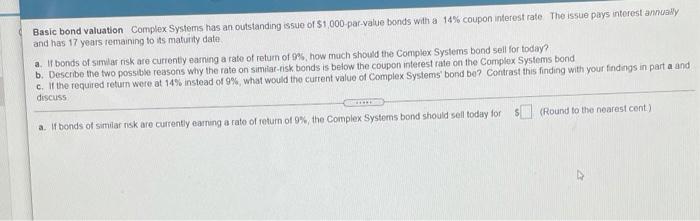

Question: Basic bond valuation Complex Systems has an outstanding issue of S1000 par-value bonds with a 14% coupon interest rate The issue pays interest annually and

Basic bond valuation Complex Systems has an outstanding issue of S1000 par-value bonds with a 14% coupon interest rate The issue pays interest annually and has 17 years remaining to its maturity date a. If bonds of similar risk are currently earning a rate of return of 99%, how much should the Complex Systems bond sell for today b. Describe the two possible reasons why the rate on similar risk bonds is below the coupon interest rate on the Complex Systems bond c. If the required return were at 14% instead of 9% what would the current value of Complex Systems bond be? Contrast this finding with your findings in part a and discuss a. It bonds of similar risk are currently earning a rate of return of the Complex Systems bond should sell today for $l (Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts