Question: BC0114 ACCOUNTING I Task brief & rubrics Task: Final Assignment (40% of the Final grade) You must answer all the questions in the proposed business

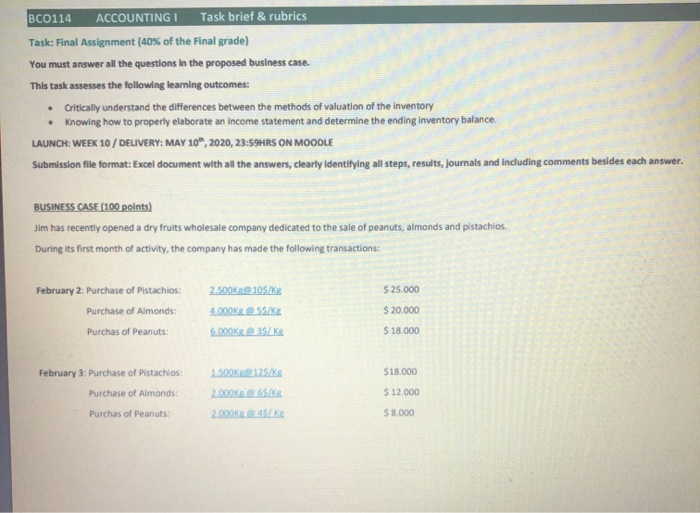

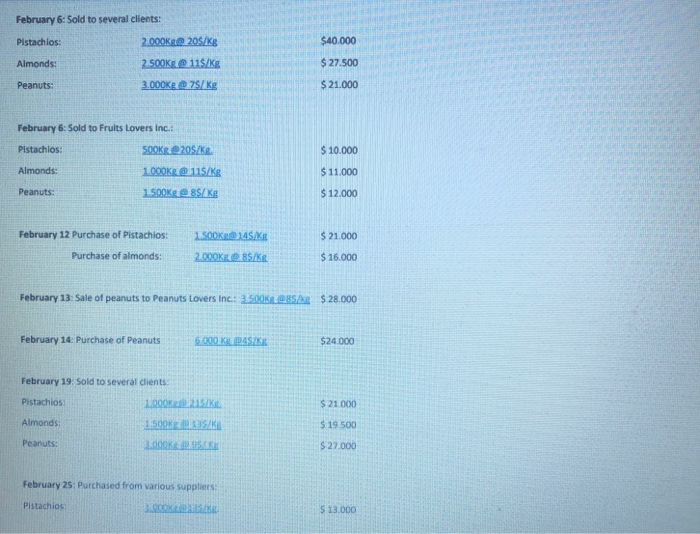

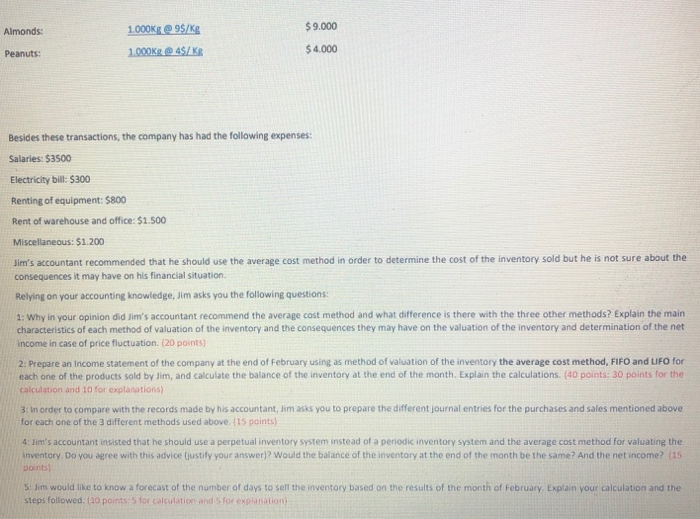

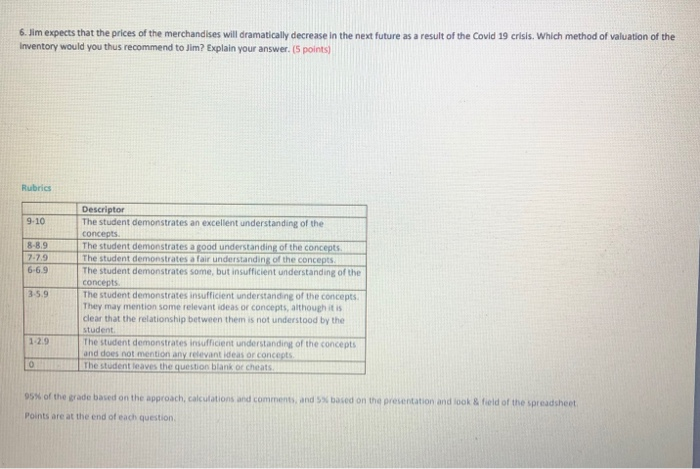

BC0114 ACCOUNTING I Task brief & rubrics Task: Final Assignment (40% of the Final grade) You must answer all the questions in the proposed business case. This task assesses the following learning outcomes: Critically understand the differences between the methods of valuation of the inventory Knowing how to properly elaborate an income statement and determine the ending inventory balance. LAUNCH: WEEK 10 / DELIVERY: MAY 10, 2020, 23:59HRS ON MOODLE Submission file format: Excel document with all the answers, clearly identifying all steps, results, journals and including comments besides each answer. BUSINESS CASE (100 points) Jim has recently opened a dry fruits wholesale company dedicated to the sale of peanuts, almonds and pistachios. During its first month of activity, the company has made the following transactions: February 2: Purchase of Pistachios: 2.500KR10SKE $ 25.000 Purchase of Almonds: $ 20.000 4.OOOKEDSSIKE 6.000K 35 KS Purchas of Peanuts: $ 18.000 1.SOOKED 125/ February 3: Purchase of Pistachios: Purchase of Almonds: 2.000KLDSSIKE $18.000 $ 12.000 $ 8.000 Purchas of Peanuts 2.000K 45 KB February 6: Sold to several clients: Pistachios 2.000KR 205/Kg Almonds: 2.sook @ 11$/kg $40.000 $ 27.500 Peanuts: 3.000KR. 75/kg $ 21.000 February 6: Sold to Fruits Lovers Inc.: Pistachios: 500K20SAKR $ 10.000 Almonds: 1.DOORS/kg $ 11,000 Peanuts: 1.500kg 85/Kg $ 12.000 February 12 Purchase of Pistachios: Purchase of almonds: SKD 245/KR 2.000kg / $ 21.000 $ 16.000 February 13: Sale of peanuts to Peanuts Lovers Inc: 3.500KR. 85/kg $28.000 February 14: Purchase of Peanuts 6.000 KLASIKE $24.000 February 19: Sold to several clients Pistachios: $ 21.000 Almonds: 1000K 225/ 1 SOKE DANSKE REDSKE $ 19.500 $ 27.000 Peanuts: February 25: Purchased from various suppliers Pistachios 2000KS S 13.000 Almonds: $9.000 1.000Kg 99/kg 1.000Kg @ 4S/Kg Peanuts: $ 4.000 Besides these transactions, the company has had the following expenses: Salaries: $3500 Electricity bill: $300 Renting of equipment: $800 Rent of warehouse and office: $1.500 Miscellaneous: $1.200 Jim's accountant recommended that he should use the average cost method in order to determine the cost of the inventory sold but he is not sure about the consequences it may have on his financial situation Relying on your accounting knowledge, Jim asks you the following questions: 1: Why in your opinion did Jim's accountant recommend the average cost method and what difference is there with the three other methods? Explain the main characteristics of each method of valuation of the inventory and the consequences they may have on the valuation of the inventory and determination of the net income in case of price fluctuation. (20 points) 2: Prepare an income statement of the company at the end of February using as method of valuation of the inventory the average cost method, FIFO and UFO for each one of the products sold by Jim, and calculate the balance of the inventory at the end of the month. Explain the calculations. (40 points: 30 points for the calculation and 10 for explanations) 3: In order to compare with the records made by his accountant, Jim asks you to prepare the different journal entries for the purchases and sales mentioned above for each one of the 3 different methods used above. 115 points) 4. Jim's accountant insisted that he should use a perpetual inventory system instead of a periodic inventory system and the average cost method for valuating the inventory. Do you agree with this advice justify your answer)? Would the balance of the inventory at the end of the month be the same? And the net income? (15 Doints Slim would like to know a forecast of the number of days to sell the inventory based on the results of the month of February. Explain your calculation and the steps followed. (10 points for calculation and for explanation) 6. Jim expects that the prices of the merchandises will dramatically decrease in the next future as a result of the Covid 19 crisis. Which method of valuation of the Inventory would you thus recommend to Jim? Explain your answer. 5 points) 8-8.9 2.79 Descriptor The student demonstrates an excellent understanding of the concepts The student demonstrates a good understanding of the concepts The student demonstrates a fair understanding of the concepts The student demonstrates some, but insufficient understanding of the concepts The student demonstrates insufficient understanding of the concepts They may mention some relevant ideas or concepts, although it is clear that the relationship between them is not understood by the Student The student demonstrates insufficient understanding of the concepts and does not mention any relevant ideas or concepts The student leaves the question blank or cheats based on the presentation and look & field of the spreadsheet 95% of the grade based on the approach, calculations and comments and Points are at the end of each question BC0114 ACCOUNTING I Task brief & rubrics Task: Final Assignment (40% of the Final grade) You must answer all the questions in the proposed business case. This task assesses the following learning outcomes: Critically understand the differences between the methods of valuation of the inventory Knowing how to properly elaborate an income statement and determine the ending inventory balance. LAUNCH: WEEK 10 / DELIVERY: MAY 10, 2020, 23:59HRS ON MOODLE Submission file format: Excel document with all the answers, clearly identifying all steps, results, journals and including comments besides each answer. BUSINESS CASE (100 points) Jim has recently opened a dry fruits wholesale company dedicated to the sale of peanuts, almonds and pistachios. During its first month of activity, the company has made the following transactions: February 2: Purchase of Pistachios: 2.500KR10SKE $ 25.000 Purchase of Almonds: $ 20.000 4.OOOKEDSSIKE 6.000K 35 KS Purchas of Peanuts: $ 18.000 1.SOOKED 125/ February 3: Purchase of Pistachios: Purchase of Almonds: 2.000KLDSSIKE $18.000 $ 12.000 $ 8.000 Purchas of Peanuts 2.000K 45 KB February 6: Sold to several clients: Pistachios 2.000KR 205/Kg Almonds: 2.sook @ 11$/kg $40.000 $ 27.500 Peanuts: 3.000KR. 75/kg $ 21.000 February 6: Sold to Fruits Lovers Inc.: Pistachios: 500K20SAKR $ 10.000 Almonds: 1.DOORS/kg $ 11,000 Peanuts: 1.500kg 85/Kg $ 12.000 February 12 Purchase of Pistachios: Purchase of almonds: SKD 245/KR 2.000kg / $ 21.000 $ 16.000 February 13: Sale of peanuts to Peanuts Lovers Inc: 3.500KR. 85/kg $28.000 February 14: Purchase of Peanuts 6.000 KLASIKE $24.000 February 19: Sold to several clients Pistachios: $ 21.000 Almonds: 1000K 225/ 1 SOKE DANSKE REDSKE $ 19.500 $ 27.000 Peanuts: February 25: Purchased from various suppliers Pistachios 2000KS S 13.000 Almonds: $9.000 1.000Kg 99/kg 1.000Kg @ 4S/Kg Peanuts: $ 4.000 Besides these transactions, the company has had the following expenses: Salaries: $3500 Electricity bill: $300 Renting of equipment: $800 Rent of warehouse and office: $1.500 Miscellaneous: $1.200 Jim's accountant recommended that he should use the average cost method in order to determine the cost of the inventory sold but he is not sure about the consequences it may have on his financial situation Relying on your accounting knowledge, Jim asks you the following questions: 1: Why in your opinion did Jim's accountant recommend the average cost method and what difference is there with the three other methods? Explain the main characteristics of each method of valuation of the inventory and the consequences they may have on the valuation of the inventory and determination of the net income in case of price fluctuation. (20 points) 2: Prepare an income statement of the company at the end of February using as method of valuation of the inventory the average cost method, FIFO and UFO for each one of the products sold by Jim, and calculate the balance of the inventory at the end of the month. Explain the calculations. (40 points: 30 points for the calculation and 10 for explanations) 3: In order to compare with the records made by his accountant, Jim asks you to prepare the different journal entries for the purchases and sales mentioned above for each one of the 3 different methods used above. 115 points) 4. Jim's accountant insisted that he should use a perpetual inventory system instead of a periodic inventory system and the average cost method for valuating the inventory. Do you agree with this advice justify your answer)? Would the balance of the inventory at the end of the month be the same? And the net income? (15 Doints Slim would like to know a forecast of the number of days to sell the inventory based on the results of the month of February. Explain your calculation and the steps followed. (10 points for calculation and for explanation) 6. Jim expects that the prices of the merchandises will dramatically decrease in the next future as a result of the Covid 19 crisis. Which method of valuation of the Inventory would you thus recommend to Jim? Explain your answer. 5 points) 8-8.9 2.79 Descriptor The student demonstrates an excellent understanding of the concepts The student demonstrates a good understanding of the concepts The student demonstrates a fair understanding of the concepts The student demonstrates some, but insufficient understanding of the concepts The student demonstrates insufficient understanding of the concepts They may mention some relevant ideas or concepts, although it is clear that the relationship between them is not understood by the Student The student demonstrates insufficient understanding of the concepts and does not mention any relevant ideas or concepts The student leaves the question blank or cheats based on the presentation and look & field of the spreadsheet 95% of the grade based on the approach, calculations and comments and Points are at the end of each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts