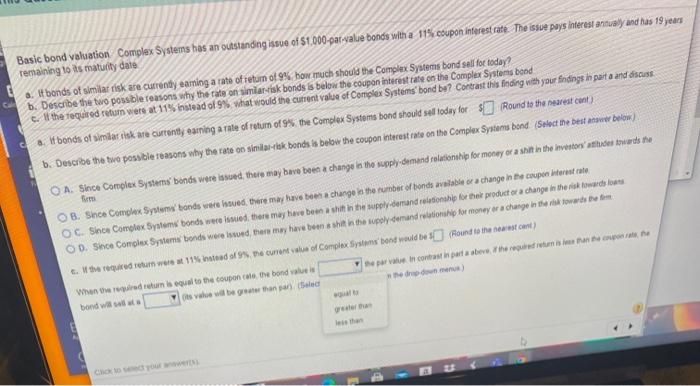

Question: Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 115 coupon interest rate. The issue pays interest annually and has

Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 115 coupon interest rate. The issue pays interest annually and has 19 years remaining to as maturity dale a. It bonds of similar risk are currently earning a rate of return of 9% how much should the Complex Systems bond sell for today! 6. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond t. It the required return were at 11% instead of 9% what would the current value of Complex Systems bond be? Contrast this finding with your findings in part a and discuss If bonds of similar eink are currently earning a rate of return of the Complex Systems bond should sell today for $ Round to the nearest cont) b. Describe the two posable reasons why the rate on similar-elok bonds is below the coupon interest rate on the Complex Systems bond (Select the best atawer below) O A. Since Complex Systems bonds were issued, there may bave been a change in the supply-demand relationship for money or a spilt in the investorsatudes towards the OB. Since Complex Systems bonds were hoved, there may have been change in the rambut of bonds slabe a change in the coupons interest rate OC. Since Complex Syam bonds were issued, there may have been set the supernandrolonship for the product or a change in the site towards our OD. She Complex Systeme bonds were issord, men may have been shit in the spy demand relationship for money or a change in the towards to them. to the required return 115 Instead 19 the current value of Complex Systems bond would be found to the nearest cant) When the return is equal to the coupon to the bond a contrastin para bevethewine . bond we Itse be great than Bale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts