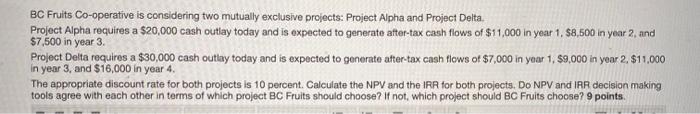

Question: BC Fruits Co-operative is considering two mutually exclusive projects Project Alpha and Project Delta, Project Alpha requires a $20,000 cash outlay today and is expected

BC Fruits Co-operative is considering two mutually exclusive projects Project Alpha and Project Delta, Project Alpha requires a $20,000 cash outlay today and is expected to generate after-tax cash flows of $11,000 in year 1, $4,500 in year 2, and $7,500 in year 3. Project Delta requires a $30,000 cash outlay today and is expected to generate after-tax cash flows of $7,000 in year 1, 89,000 in year 2, $11,000 in year 3, and $16,000 in year 4. The appropriate discount rate for both projects is 10 percent. Calculate the NPV and the IRR for both projects. Do NPV and IAR decision making tools agree with each other in terms of which project BC Fruits should choose? If not, which project should BC Fruits choose? 9 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts