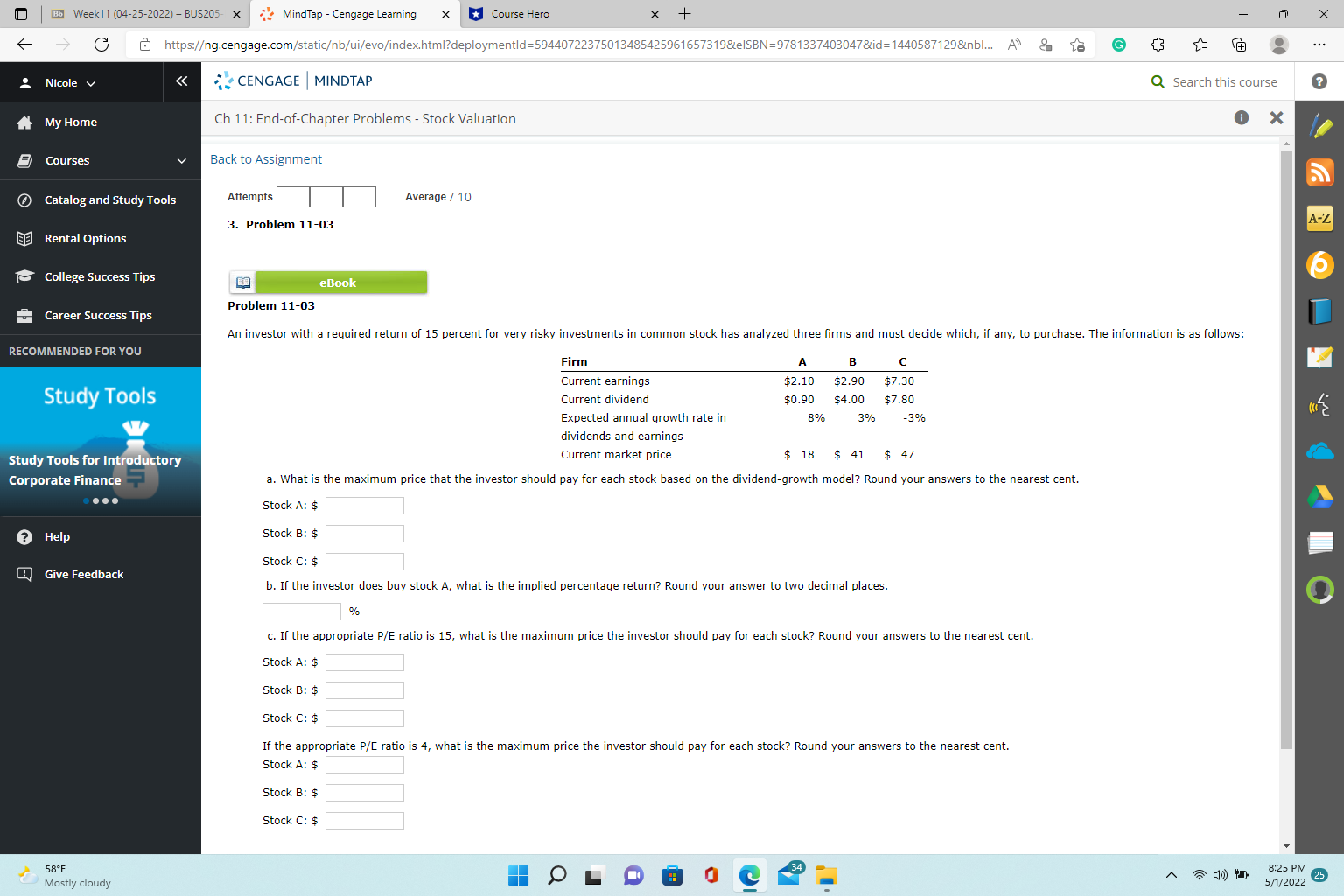

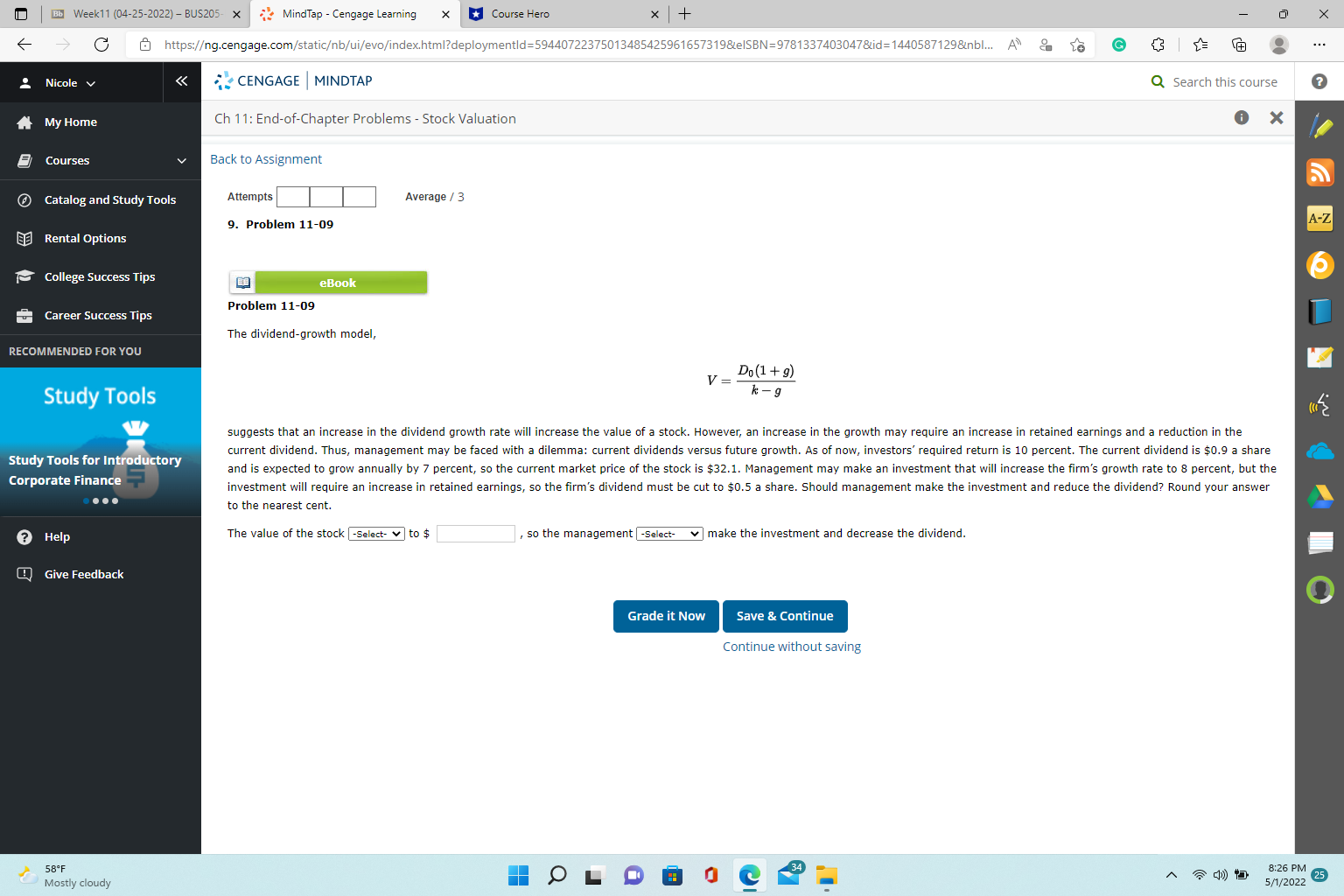

Question: |Bb Week11 (04-25-2022) - BUS205- x MindTap - Cengage Learning * *Course Hero * + X C & https:/g.cengage.com/staticb/ui/evo/index.html?deploymentld=59440722375013485425961657319&eISBN=9781337403047&id=1440587129&nbl... A G .. ? Nicole v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts