Question: Bb Discussion Problem (Student) -C X Bb INCLASS_W20-202020.FIN363.0 x Bb Microsoft PowerPoint - 8th ed_CH X + bb.umflint.edu/bbcswebdav/pid-7551708-dt-content-rid-18070585_2/courses/202020.FIN363.01/8th%20ed_CHAP%2006_price%20ratio%20model_sv.pdf C Microsoft PowerPoint - 8th ed_CHAP

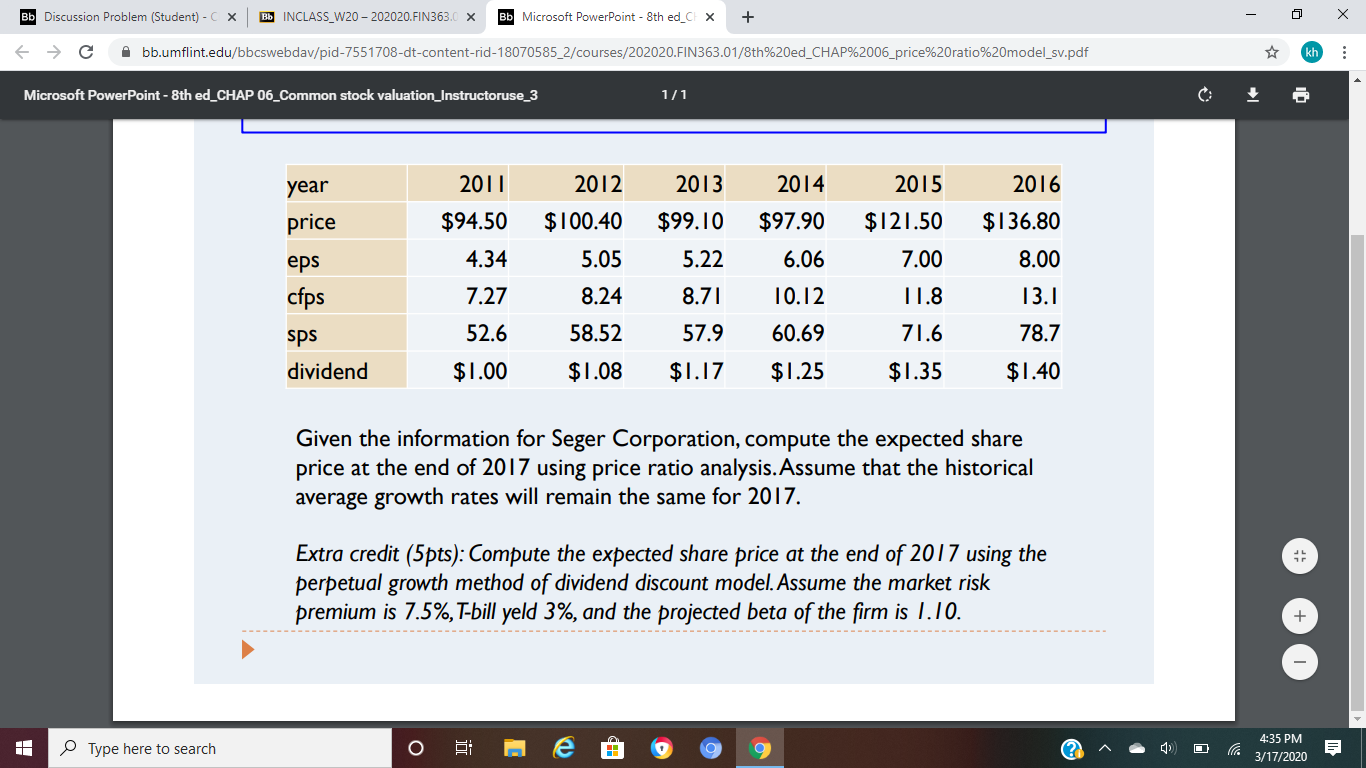

Bb Discussion Problem (Student) -C X Bb INCLASS_W20-202020.FIN363.0 x Bb Microsoft PowerPoint - 8th ed_CH X + bb.umflint.edu/bbcswebdav/pid-7551708-dt-content-rid-18070585_2/courses/202020.FIN363.01/8th%20ed_CHAP%2006_price%20ratio%20model_sv.pdf C Microsoft PowerPoint - 8th ed_CHAP 06_Common stock valuation_Instructoruse_3 1/1 0 year 2011 2012 2013 2014 2015 2016 price $94.50 $100.40 $99.10 $97.90 $121.50 $136.80 eps 4.34 5.05 5.22 6.06 7.00 8.00 cfps 7.27 8.24 8.71 10.12 11.8 13.1 sps 52.6 58.52 57.9 60.69 71.6 78.7 dividend $1.00 $1.08 $1.17 $1.25 $1.35 $1.40 H kh Given the information for Seger Corporation, compute the expected share price at the end of 2017 using price ratio analysis. Assume that the historical average growth rates will remain the same for 2017. Extra credit (5pts): Compute the expected share price at the end of 2017 using the perpetual growth method of dividend discount model. Assume the market risk premium is 7.5%, T-bill yeld 3%, and the projected beta of the firm is 1.10. Type here to search + e O ? 4:35 PM 3/17/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts