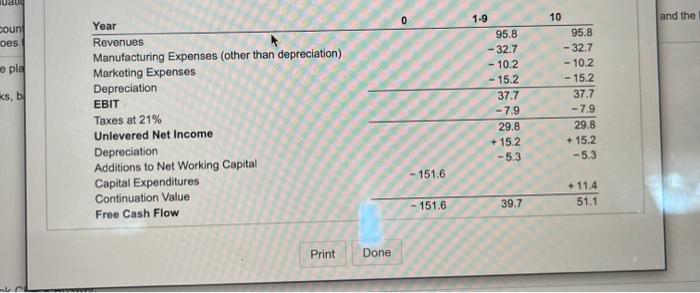

Question: Bauer Industries on mobile and Management is currenting a proposal to build a planta intre io Boerplane to seco o capital of this projeto research

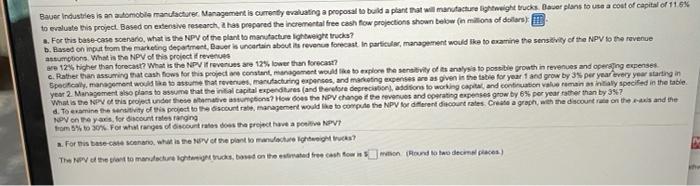

Bauer Industries on mobile and Management is currenting a proposal to build a planta intre io Boerplane to seco o capital of this projeto research has prepared the incremecah flow projections shown below in milions of a. For this bate case scenario what is the NPV of plant to manure light . Bured on ipak trom the marketing departmentBut is uncertain about is reverse forcat. In particular, management would be a heavy of the NPV to the won. Whether are 12% Ngher than forecast? What is the NPV revenues are 12 tower than forecast? c. Rather than assuming that cash flows for projecte constant management would be explore they ofta mye pouble growth in revenue and experiment e manufacturing expenses and maingeren genie 68 for yowi w grow by per year very owning in yow 2. Mange ao para tomar por two depreciation stone to working capital and contain value reman sayeed in Wall The NPV presentiem? How do NPV changer under grow by year wherranty 35 d. to examine the seativity of this project to the current would be com Perle the one and the NPV Foto 30For what range of controle de the have a NPV) For the base-case scenario what is the NPV of the lo mereix? The NPV of the part to manufacture that the bed on the time the chwindines pts P 9-32 (similar to) Question Help Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 11.6% to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown below (in millions of dollars): a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 12% higher than forecast? What is the NPV if revenues are 12% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated tree cash flow is million (Round to two decimal places.) For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management ould like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues e 12% higher than forecast? What is the NPV if revenues are 12% lower than forecast? Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its nalysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that avenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year very year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore epreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of mis project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 3%? 3. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different Discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging From 5% to 30%. For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is $ million. (Round to two decimal places.) Bauer Industries on mobile and Management is currenting a proposal to build a planta intre io Boerplane to seco o capital of this projeto research has prepared the incremecah flow projections shown below in milions of a. For this bate case scenario what is the NPV of plant to manure light . Bured on ipak trom the marketing departmentBut is uncertain about is reverse forcat. In particular, management would be a heavy of the NPV to the won. Whether are 12% Ngher than forecast? What is the NPV revenues are 12 tower than forecast? c. Rather than assuming that cash flows for projecte constant management would be explore they ofta mye pouble growth in revenue and experiment e manufacturing expenses and maingeren genie 68 for yowi w grow by per year very owning in yow 2. Mange ao para tomar por two depreciation stone to working capital and contain value reman sayeed in Wall The NPV presentiem? How do NPV changer under grow by year wherranty 35 d. to examine the seativity of this project to the current would be com Perle the one and the NPV Foto 30For what range of controle de the have a NPV) For the base-case scenario what is the NPV of the lo mereix? The NPV of the part to manufacture that the bed on the time the chwindines pts P 9-32 (similar to) Question Help Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 11.6% to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown below (in millions of dollars): a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 12% higher than forecast? What is the NPV if revenues are 12% lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated tree cash flow is million (Round to two decimal places.) For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management ould like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues e 12% higher than forecast? What is the NPV if revenues are 12% lower than forecast? Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its nalysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that avenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year very year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore epreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of mis project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 3%? 3. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different Discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging From 5% to 30%. For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts