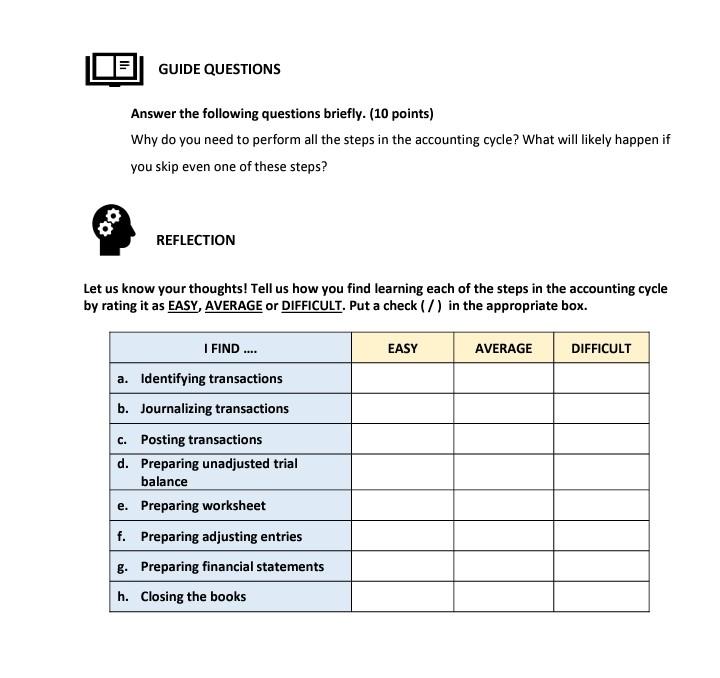

LEARNING COMPETENCY WITH CODE Complete the accounting cycle of a merchandising business (ABM_FABM11-IVe-j-40). ACTIVITY COMPLETE THE ACCOUNTING CYCLE: PERIODIC INVENTORY SYSTEM DIRECTIONS: Read and analyze the transactions below. Using PERIODIC INVENTORY SYSTEM, perform all the steps in the accounting cycle. Chart of accounts and sample answers are provided for you. 1 6 In March 2019, Ms. Rea Navara opened Navara Department Store. The following are the transactions incurred by her business in its first month of operation: March Ms. Navarra invested Php 150,000 cash and Php 25,000 worth of office equipment in the name of the business. 2 Hired a sales assistant with a monthly salary of Php 3,000. 4 Bought merchandise from LS Enterprises for Php 21,500 cash and paid transportation cost of Php 300. 5 Paid advertising for the month, Php 500. Purchased office supplies for cash, Php 6,000. 7 Returned defective merchandise worth Php 1,800 to LS Enterprises. 9 Sold merchandise on credit to Mr. Alejo, Php 19,200. The cost of merchandise is Php 15,000. 10 Paid the transportation worth Php 120 for the merchandise sold on July 9. 12 Received returned merchandise from Mr. Alejo worth Php 750. The cost of merchandise returned if Php 586. 15 Paid half-month salary of employee, Php 1,500. 16 Sold merchandise for cash amounting to Php 10,800. The cost of merchandise is P6,000. 18 Received payment from the credit of Mr. Alejo. Navara Department Store granted a discount of Php 369. 19 Bought merchandise on credit from Zee Wear Store for Php 8,400. 20 Paid transportation cost of Php 80 for the merchandise bought on March 19. 22 Returned defective merchandise to Zee Wear Store, Php 800. 23 Sold merchandise for cash, P5,000. The cost of merchandise is 3,800. 25 Paid the credit to Zee Wear Store. A discount of Php 152 was granted. 28 Paid the utilities for the month amounting to Php 1,200. 31 Ms. Navara withdrew Php 4,000 cash from the business. Adjustments: a. Half-month salary of employee has accrued on March 31. b. Supplies at the end of the month amounted to Php 5,400 c. Office equipment depreciated by Php 100 on March 31. d. Merchandise inventory at month-end amounted to Php 3,314. 17 Account Titles Account No. 100 120 130 140 150 CHART OF ACCOUNTS Account Account Titles No. Cash 400 Accounts Receivable 410 Merchandise Inventory 420 Office Supplies 500 Office Equipment 510 Sales Sales Returns and Allowances Sales Discount Purchases Purchase Returns and Allowances COMPLETE THE ACCOUNTING CYCLE 1. IDENTIFYING TRANSACTIONS a. From the transactions incurred by Navara Department Store, is there any transaction which has no financial effect on the business and cannot be measured? b. If your answer is yes, write the transaction below: 2. JOURNALIZING TRANSACTIONS General Journal Account Title and Explanation Ref Debit Credit Date 2019 March1 Php 150,000 25,000 Cash Office Equipment Navara, Capital To record initial investment of owner Php 175,000 18 3. POSTING TRANSACTIONS TO THE LEDGER No: 100 Credit F Debit 150,000 4 21,800 500 6,000 1,800 Account: Cash Date 2019 Items Mar 1 Initial Investment Payment to supplier and transportation 5 Paid advertising 6 Purchased office supplies 7 Returned merchandise 10 Paid transportation Paid salary Cash sales Payment from customer Paid transportation Cash sales 25 Payment to supplier Paid utilities Owner's drawing Balance Debit Credit 150,000 128,200 127,700 121,700 123,500 123,380 121,880 132,680 150,761 150,681 155,681 148,233 120 15 1,500 16 10,800 18,081 18 20 80 23 5,000 28 7,448 1,200 4,000 147,033 143,033 30 Account: Accounts Receivable No: 120 Balance Credit Date Items F Debit Credit Debit Account: Merchandise Inventory No: 130 Balance Date 2019 Items F Debit Credit Debit Credit Account: Office Supplies No: 140 Balance Date Items F Debit Credit Debit Credit Account: Office Equipment No: 150 Balance Date Items F Debit Credit Debit Credit Account: Accumulated Depreciation Office Equipment No: 151 Balance Date Items F Debit Credit Debit Credit Account: Accounts Payable Date Items No: 200 Credit Balance Credit F Debit Debit Account: Salaries Payable No: 210 Balance Date Items F Debit Credit Debit Credit Mar 31 Adjustment (a) 1,500 1,500 No: 300 Account: Capital Date Balance Debit Credit Items F Debit Credit 31 4,147 Closing Entry Closing Entry 179,147 175 147 31 4,000 Account: Drawing No: 310 Balance Date Items F Debit Credit Debit Credit Mar 31 Closing Entry 4,000 0 Account: Sales Date Mar No: 400 Credit Balance Debit Credit Items F Debit 31 Closing Entry 35,000 0 21 No: 410 Balance Account: Sales Returns and Allowances Date Items F Debit Credit Debit Credit Mar 31 Closing Entry 750 0 No: 420 Balance Account: Sales Discount Date Items F Debit Credit Debit Credit Account: Purchases N: 500 Balance Date Items F Debit Credit Debit Credit Account: Purchase Returns and Allowances No: 510 Balance Date Items F Debit Credit Debit Credit Account: Purchase Discount No: 520 Balance Date Items F Debit Credit Debit Credit Account: Freight-in No: 530 Balance Date Items F Debit Credit Debit Credit Account: Freight-Out No: 600 Balance Date Items F Debit Credit Debit Credit 22 No: 610 Balance Account: Advertising Expense Date Items F Debit Credit Debit Credit Account: Salaries Expense Date No: 620 Credit Balance Debit Credit Items F Debit Account: Utilities Expense Date No: 630 Credit Balance Debit Credit Items F Debit Account: Office Supplies Expense No: 640 Balance Date Items F Debit Credit Debit Credit Account: Depreciation Expense-Office Equipment Date Items F No: 650 Credit Balance Debit Credit Debit Account: Income Summary No: 700 Balance Date Items F Debit Credit Debit Credit Mar 31 Adjustment (d) 3,314 3,314 4. PREPARING UNADJUSTED TRIAL BALANCE NAVARA DEPARTMENT STORE UNADJUSTED TRIAL BALANCE For the month ended March 31, 2019 Account Debit Credit Cash Php 143,033 Office Supplies Office Equipment Navara, Capital Navara, Drawing Sales Sales Returns and Allowances Sales Discount Purchases Purchase Returns and Allowances Purchase Discount Freight-In Freight-Out Advertising Expense Salaries Expense Utilities Expense Total Php Php NAVARA DEPARTMENT STORE Worksheet For the month ended March 31, 2019 Adjustments Adjusted Trial Balance Debit Credit Debit Credit 143,033 Income Statement Unadjusted Trial Balance Debit Credit 143,033 Account Title Debit Credit Balance Sheet Debit Credit 143,033 Cash 5. PREPARING WORKSHEET Merchandise Inventory Office Supplies Office Equipment Accumulated Depreciation Office Equipment Salaries Payable Navara, Capital Navara, Drawing Sales Sales Returns and Allowances Sales Discount Purchases Purchase Ret. and Allowances Purchase Discount Freight-In Freight-Out Advertising Expense Salaries Expense Utilities Expense Office Supplies Expense Depreciation Expense-Office Equipment 212,752 212,752 6. PREPARING ADJUSTING ENTRIES General Journal Account Title and Explanation Ref Debit Credit Date 2019 March 31 Php 1,500 Salaries Expense Salaries Payable To record accrued salary Php 1,500 31 31 31 After journalizing adjusting entries, make sure to post them in the ledger. 7. PREPARING FINANCIAL STATEMENTS NAVARA DEPARTMENT STORE Income Statement For the month ended March 31, 2019 Net Sales Sales Php 35,000 Less: Sales Returns and Allowances Sales Discount Net Sales Php Cost of Sales Merchandise Inventory, Beginning Php 0 Purchases Less: Purchase Returns and Allowances Purchase Discount Net Purchases 27,148 Add: Freight-In Goods Available for Sale Less: Merchandising Inventory, Ending Cost of Sales Php 26 Operating Expenses Freight-Out Advertising Expense Php 120 500 Salaries Expense 3,000 Utilities Expense 1,200 Office Supplies Expense 600 100 Depreciation Expense-Office Equipment Total Operating Expenses Php Net Profit Php NAVARA DEPARTMENT STORE Balance Sheet For the month ended March 31, 2019 Assets Amount Liabilities and Equity Amount Current Assets Liabilities Cash Php 143,033 Salaries Payable Php 1,500 Merchandise Inventory Office Supplies Owner's Equity Total Current Assets Php Capital, 03/01/2019 Fixed Assets Add: Profit Office Equipment Php 25,000 Total Less: Accumulated Depreciation - Office Equipment 100 Less Navara, Drawing Total Fixed Assets Php Capital, 03/31/2019 Total Assets Php Total Liabilities and Owner's Equity Php 27 NAVARA DEPARTMENT STORE Statement of Owner's Equity For the month ended March 31, 2019 Capital, 03/01/2019 Add: Profit Total Less: Navara, Drawing Capital, 03/31/2019 NAVARA DEPARTMENT STORE Statement of Cash Flow For the month ended March 31, 2019 Operating Activities Cash received from customers Php 35,681 Cash paid to suppliers Cash paid to employee Cash paid for advertising Cash paid for office supplies Cash paid for utilities Cash paid for transportation Net cash used in operating activities Php (2,967) Investing Activities Php 0 Financing Activities Owner's contribution Php 150,000 Owner's drawing (4,000) Net cash from financing activities Php Php Net change in cash Capital, 03/01/2019 Capital, 03/31/2019 0 Php 27 2. 8. CLOSING THE BOOKS General Journal Account Title and Explanation Ref Debit Credit Date 2019 March 31 Sales Php 35,000 After journalizing closing entries, make sure to post them in the ledger. NAVARA DEPARTMENT STORE POST-CLOSING TRIAL BALANCE For the month ended March 31, 2019 Debit Account Credit Cash Merchandise Inventory Office Supplies Office Equipment Accumulated Depreciation Office Equipment Salaries Payable Navara, Capital Total 29 GUIDE QUESTIONS Answer the following questions briefly. (10 points) Why do you need to perform all the steps in the accounting cycle? What will likely happen if you skip even one of these steps? REFLECTION Let us know your thoughts! Tell us how you find learning each of the steps in the accounting cycle by rating it as EASY, AVERAGE or DIFFICULT. Put a check (/) in the appropriate box. EASY AVERAGE DIFFICULT I FIND .... a. Identifying transactions b. Journalizing transactions c. Posting transactions d. Preparing unadjusted trial balance e. Preparing worksheet f. Preparing adjusting entries g. Preparing financial statements h. Closing the books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts