Question: BBMC2023 DECISION MANAGEMENT Question 2 Finally Sdn. Bhd. has been making losses in the last 2 years due to the challenging business environment brought about

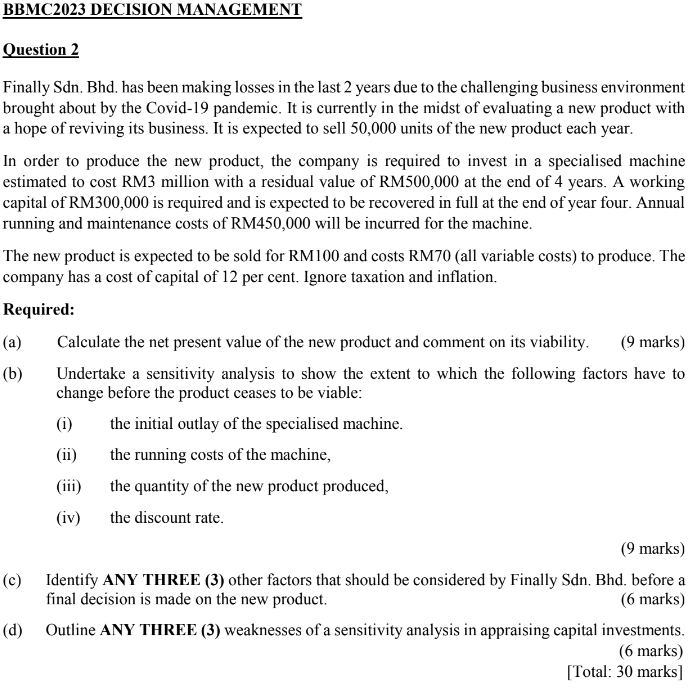

BBMC2023 DECISION MANAGEMENT Question 2 Finally Sdn. Bhd. has been making losses in the last 2 years due to the challenging business environment brought about by the Covid-19 pandemic. It is currently in the midst of evaluating a new product with a hope of reviving its business. It is expected to sell 50,000 units of the new product each year. In order to produce the new product, the company is required to invest in a specialised machine estimated to cost RM3 million with a residual value of RM500,000 at the end of 4 years. A working capital of RM300,000 is required and is expected to be recovered in full at the end of year four. Annual running and maintenance costs of RM450,000 will be incurred for the machine. The new product is expected to be sold for RM100 and costs RM70 (all variable costs) to produce. The company has a cost of capital of 12 per cent. Ignore taxation and inflation. Required: (a) Calculate the net present value of the new product and comment on its viability. (9 marks) (b) Undertake a sensitivity analysis to show the extent to which the following factors have to change before the product ceases to be viable: (i) the initial outlay of the specialised machine. (ii) the running costs of the machine, (iii) the quantity of the new product produced, (iv) the discount rate. (9 marks) (c) Identify ANY THREE (3) other factors that should be considered by Finally Sdn. Bhd. before a final decision is made on the new product. (6 marks) (d) Outline ANY THREE (3) weaknesses of a sensitivity analysis in appraising capital investments. (6 marks) [Total: 30 marks] BBMC2023 DECISION MANAGEMENT Question 2 Finally Sdn. Bhd. has been making losses in the last 2 years due to the challenging business environment brought about by the Covid-19 pandemic. It is currently in the midst of evaluating a new product with a hope of reviving its business. It is expected to sell 50,000 units of the new product each year. In order to produce the new product, the company is required to invest in a specialised machine estimated to cost RM3 million with a residual value of RM500,000 at the end of 4 years. A working capital of RM300,000 is required and is expected to be recovered in full at the end of year four. Annual running and maintenance costs of RM450,000 will be incurred for the machine. The new product is expected to be sold for RM100 and costs RM70 (all variable costs) to produce. The company has a cost of capital of 12 per cent. Ignore taxation and inflation. Required: (a) Calculate the net present value of the new product and comment on its viability. (9 marks) (b) Undertake a sensitivity analysis to show the extent to which the following factors have to change before the product ceases to be viable: (i) the initial outlay of the specialised machine. (ii) the running costs of the machine, (iii) the quantity of the new product produced, (iv) the discount rate. (9 marks) (c) Identify ANY THREE (3) other factors that should be considered by Finally Sdn. Bhd. before a final decision is made on the new product. (6 marks) (d) Outline ANY THREE (3) weaknesses of a sensitivity analysis in appraising capital investments. (6 marks) [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts