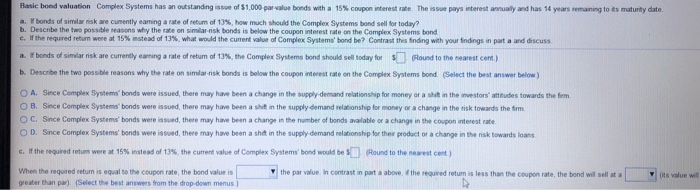

Question: Basic bond valuation Complex Systems has an outstanding issue of $1.000 por bonds with a 15% coupon interest rate The pay wrest l y and

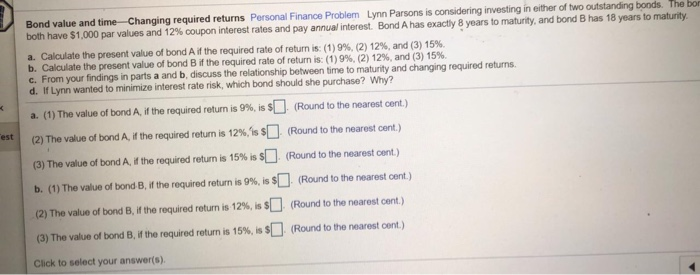

Basic bond valuation Complex Systems has an outstanding issue of $1.000 por bonds with a 15% coupon interest rate The pay wrest l y and has 14 years remaning to its maturity date. a. bonds of similsk are curently coming of rum of 13 how much should the Complex Systems bond sell for today? b. Describe the two possible reasons why the wateon mankbonds is below the coupon state on the Complex Systems bond c. I the required return were at 15% stead of 13%, what would the current value of Complex Systems' bond be? Contrast this finding with your findings in part and discuss a. bonds of similar risk are currently earning a rate of return of the Complex Systems and should sell today for s o und to the newest cent) b. Describe the two possible reasons why the rate on si i s bonds is below the counterest rate on the Complex Systems bond (Select the best answer below) A. Since Complex Systems' bonds were issued, there may have been a change in the supply demand relationship for money or in the investors titudes towards the firm OB. Since Complex Systems' bonds were issued, there may have been in the supply demand relationship for money or a change in the risk towards them OC. Since Complex Systems' bonds were sued, there may have been a change in the number of bonds available or a change in the coupon interest rate OD. Since Complex Systems' bonds were issued, there may have been a shit in the supply demand relationship for the product or a change in the risk towards loans c. If the required return were at 15% instead of 13 the current value of Complex Systems' bond would be found to the newest cont the par value in contrastinata above the re When the required return is equal to the coupon rate the bond value is greater than a Select the best answers from the drop down menus) s umes than the coupon the band wiselta Bond value and time Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding boods. The bo both have $1.000 par values and 12% coupon interest rates and pay annual interest. Bond A has exactly 8 years to maturity, and bond B has 18 years to maturity a. Calculate the present value of bond A if the required rate of return is: (1) 9%, (2) 12%, and (3) 15% b. Calculate the present value of bond Bif the required rate of return is: (1)9%, (2) 12%, and (3) 15% c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? a. (1) The value of bond A. if the required return is 9%, is $ . (Round to the nearest cont.) (2) The value of bond A, if the required return is 12%, is $ (Round to the nearest cent.) (3) The value of bond A, if the required return is 15% is (Round to the nearest cent.) b. (1) The value of bond B, if the required return is 9%, is (Round to the nearest cont.) (2) The value of bond B, if the required return is 12%, is (Round to the nearest cent.) (3) The value of bond B, if the required return is 15%, is $ . (Round to the nearest cont.) Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts