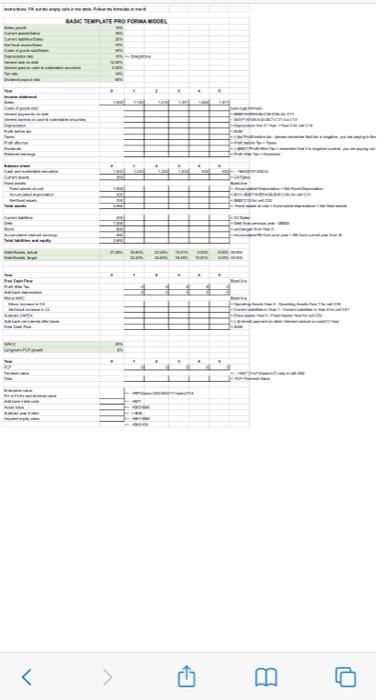

Question: BASIC TEMPLATE PRO FORMA MODEL 1333 i3 . -1- I wished in the follow the desire BASIC TEMPLATE PRO FORMA MODEL Outside One 30 Marted

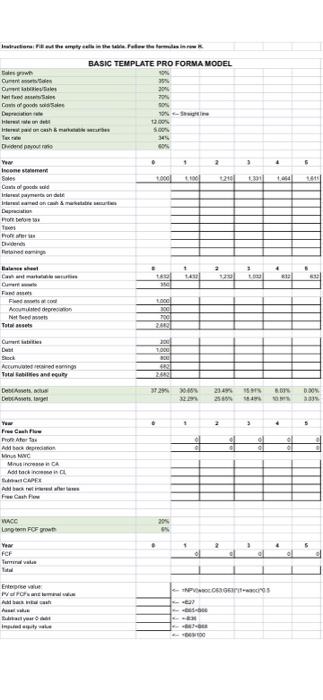

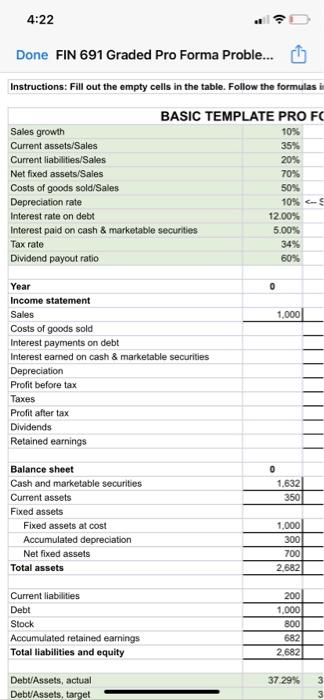

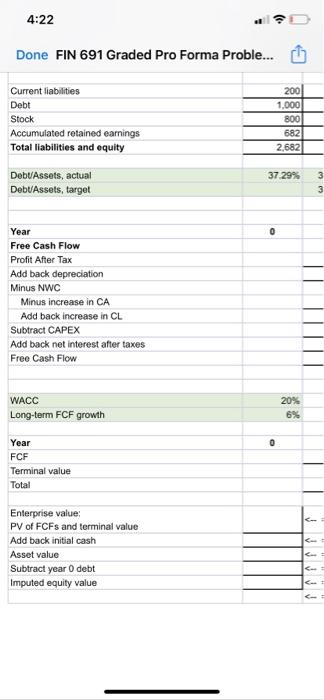

BASIC TEMPLATE PRO FORMA MODEL 1333 i3 . -1- I wished in the follow the desire BASIC TEMPLATE PRO FORMA MODEL Outside One 30 Marted Cow of good wie os Der Het 12.00 Ich machen SON Dend you to Yew . 1 2 Income Soes 100 1216 Castell Intermunte onde Internet > 1111 How . + ta 10 Fler Apr Not be cl 700 243 for BE Camera Det Amet hold ar Total ties and Dessous Design 22 3729 2010 15 . 2049 250 . . 1 www Free Cashhur Pro Moro Add to INC MCA Add to CAPEX Add back with a FreeCat 20% wce Loron FC grow Year FCF Termenul Total . 4 al ol PVNOG Entero FO A Ae In the DOO 4:22 10% 35% Done FIN 691 Graded Pro Forma Proble... Instructions: Fill out the empty cells in the table. Follow the formulas i BASIC TEMPLATE PRO FC Sales growth Current assets/Sales Current liabilities/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash & marketable securities Dividend payout ratio 20% Net fixed assets/Sales 70% 50% 10% CS 12.00% 5.00% 34% 60% Tax rate 0 1,000 Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash & marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings 0 1.632 350 Balance sheet Cash and marketable securities Current assets Fixed assets Fixed assets at cost Accumulated depreciation Net fixed assets Total assets 1,000 300 700 2.682 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 200 1,000 800 682 2.682 37 29% 3 DebtAssets, actual DebtAssets, target 3 4:22 Done FIN 691 Graded Pro Forma Proble... Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity DebtAssets, actual DebtAssets, target 200 1,000 800 682 2.682 3729% 3 3 0 Year Free Cash Flow Profit After Tax Add back depreciation Minus NWC Minus increase in CA Add back increase in CL Subtract CAPEX Add back net interest after taxes Free Cash Flow WACC Long-term FCF growth 20% 6% 0 Year FCF Terminal value Total Enterprise value: PV of FCFs and terminal value Add back initial cash Asset value Subtract year 0 debt Imputed equity value BASIC TEMPLATE PRO FORMA MODEL 1333 i3 . -1- I wished in the follow the desire BASIC TEMPLATE PRO FORMA MODEL Outside One 30 Marted Cow of good wie os Der Het 12.00 Ich machen SON Dend you to Yew . 1 2 Income Soes 100 1216 Castell Intermunte onde Internet > 1111 How . + ta 10 Fler Apr Not be cl 700 243 for BE Camera Det Amet hold ar Total ties and Dessous Design 22 3729 2010 15 . 2049 250 . . 1 www Free Cashhur Pro Moro Add to INC MCA Add to CAPEX Add back with a FreeCat 20% wce Loron FC grow Year FCF Termenul Total . 4 al ol PVNOG Entero FO A Ae In the DOO 4:22 10% 35% Done FIN 691 Graded Pro Forma Proble... Instructions: Fill out the empty cells in the table. Follow the formulas i BASIC TEMPLATE PRO FC Sales growth Current assets/Sales Current liabilities/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash & marketable securities Dividend payout ratio 20% Net fixed assets/Sales 70% 50% 10% CS 12.00% 5.00% 34% 60% Tax rate 0 1,000 Year Income statement Sales Costs of goods sold Interest payments on debt Interest earned on cash & marketable securities Depreciation Profit before tax Taxes Profit after tax Dividends Retained earnings 0 1.632 350 Balance sheet Cash and marketable securities Current assets Fixed assets Fixed assets at cost Accumulated depreciation Net fixed assets Total assets 1,000 300 700 2.682 Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity 200 1,000 800 682 2.682 37 29% 3 DebtAssets, actual DebtAssets, target 3 4:22 Done FIN 691 Graded Pro Forma Proble... Current liabilities Debt Stock Accumulated retained earnings Total liabilities and equity DebtAssets, actual DebtAssets, target 200 1,000 800 682 2.682 3729% 3 3 0 Year Free Cash Flow Profit After Tax Add back depreciation Minus NWC Minus increase in CA Add back increase in CL Subtract CAPEX Add back net interest after taxes Free Cash Flow WACC Long-term FCF growth 20% 6% 0 Year FCF Terminal value Total Enterprise value: PV of FCFs and terminal value Add back initial cash Asset value Subtract year 0 debt Imputed equity value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts