Question: Basic Scenario 7: Jacob and Martha Mills Directions Complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets . Answer the

Basic Scenario 7: Jacob and Martha Mills Directions

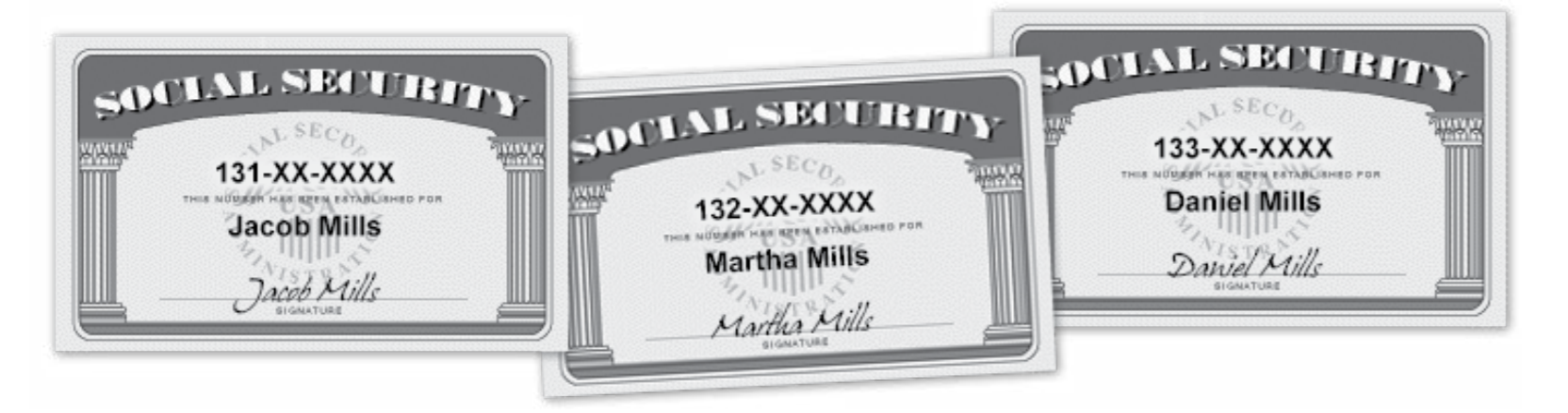

Complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets . Answer the questions following the scenario . Note: When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice.

Interview Notes

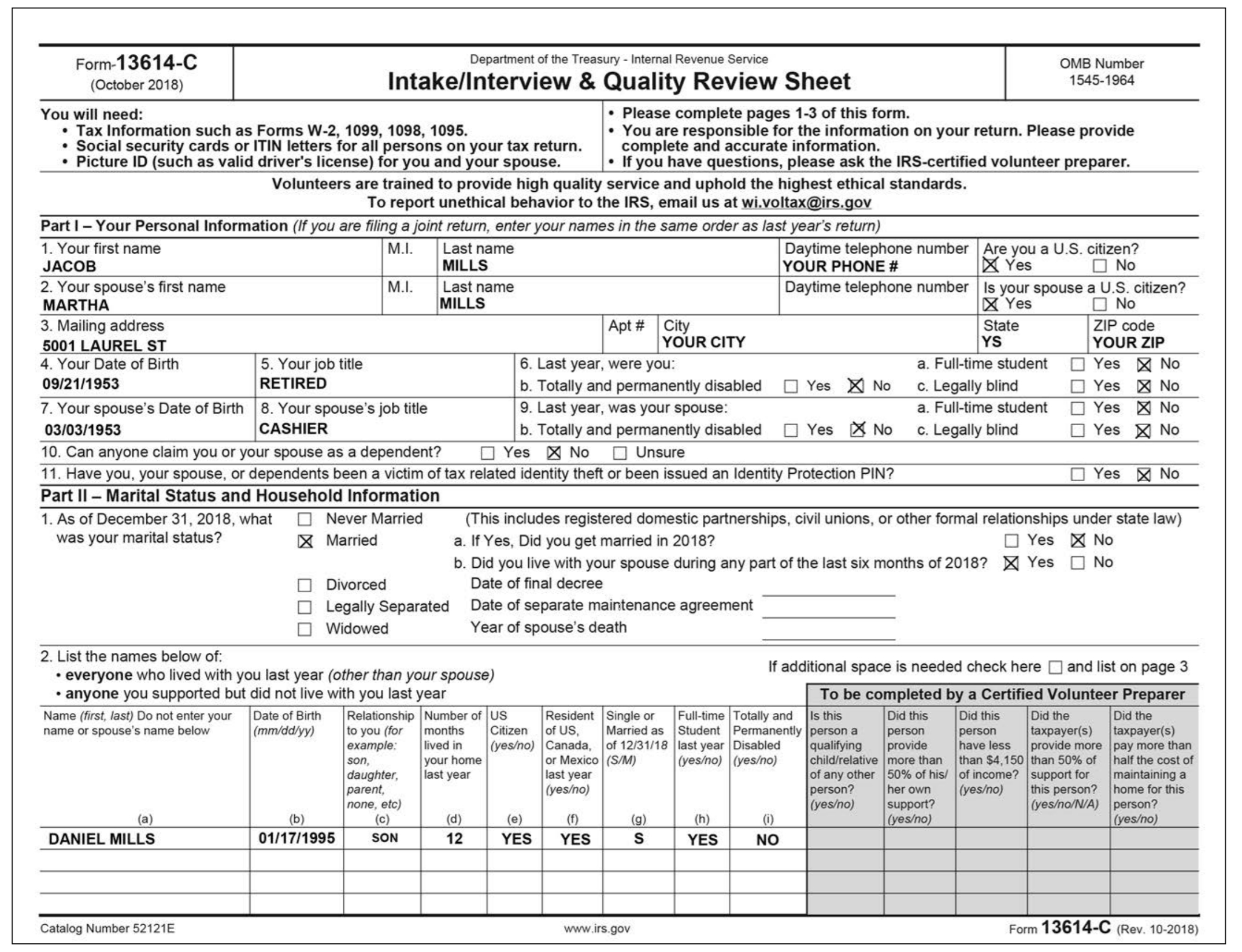

Jacob and Martha are age 65 years old and married. They elect to file Married Filing Jointly .

They have a son, Daniel, who is 23 years old and a full-time college student in his third year of study . He is pursuing a degree in Business Administration and does not have a felony drug conviction .

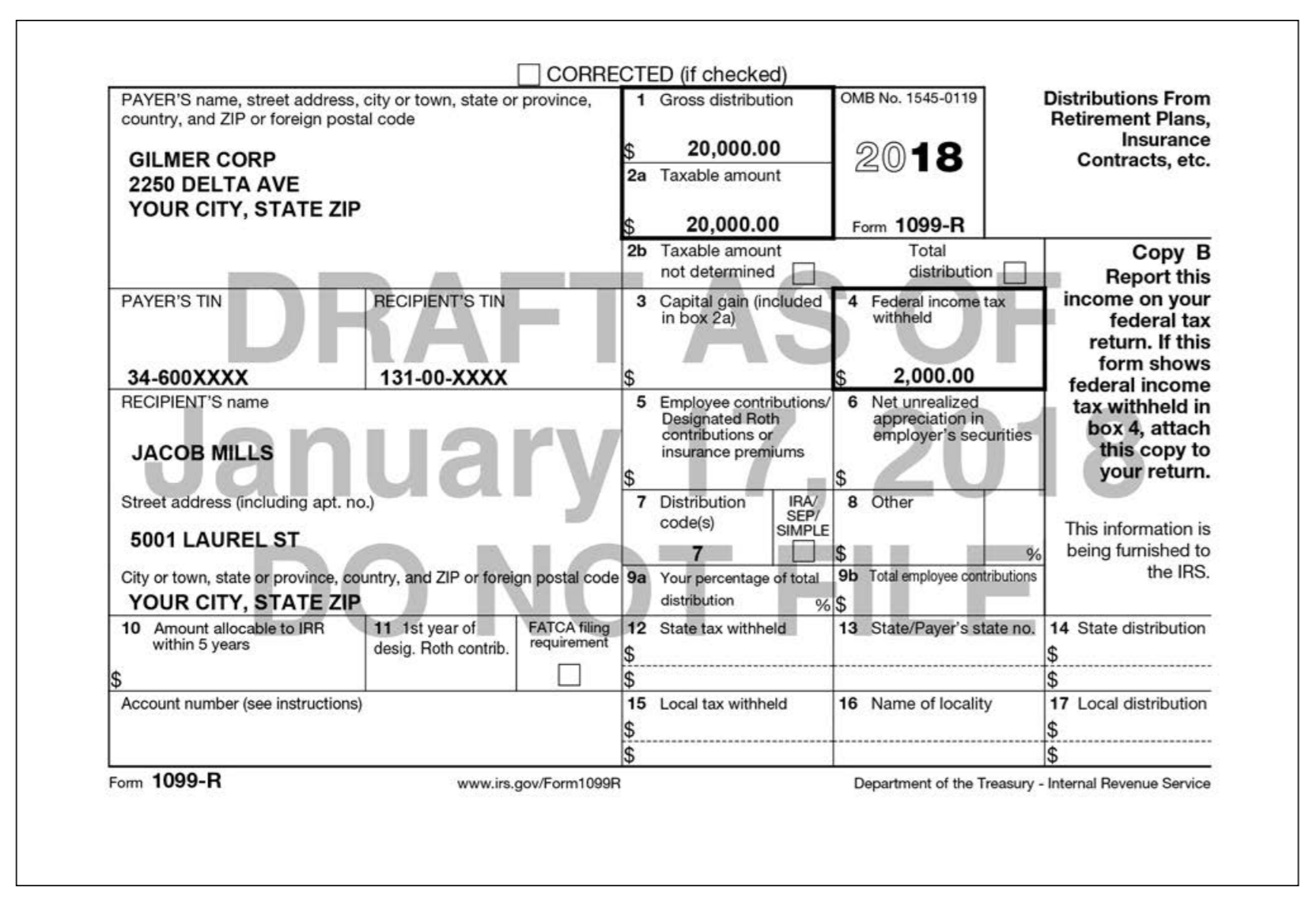

Jacob retired in 2018 .

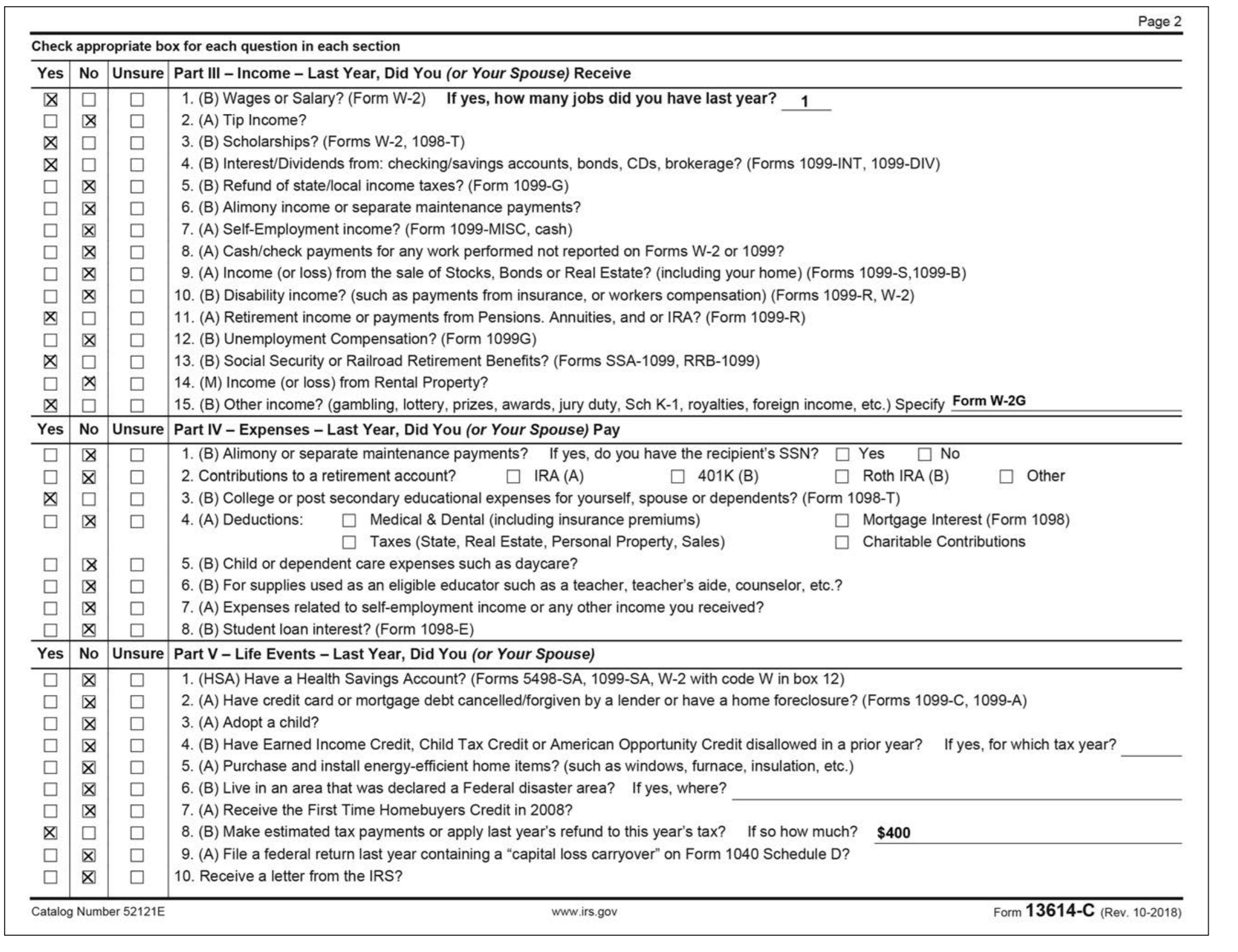

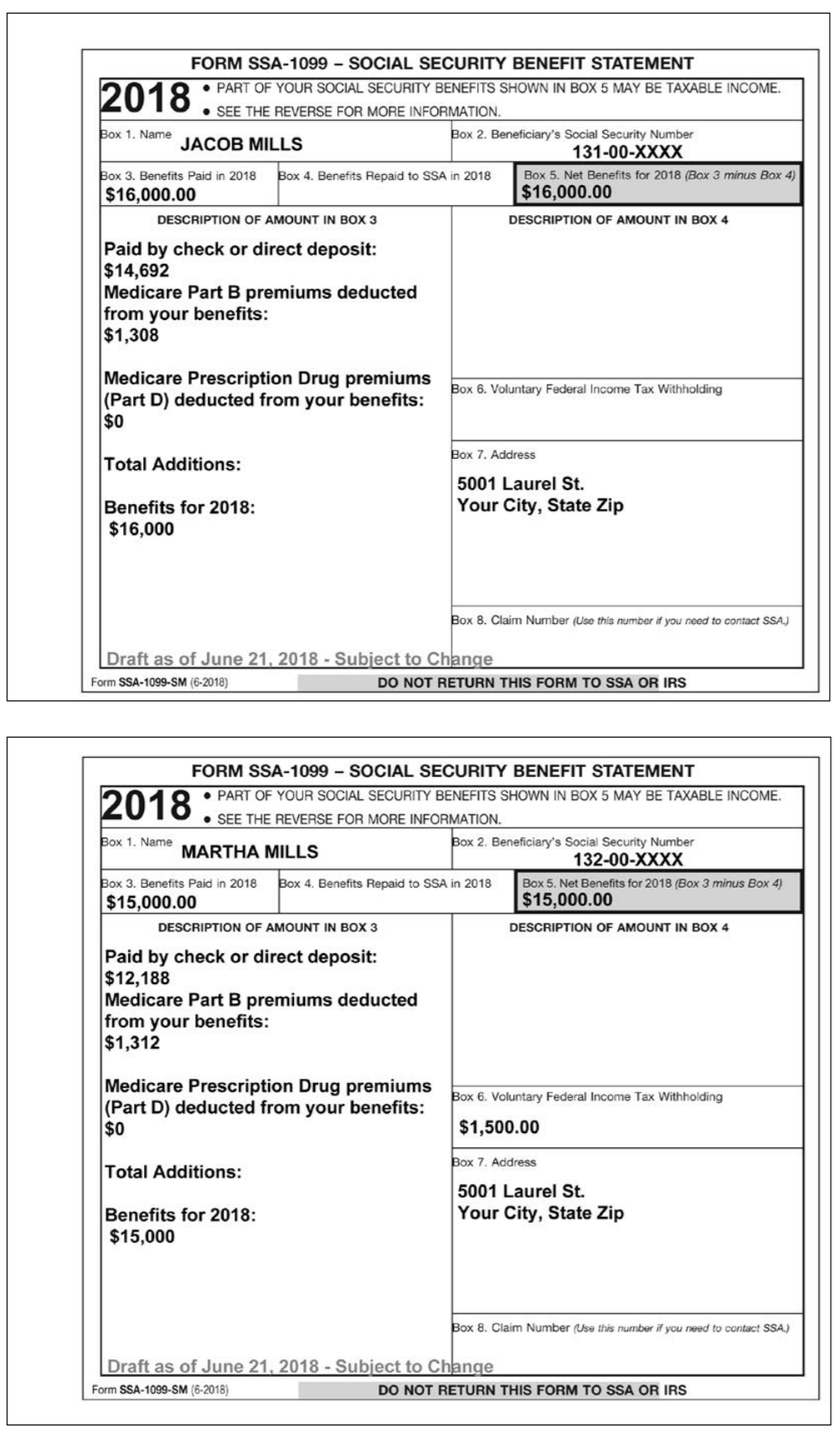

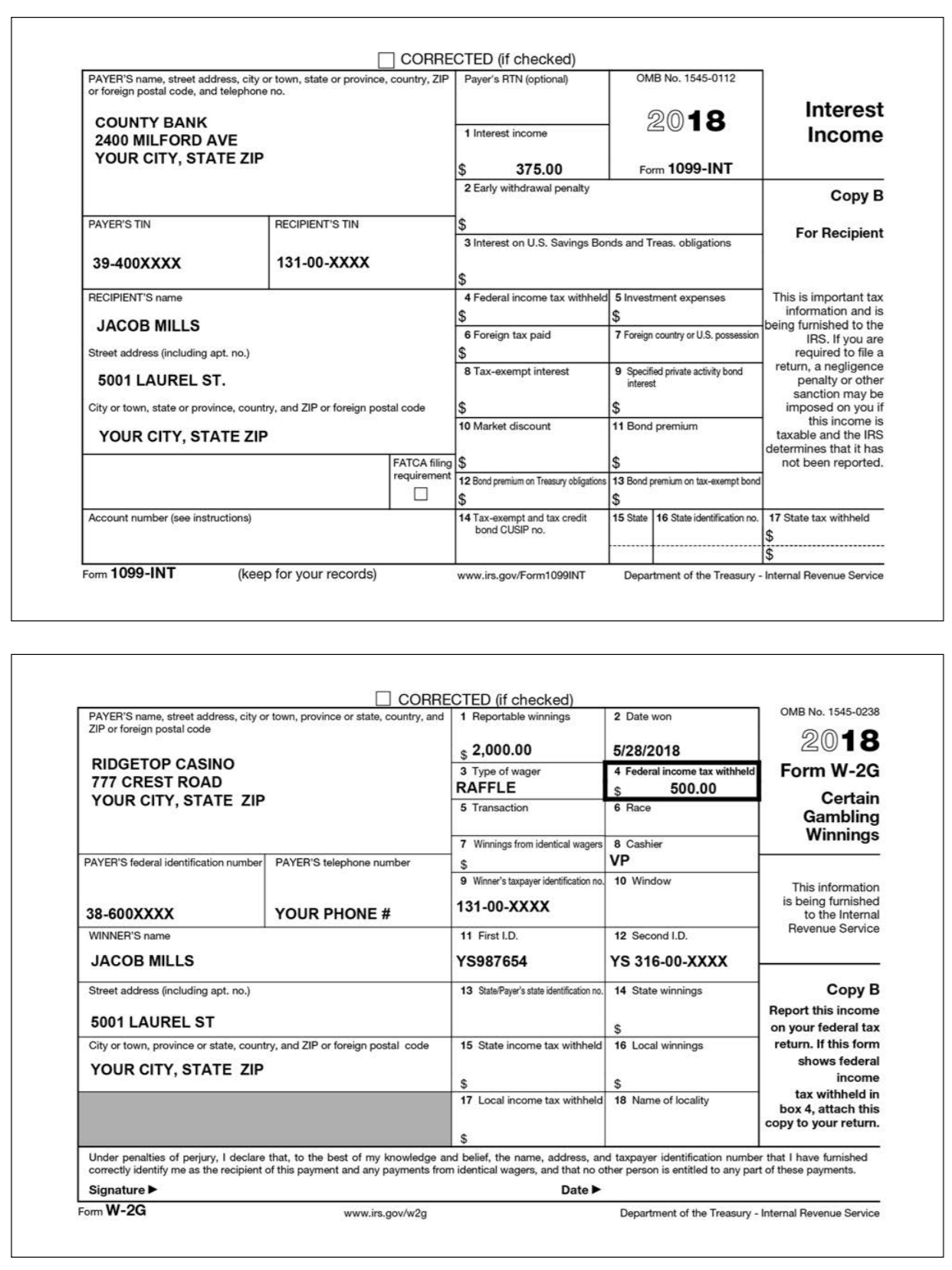

Jacob received interest, Social Security benefits, and pension income. He went to the local casino and won some money in 2018 . During the interview he mentions that he had gambling losses of $700 .

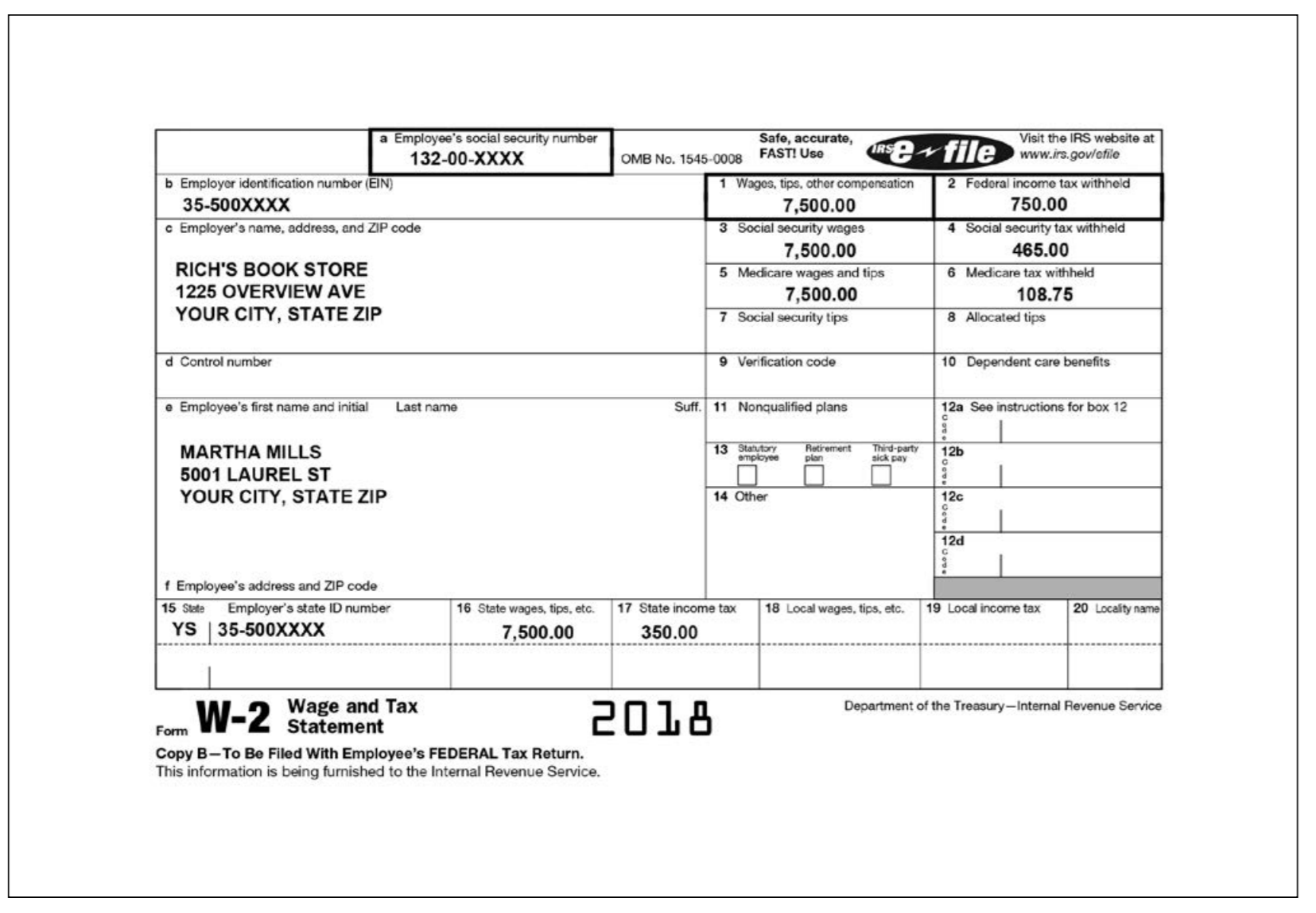

Martha received Social Security benefits and received wages from a part-time job.

Jacob and Martha elected to have their 2017 refund of $400 applied as an estimated tax payment to their 2018 tax return .

Jacob and Martha do not have enough deductions to itemize .

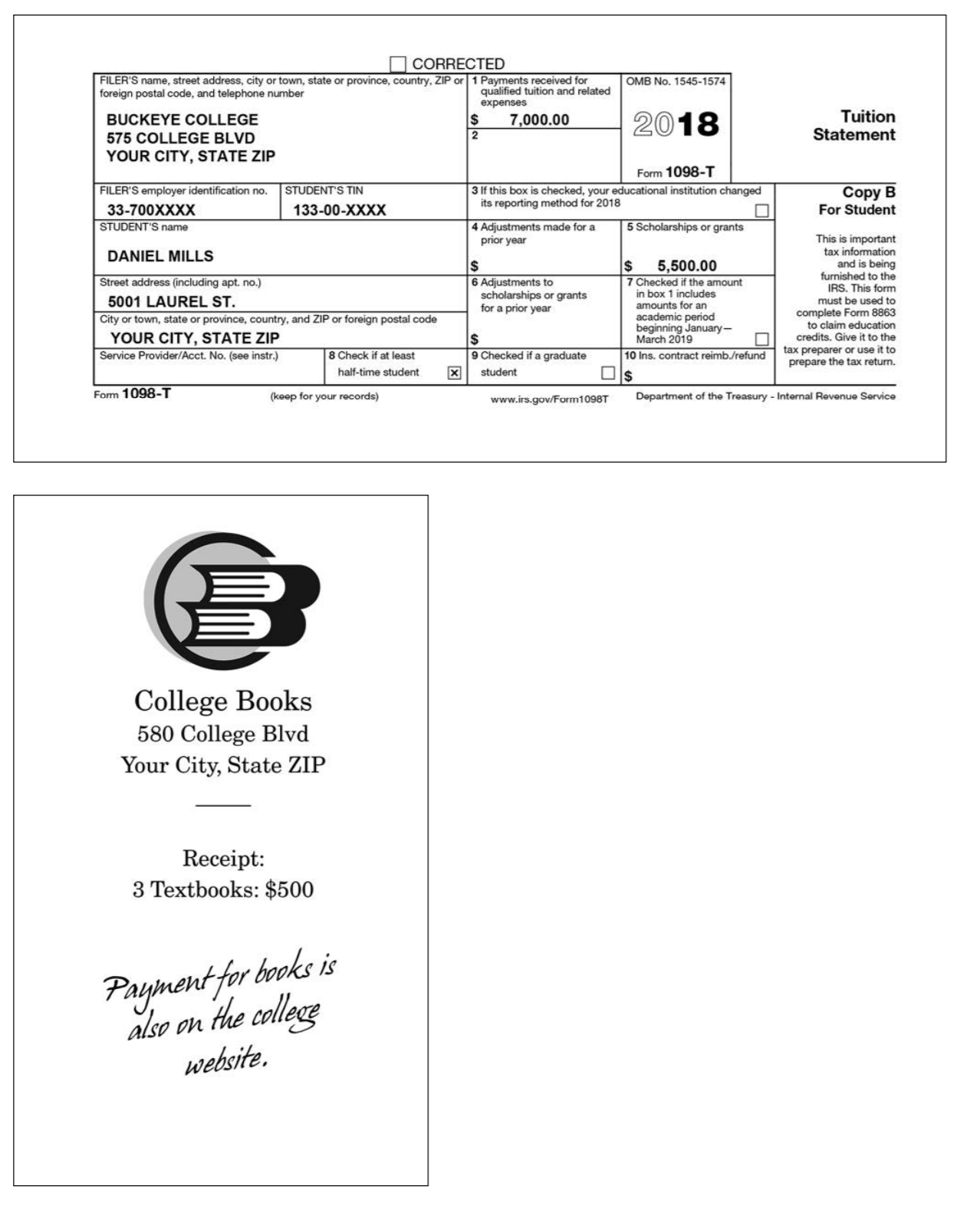

Daniel received a scholarship and the terms require that it be used to pay tuition . Jacob and Martha paid the cost of Daniels tuition and books in 2018 not covered by scholarship . They also provided all of his support for 2018 .

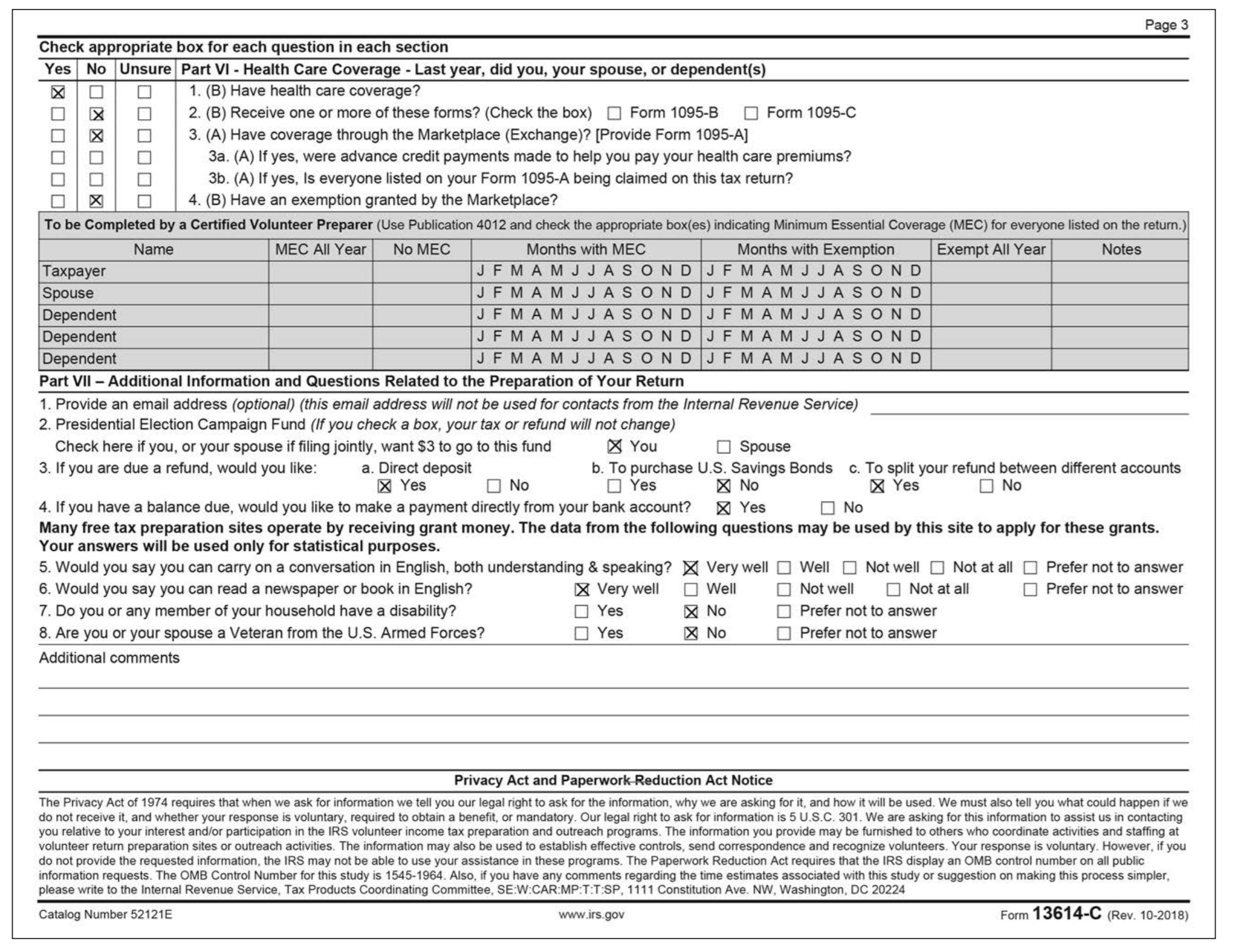

Jacob and Martha were covered by Medicare Parts A and B for the whole year .

Daniel had minimum essential healthcare coverage through his University health plan .

If Jacob and Martha receive a refund, they would like to deposit half into their checking account and half into their savings account . Documents from their bank show that the routing number for both accounts is: 111000025 . Their checking account number is 987654321 and their savings account number is 234567890 .

Questions:

|

| ||||||

|

| ||||||

|

| ||||||||||

|

| ||||||

|

| ||||||

|

, SEC 131-XX-XXXX Jacob Mills SECO 132-XX-XXXX Martha Mills Mara Pil 133-XX-XXXX Daniel Mills Daiiel Xtil NIS Jaob Vill Form-13614-C (October 2018) Department of the Treasury Internal Revenue Service OMB Number 1545-1964 Intake/Interview & Quality Review Sheet Please complete pages 1-3 of this form You are responsible for the information on your return. Please provide complete and accurate information If you have questions, please ask the IRS-certified volunteer preparer You will need . Tax Information such as Forms W-2, 1099, 1098, 1095 Social security cards or ITIN letters for all persons on your tax return . Picture ID (such as valid driver's license) for vou and vour spouse Volunteers are trained to provide high quality service and uphold the highest ethical standards To report unethical behavior to the IRS, email us at wi.voltax@irs.gov Part I - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's return) 1. Your first name JACOB 2. Your spouse's first name MARTHA 3. Mailing address 5001 LAUREL ST 4. Your Date of Birth 09/21/1953 M.I. Last name Daytime telephone number Are you a U.S. citizen? YOUR PHONE # MILLS M.I. ast name Daytime telephone number Is your spouse a U.S. citizen? MILLS State YOUR CITY YOUR ZIP 6. Last year, were you b. Totally and permanently disabledYes X No c. Legally blind 9. Last year, was your spouse b. Totally and permanently disabled Yes No c. Legally blind a. Full-time student Yes No 0 YesNo 0 5. Your job title RETIRED a. Full-time student 7. Your spouse's Date of Birth 8. Your spouse's job title 03/03/1953 10. Can anyone claim you or your spouse as a dependent? Yes X No Unsure 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? Part IIMarital Status and Household Information 1. As of December 31, 2018, what Never Married (This includes registered domestic partnerships, civil unions, or other formal relationships under state law) CASHIER was your marital status? X Married a. If Yes, Did you get married in 2018 b. Did you live with your spouse during any part of the last six months of 2018 X Yes No Divorced Legally Separated Widowed Date of final decree Date of separate maintenance agreement Year of spouse's death 2. List the names below of everyone who lived with you last year (other than your spouse) anyone you supported but did not live with you last year If additional space is needed check here and list on page 3 To be completed by a Certified Volunteer Preparer Name (first, last) Do not enter your Date of Birth Relationship Number of US name or spouse's name below Resident Single or Full-time Totally and Is this Did this Did this Did the (mm/ddlyy) to you (for months Citizen of US, Married as Student Permanently person a person person taxpayer(s) taxpayer(s) example: lived in (yeso) Canada, of 12/31/18 last year Disabled qualifying provide have less provide more pay more than son daughter, last year parent none, etc) (yesno) | (yesino) | child/relative | more than of any other 50% of his/ | of income? | support for person? her own (yeso)this person? (yeso)support? | than $4,150 | than 50% of | half the cost of | maintaining a home for this your home or Mexico (S/M) last year yeso/N/A) person? (yeso) DANIEL MILLS 01/17/1995SON YES YES YES Catalog Number 52121E Form 13614-C (Rev. 10-2018) Page 3 Check appropriate box for each question in each section Yes No Unsure Part VI - Health Care Coverage Last year, did you, your spouse, or dependent(s) d | | D | | 1, (B) Have health care coverage? | 2, (B) Receive one or more of these forms? (Check the box) Form 1095-B Form 1095-C 3. (A) Have coverage through the Marketplace (Exchange)? [Provide Form 1095-A] 3a. (A) If yes, were advance credit payments made to help you pay your health care premiums? 3b. (A) If yes, Is everyone listed on your Form 1095-A being claimed on this tax return? 4. (B) Have an exemption granted by the Marketplace? To be Completed by a Certified Volunteer Preparer (Use Publication 4012 and check the appropriate box(es) indicating Minimum Essential Coverage (MEC) for everyone listed on the return.) Name MEC All YearNo MEC Months with MEC Months with Exemption Exempt All Year Notes Taxpayer Spouse Dependent Dependent Dependent Part VIl -Additional Information and Questions Related to the Preparation of Your Return 1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D You Check here if you, or your spouse if filing jointly, want $3 to go to this fund 3. If you are due a refund, would you like Spouse a. Direct deposit b. To purchase U.S. Savings Bonds c. To split your refund between different accounts 0 X Yes Yes X No X Yes 4. If you have a balance due, would you like to make a payment directly from your bank account? X Yes Many free tax preparation sites operate by receiving grant money. The data from the following questions may be used by this site to apply for these grants Your answers will be used only for statistical purposes 5. Would you say you can carry on a conversation in English, both understanding & speaking? Very well Well Not well Not at all Prefer not to answer 6. Would you say you can read a newspaper or book in English? 7. Do you or any member of your household have a disability? 8. Are you or your spouse a Veteran from the U.S. Armed Forces? Additional comments Very well Well Not well Not at all Prefer not to answer Yes Yes Prefer not to answer Prefer not to answer x No Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1964. Also, if you have any comments regarding the time estimates associated with this study or suggestion on making this process simpler please write to the Internal Revenue Service, Tax Products Coordinating Committee, SE W:CAR:MP:T T SP, 1111 Constitution Ave. NW, Washington, DC 20224 Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2018) a Employee's social security number Visit the IRS website at www.irs.gov/afie Safe, accurate, efile IR 132-00-XXXX OMB No. 1545-0008 FAST! Use b Employer identification numbor (EIN) 1 Wages, tips, other compensaticn 3 Social security wages 5 Medicare wages and tips 7 Social security tips 2 Fodoral income tax withheld 750.00 4 Social security tax withheld 465.00 35-500XXXX c Employer's name, address, and ZIP code 7,500.00 7,500.00 7,500.00 RICH'S BOOK STORE 1225 OVERVIEW AVE YOUR CITY, STATE ZIP 6 Medicare tax withhekd 108.75 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 party 12b MARTHA MILLS 5001 LAUREL ST YOUR CITY, STATE ZIP tory plan sick pay 14 Other 12c 12d Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 35-500XXXX 7,500.00 350.00 Wage and Tax Statement 2018 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. CORRECTED (if checked OMB No. 1545-0119 Distributions From PAYER'S name, street address, city or town, state or province, country, and ZIP or foreign postal code 1 Gross distribution Retirement Plans 20,000.00 2a Taxable amount Insurance Contracts, etc. GILMER CORP 2250 DELTA AVE YOUR CITY, STATE ZIP 20,000.00 2b Taxable amount Form 1099-R Total Copy B not determineddistributionReport this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax withheld ncome on your federal tax return. If this form shows federal income tax withheld in box 4, attach this copy to your return in box 2a) 2,000.00 34-600XXXX RECIPIENT'S name 131-00-XXXX 5 Employee contributions/ 6 Net unrealized Designated Roth contributions or appreciation in employer's securities nuary JACOB MILLS insurance premiums Street address (including apt. no.) RAV 8 Other 7 Distribution code(s) SEP SIMPLE This information is being furnished to the IRS 5001 LAUREL ST 7 %) City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions YOUR CITY, STATE ZIP 10 Amount allocable to IRR distribution FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution 11 1st year of desig. Roth contrib. requirement within 5 years Account number (see instructions) 15 Local tax withheld 16 Name of locality 17 Local distribution Form 1099-R www.irs.gov/Form1099R Department of the Treasury - Internal Revenue Service FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME SEE THE REVERSE FOR MORE INFORMATION ox 1. Name JACOB MILLS x 2. Beneficiary's Social Security Number 131-00-XXXX Box 5. Net Benefits for 2018 (Box 3 minus Box 4) $16,000.00 x 3. Benefits Paid in 2018 4. Benefits Repaid to SSA in 2018 $16,000.00 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $14,692 Medicare Part B premiums deducted from your benefits: $1,308 Medicare Prescription Drug premiums (Part D) deducted from your benefits: $0 x 6. Voluntary Federal Income Tax Withholding 7. Address Total Additions: 5001 Laurel St. Your City, State Zip Benefits for 2018: $16,000 x 8. Claim Number (Use this number if you need to contact SSA) Draft as of June 21, 2018 -Subject to Change Form SSA-1099-SM (6-2018) DO NOT RETURN THIS FORM TO SSA OR IRS FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME SEE THE REVERSE FOR MORE INFORMATION ox 1. Name MARTHA MILLS 2. Beneficiary's Social Security Number 132-00-XXXX 3. Benefits Paid in 2018 4. Benefits Repaid to SSA in 2018 Box 5. Net Benefits for 2018 (Box 3 minus Box 4) $15,000.00 $15,000.00 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $12,188 Medicare Part B premiums deducted from your benefits: $1,312 Medicare Prescription Drug premiums (Part D) deducted from your benefits: $0 6. Voluntary Federal Income Tax Withholding $1,500.00 7. Address 5001 Laurel St. Your City, State Zip Total Additions: Benefits for 2018: $15,000 8. Claim Number (Use this number if you need to contact SSA) Draft as of June 21, 2018 -Subiect to Change Form SSA-1099-SM (6-2018) DO NOT RETURN THIS FORM TO SSA OR IRS CORRECTED if checked) OMB No. 1545-0112 PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Payer's RTN (optional) COUNTY BANK 2400 MILFORD AVE YOUR CITY, STATE ZIP 2018 Interest Income 1 Interest income 375.00 Form 1099-INT 2 E awal opy B PAYERS TIN RECIPIENT'S TIN For Recipient 3 Interest on U.S. Savings Bonds and Treas, obligations 39-400XXXX 131-00-XXXX This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence other sanction may be on you if this income is taxable and the IRS determines that it has not been reported RECIPIENT'S name 4 Federal income tax ex JACOB MILLS 6 Foreign tax paid 7 Foreign country or US. possession Street address (including apt. no.) 8 Tax-exempt interest 9 Specified private activity bond 5001 LAUREL ST. City or town, state or province, country, and ZIP or foreign postal code$ im 10 Market discount 11 Bond premium YOUR CITY, STATE ZIP FATCA filing 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond Account number (see instructions) 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP no Form 1099-INT (keep for your records) www.irs.gov/Form1099INT Department of the Treasury-Internal Revenue Service CORRECTED if checked OMB No. 1545-0238 PAYER'S name, street address, city or town, province or state, country, and1 Reportable winnings ZIP or foreign postal code s 2,000.00 3 Type of wager RAFFLE 5 Transaction 2018 4 Federal income tax withheld Form W-2G 5/28/2018 RIDGETOP CASINO 777 CREST ROAD YOUR CITY, STATE ZIP 500.00 ertain Gambling Winnings Winnings from identical wagers PAYER'S federal identification number PAYER'S telephone number 9 Winner's taxpayer identification no. 10 Window 131-00-XXXX 11 First I.D YS987654 13 State/Payer's state identification no.14 State winnings This information is being furnished to the Internal Revenue Service 38-600XXXX WINNER'S name JACOB MILLS Street address (including apt. no.) 5001 LAUREL ST City or town, province or state, country, and ZIP or foreign postal code 15 State income tax withheld 16 Local winnings YOUR CITY, STATE ZIP YOUR PHONE # 12 Second I.D. YS 316-00-XXXX Report this income on your federal tax return. If this form shows federal tax withheld in box 4, attach this copy to your return. 17 Local income tax withheld 18 Name of locality Under penalties of perjury, I declare that, to the best of my knowledge and belief, the name, address, and taxpayer identification number that I have furnished correctly identify me as the recipient of this payment and any payments from identical wagers, and that no other person is entitled to any part of these payments. Signature Fom W-2G Department of the T Internal Revenue Service www.irs 9 CORRECTED FILER'S name, street address, city or town, state or province, country, ZIP or 1 Payments received for foreign postal code, and telephone number OMB No. 1545-1574 qualified tuition and related expenses BUCKEYE COLLEGE 575 COLLEGE BLVD YOUR CITY, STATE ZIP Tuition Statement $7,000.00 Form 1098-T FILER'S employer identification no. STUDENTS TIN 3 If this box is checked, your educational institution changed Copy B For Student its reporting method for 2018 33-700XXXX STUDENT'S name 133-00-XXXX 4 Adjustments made for a5 Scholarships or grants This is important tax information and is being furnished to the IRS. This form must be used to complete Form 8863 to claim education prior year DANIEL MILLS $5,500.00 7 Checked if the amount Street address (including apt. no.) 6 Adjustments to 5001 LAUREL ST. City or town, state or province, country, and ZIP or foreign postal code scholarships or grants for a prior year n box 1 includes amounts for an academic period YOUR CITY, STATE ZIP Service Provider/Acct. No. (see instr.) credits. Give it to the x preparer or use it to prepare the tax return. March 2019 8 Check if at least 9 Checked if a graduate 10 Ins. contract reimb/refund half-time student xstudent Form 1098-T (keep for your records) Department of the Treasury - Internal Revenue Service www.irs.gov/Form1098T College Books 580 College Blvd Your City, State ZIP Receipt: 3 Textbooks: $500 Paument tor books is also on he college website , SEC 131-XX-XXXX Jacob Mills SECO 132-XX-XXXX Martha Mills Mara Pil 133-XX-XXXX Daniel Mills Daiiel Xtil NIS Jaob Vill Form-13614-C (October 2018) Department of the Treasury Internal Revenue Service OMB Number 1545-1964 Intake/Interview & Quality Review Sheet Please complete pages 1-3 of this form You are responsible for the information on your return. Please provide complete and accurate information If you have questions, please ask the IRS-certified volunteer preparer You will need . Tax Information such as Forms W-2, 1099, 1098, 1095 Social security cards or ITIN letters for all persons on your tax return . Picture ID (such as valid driver's license) for vou and vour spouse Volunteers are trained to provide high quality service and uphold the highest ethical standards To report unethical behavior to the IRS, email us at wi.voltax@irs.gov Part I - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's return) 1. Your first name JACOB 2. Your spouse's first name MARTHA 3. Mailing address 5001 LAUREL ST 4. Your Date of Birth 09/21/1953 M.I. Last name Daytime telephone number Are you a U.S. citizen? YOUR PHONE # MILLS M.I. ast name Daytime telephone number Is your spouse a U.S. citizen? MILLS State YOUR CITY YOUR ZIP 6. Last year, were you b. Totally and permanently disabledYes X No c. Legally blind 9. Last year, was your spouse b. Totally and permanently disabled Yes No c. Legally blind a. Full-time student Yes No 0 YesNo 0 5. Your job title RETIRED a. Full-time student 7. Your spouse's Date of Birth 8. Your spouse's job title 03/03/1953 10. Can anyone claim you or your spouse as a dependent? Yes X No Unsure 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? Part IIMarital Status and Household Information 1. As of December 31, 2018, what Never Married (This includes registered domestic partnerships, civil unions, or other formal relationships under state law) CASHIER was your marital status? X Married a. If Yes, Did you get married in 2018 b. Did you live with your spouse during any part of the last six months of 2018 X Yes No Divorced Legally Separated Widowed Date of final decree Date of separate maintenance agreement Year of spouse's death 2. List the names below of everyone who lived with you last year (other than your spouse) anyone you supported but did not live with you last year If additional space is needed check here and list on page 3 To be completed by a Certified Volunteer Preparer Name (first, last) Do not enter your Date of Birth Relationship Number of US name or spouse's name below Resident Single or Full-time Totally and Is this Did this Did this Did the (mm/ddlyy) to you (for months Citizen of US, Married as Student Permanently person a person person taxpayer(s) taxpayer(s) example: lived in (yeso) Canada, of 12/31/18 last year Disabled qualifying provide have less provide more pay more than son daughter, last year parent none, etc) (yesno) | (yesino) | child/relative | more than of any other 50% of his/ | of income? | support for person? her own (yeso)this person? (yeso)support? | than $4,150 | than 50% of | half the cost of | maintaining a home for this your home or Mexico (S/M) last year yeso/N/A) person? (yeso) DANIEL MILLS 01/17/1995SON YES YES YES Catalog Number 52121E Form 13614-C (Rev. 10-2018) Page 3 Check appropriate box for each question in each section Yes No Unsure Part VI - Health Care Coverage Last year, did you, your spouse, or dependent(s) d | | D | | 1, (B) Have health care coverage? | 2, (B) Receive one or more of these forms? (Check the box) Form 1095-B Form 1095-C 3. (A) Have coverage through the Marketplace (Exchange)? [Provide Form 1095-A] 3a. (A) If yes, were advance credit payments made to help you pay your health care premiums? 3b. (A) If yes, Is everyone listed on your Form 1095-A being claimed on this tax return? 4. (B) Have an exemption granted by the Marketplace? To be Completed by a Certified Volunteer Preparer (Use Publication 4012 and check the appropriate box(es) indicating Minimum Essential Coverage (MEC) for everyone listed on the return.) Name MEC All YearNo MEC Months with MEC Months with Exemption Exempt All Year Notes Taxpayer Spouse Dependent Dependent Dependent Part VIl -Additional Information and Questions Related to the Preparation of Your Return 1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D JFMAMJJASONDJ F M A M J J A S O N D You Check here if you, or your spouse if filing jointly, want $3 to go to this fund 3. If you are due a refund, would you like Spouse a. Direct deposit b. To purchase U.S. Savings Bonds c. To split your refund between different accounts 0 X Yes Yes X No X Yes 4. If you have a balance due, would you like to make a payment directly from your bank account? X Yes Many free tax preparation sites operate by receiving grant money. The data from the following questions may be used by this site to apply for these grants Your answers will be used only for statistical purposes 5. Would you say you can carry on a conversation in English, both understanding & speaking? Very well Well Not well Not at all Prefer not to answer 6. Would you say you can read a newspaper or book in English? 7. Do you or any member of your household have a disability? 8. Are you or your spouse a Veteran from the U.S. Armed Forces? Additional comments Very well Well Not well Not at all Prefer not to answer Yes Yes Prefer not to answer Prefer not to answer x No Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1964. Also, if you have any comments regarding the time estimates associated with this study or suggestion on making this process simpler please write to the Internal Revenue Service, Tax Products Coordinating Committee, SE W:CAR:MP:T T SP, 1111 Constitution Ave. NW, Washington, DC 20224 Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2018) a Employee's social security number Visit the IRS website at www.irs.gov/afie Safe, accurate, efile IR 132-00-XXXX OMB No. 1545-0008 FAST! Use b Employer identification numbor (EIN) 1 Wages, tips, other compensaticn 3 Social security wages 5 Medicare wages and tips 7 Social security tips 2 Fodoral income tax withheld 750.00 4 Social security tax withheld 465.00 35-500XXXX c Employer's name, address, and ZIP code 7,500.00 7,500.00 7,500.00 RICH'S BOOK STORE 1225 OVERVIEW AVE YOUR CITY, STATE ZIP 6 Medicare tax withhekd 108.75 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 party 12b MARTHA MILLS 5001 LAUREL ST YOUR CITY, STATE ZIP tory plan sick pay 14 Other 12c 12d Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 35-500XXXX 7,500.00 350.00 Wage and Tax Statement 2018 Department of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. CORRECTED (if checked OMB No. 1545-0119 Distributions From PAYER'S name, street address, city or town, state or province, country, and ZIP or foreign postal code 1 Gross distribution Retirement Plans 20,000.00 2a Taxable amount Insurance Contracts, etc. GILMER CORP 2250 DELTA AVE YOUR CITY, STATE ZIP 20,000.00 2b Taxable amount Form 1099-R Total Copy B not determineddistributionReport this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain (included 4 Federal income tax withheld ncome on your federal tax return. If this form shows federal income tax withheld in box 4, attach this copy to your return in box 2a) 2,000.00 34-600XXXX RECIPIENT'S name 131-00-XXXX 5 Employee contributions/ 6 Net unrealized Designated Roth contributions or appreciation in employer's securities nuary JACOB MILLS insurance premiums Street address (including apt. no.) RAV 8 Other 7 Distribution code(s) SEP SIMPLE This information is being furnished to the IRS 5001 LAUREL ST 7 %) City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions YOUR CITY, STATE ZIP 10 Amount allocable to IRR distribution FATCA filing 12 State tax withheld 13 State/Payer's state no. 14 State distribution 11 1st year of desig. Roth contrib. requirement within 5 years Account number (see instructions) 15 Local tax withheld 16 Name of locality 17 Local distribution Form 1099-R www.irs.gov/Form1099R Department of the Treasury - Internal Revenue Service FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME SEE THE REVERSE FOR MORE INFORMATION ox 1. Name JACOB MILLS x 2. Beneficiary's Social Security Number 131-00-XXXX Box 5. Net Benefits for 2018 (Box 3 minus Box 4) $16,000.00 x 3. Benefits Paid in 2018 4. Benefits Repaid to SSA in 2018 $16,000.00 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $14,692 Medicare Part B premiums deducted from your benefits: $1,308 Medicare Prescription Drug premiums (Part D) deducted from your benefits: $0 x 6. Voluntary Federal Income Tax Withholding 7. Address Total Additions: 5001 Laurel St. Your City, State Zip Benefits for 2018: $16,000 x 8. Claim Number (Use this number if you need to contact SSA) Draft as of June 21, 2018 -Subject to Change Form SSA-1099-SM (6-2018) DO NOT RETURN THIS FORM TO SSA OR IRS FORM SSA-1099 SOCIAL SECURITY BENEFIT STATEMENT PART OF YOUR SOCIAL SECURITY BENEFITS SHOWN IN BOX 5 MAY BE TAXABLE INCOME SEE THE REVERSE FOR MORE INFORMATION ox 1. Name MARTHA MILLS 2. Beneficiary's Social Security Number 132-00-XXXX 3. Benefits Paid in 2018 4. Benefits Repaid to SSA in 2018 Box 5. Net Benefits for 2018 (Box 3 minus Box 4) $15,000.00 $15,000.00 DESCRIPTION OF AMOUNT IN BOX 3 DESCRIPTION OF AMOUNT IN BOX 4 Paid by check or direct deposit: $12,188 Medicare Part B premiums deducted from your benefits: $1,312 Medicare Prescription Drug premiums (Part D) deducted from your benefits: $0 6. Voluntary Federal Income Tax Withholding $1,500.00 7. Address 5001 Laurel St. Your City, State Zip Total Additions: Benefits for 2018: $15,000 8. Claim Number (Use this number if you need to contact SSA) Draft as of June 21, 2018 -Subiect to Change Form SSA-1099-SM (6-2018) DO NOT RETURN THIS FORM TO SSA OR IRS CORRECTED if checked) OMB No. 1545-0112 PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Payer's RTN (optional) COUNTY BANK 2400 MILFORD AVE YOUR CITY, STATE ZIP 2018 Interest Income 1 Interest income 375.00 Form 1099-INT 2 E awal opy B PAYERS TIN RECIPIENT'S TIN For Recipient 3 Interest on U.S. Savings Bonds and Treas, obligations 39-400XXXX 131-00-XXXX This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence other sanction may be on you if this income is taxable and the IRS determines that it has not been reported RECIPIENT'S name 4 Federal income tax ex JACOB MILLS 6 Foreign tax paid 7 Foreign country or US. possession Street address (including apt. no.) 8 Tax-exempt interest 9 Specified private activity bond 5001 LAUREL ST. City or town, state or province, country, and ZIP or foreign postal code$ im 10 Market discount 11 Bond premium YOUR CITY, STATE ZIP FATCA filing 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond Account number (see instructions) 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP no Form 1099-INT (keep for your records) www.irs.gov/Form1099INT Department of the Treasury-Internal Revenue Service CORRECTED if checked OMB No. 1545-0238 PAYER'S name, street address, city or town, province or state, country, and1 Reportable winnings ZIP or foreign postal code s 2,000.00 3 Type of wager RAFFLE 5 Transaction 2018 4 Federal income tax withheld Form W-2G 5/28/2018 RIDGETOP CASINO 777 CREST ROAD YOUR CITY, STATE ZIP 500.00 ertain Gambling Winnings Winnings from identical wagers PAYER'S federal identification number PAYER'S telephone number 9 Winner's taxpayer identification no. 10 Window 131-00-XXXX 11 First I.D YS987654 13 State/Payer's state identification no.14 State winnings This information is being furnished to the Internal Revenue Service 38-600XXXX WINNER'S name JACOB MILLS Street address (including apt. no.) 5001 LAUREL ST City or town, province or state, country, and ZIP or foreign postal code 15 State income tax withheld 16 Local winnings YOUR CITY, STATE ZIP YOUR PHONE # 12 Second I.D. YS 316-00-XXXX Report this income on your federal tax return. If this form shows federal tax withheld in box 4, attach this copy to your return. 17 Local income tax withheld 18 Name of locality Under penalties of perjury, I declare that, to the best of my knowledge and belief, the name, address, and taxpayer identification number that I have furnished correctly identify me as the recipient of this payment and any payments from identical wagers, and that no other person is entitled to any part of these payments. Signature Fom W-2G Department of the T Internal Revenue Service www.irs 9 CORRECTED FILER'S name, street address, city or town, state or province, country, ZIP or 1 Payments received for foreign postal code, and telephone number OMB No. 1545-1574 qualified tuition and related expenses BUCKEYE COLLEGE 575 COLLEGE BLVD YOUR CITY, STATE ZIP Tuition Statement $7,000.00 Form 1098-T FILER'S employer identification no. STUDENTS TIN 3 If this box is checked, your educational institution changed Copy B For Student its reporting method for 2018 33-700XXXX STUDENT'S name 133-00-XXXX 4 Adjustments made for a5 Scholarships or grants This is important tax information and is being furnished to the IRS. This form must be used to complete Form 8863 to claim education prior year DANIEL MILLS $5,500.00 7 Checked if the amount Street address (including apt. no.) 6 Adjustments to 5001 LAUREL ST. City or town, state or province, country, and ZIP or foreign postal code scholarships or grants for a prior year n box 1 includes amounts for an academic period YOUR CITY, STATE ZIP Service Provider/Acct. No. (see instr.) credits. Give it to the x preparer or use it to prepare the tax return. March 2019 8 Check if at least 9 Checked if a graduate 10 Ins. contract reimb/refund half-time student xstudent Form 1098-T (keep for your records) Department of the Treasury - Internal Revenue Service www.irs.gov/Form1098T College Books 580 College Blvd Your City, State ZIP Receipt: 3 Textbooks: $500 Paument tor books is also on he college website

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts