Question: BASIC (Questions 1-28) LO 1 1. Present Value and Multiple Cash Flows. Eulis Co, has identified an investment project with the following cash flows. If

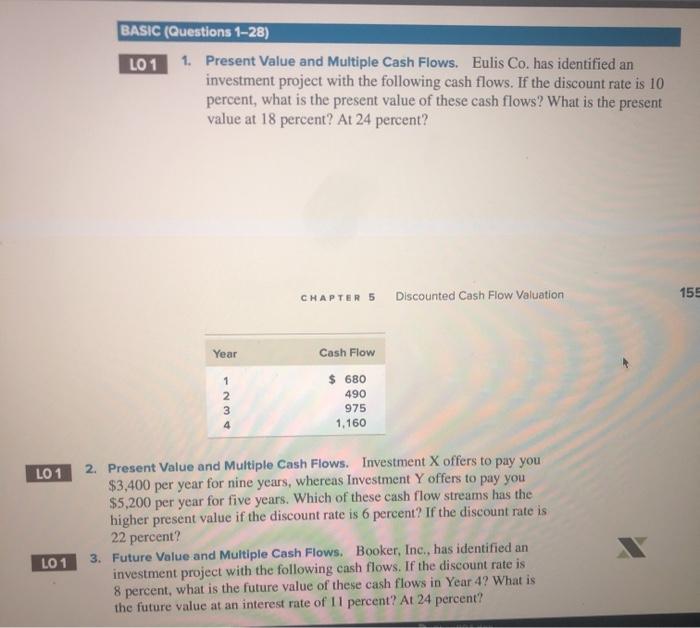

BASIC (Questions 1-28) LO 1 1. Present Value and Multiple Cash Flows. Eulis Co, has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent? 155 CHAPTER 5 Discounted Cash Flow Valuation Year 1 2 3 4 Cash Flow $ 680 490 975 1,160 LO 1 2. Present Value and Multiple Cash Flows. Investment X offers to pay you $3,400 per year for nine years, whereas Investment Y offers to pay you $5,200 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 6 percent? If the discount rate is 22 percent? 3. Future Value and Multiple Cash Flows. Booker, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 percent, what is the future value of these cash flows in Year 4? What is the future value at an interest rate of 11 percent? At 24 percent? LO 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts