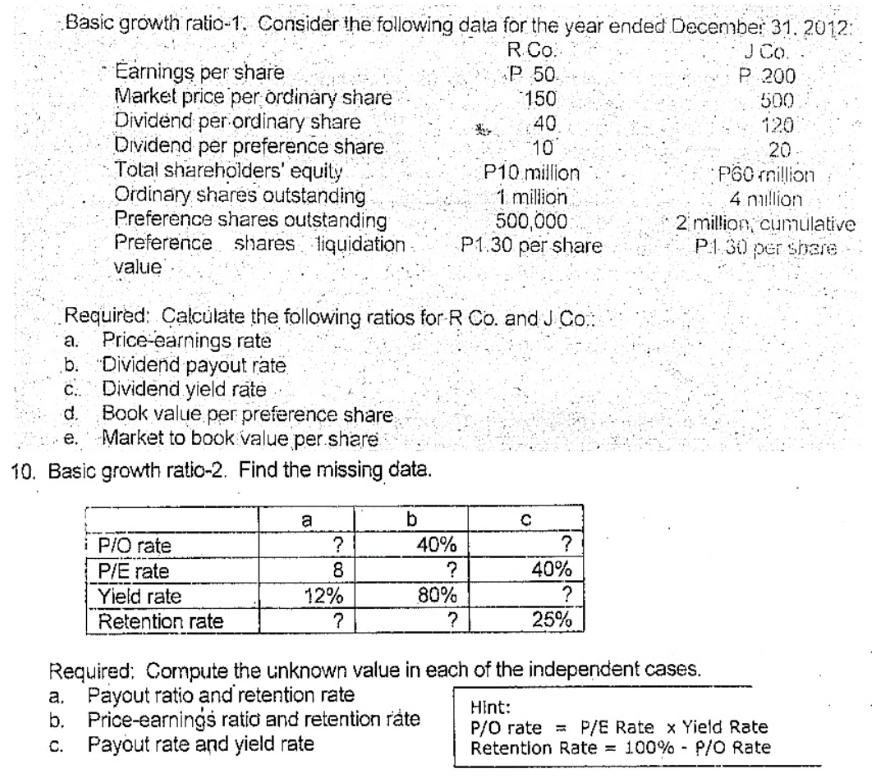

Question: Basic growth ratio-1. Consider the following data for the year ended December 31. 2012: R.Co. J Co. P 200 500 120 Earnings per share

Basic growth ratio-1. Consider the following data for the year ended December 31. 2012: R.Co. J Co. P 200 500 120 Earnings per share Market price per ordinary share Dividend per ordinary share Dividend per preference share Total shareholders' equity Ordinary shares outstanding Preference shares outstanding Preference shares liquidation value Required: Calculate the following ratios for R Co. and J. Co... Price-earnings rate b. Dividend payout rate c. Dividend yield rate Book value per preference share e. Market to book value per share 10. Basic growth ratio-2. Find the missing data. i P/O rate P/E rate Yield rate Retention rate a ? 8 12% ? b 40% ? 80% P 50. 150 40 10 P10 million 1 million 500,000 P1.30 per share ? C ? 40% ? 25% 20- P60 million 4 million 2 million, cumulative P1.30 per share Required; Compute the unknown value in each of the independent cases. a. Payout ratio and retention rate b. Price-earnings ratio and retention rate c. Payout rate and yield rate Hint: P/O rate P/E Rate x Yield Rate Retention Rate = 100% P/O Rate

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Okay let me solve these ratios stepbystep 1 Basic growth ratio 1 a P... View full answer

Get step-by-step solutions from verified subject matter experts