Question: Bat Homework Hero With Chase Study Cheng.com Question 9 3 pts When $1 million is deposited at a bank, the required reserve ratio is 15

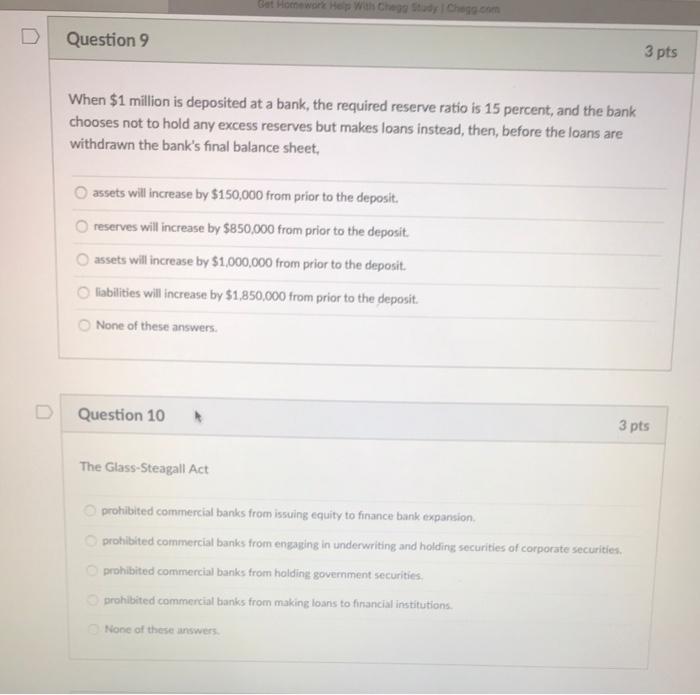

Bat Homework Hero With Chase Study Cheng.com Question 9 3 pts When $1 million is deposited at a bank, the required reserve ratio is 15 percent, and the bank chooses not to hold any excess reserves but makes loans instead, then, before the loans are withdrawn the bank's final balance sheet, assets will increase by $150,000 from prior to the deposit. reserves will increase by $850,000 from prior to the deposit. assets will increase by $1,000,000 from prior to the deposit liabilities will increase by $1,850,000 from prior to the deposit. None of these answers Question 10 3 pts The Glass-Steagall Act prohibited commercial banks from issuing equity to finance bank expansion prohibited commercial banks from engaging in underwriting and holding securities of corporate securities. prohibited commercial banks from holding government securities prohibited commercial banks from making loans to financial institutions. None of these answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts