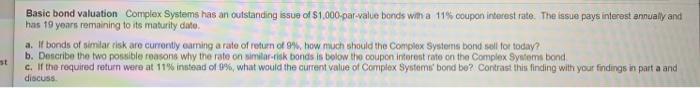

Question: Basic bond valuation Complex Systems has an outstanding issue of $1.000 par-value bonds with a 11% coupon interest rate. The issue pays interest annually and

Basic bond valuation Complex Systems has an outstanding issue of $1.000 par-value bonds with a 11% coupon interest rate. The issue pays interest annually and has 19 years remaining to its maturity date a. If bonds of similar risk are currently coming a rate of return of 9%, how much should the Complex Systems bond sell for today? b. Describe the two possible reasons why the rate on similar risk bonds is below the coupon interest rate on the Complex Systems bond c. If the required return were at 11% instead of 9%, what would the current value of Complex Systems bond be? Contrast this finding with your findings in part a and discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts