Question: QUESTION 19 (the date when the project ends will not be known until it happens and that will be when the equipment stops working in

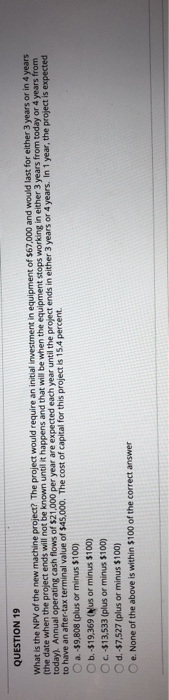

QUESTION 19 (the date when the project ends will not be known until it happens and that will be when the equipment stops working in either 3 years from today or 4 years from What is the NPV of the new machine project? The project would require an initial investment in equipment of $67,000 and would last for either 3 years or in 4 years today). Annual operating cash flows of $21,000 per year are expected each year until the project ends in either 3 years or 4 years. In 1 year, the project is expected to have an after-tax terminal value of $45,000. The cost of capital for this project is 15.4 percent. a.-$9,808 (plus or minus $100) b. $19,369 (Nus or minus $100) OC -$13,533 (plus or minus $100) d. -$7,527 (plus or minus $100) e. None of the above is within $100 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts