Question: BE CLEAR PLEASE. THANK YOU! We are evaluating a project that costs $787,000, has a life of 7 years, and has no salvage value. Assume

BE CLEAR PLEASE. THANK YOU!

BE CLEAR PLEASE. THANK YOU!

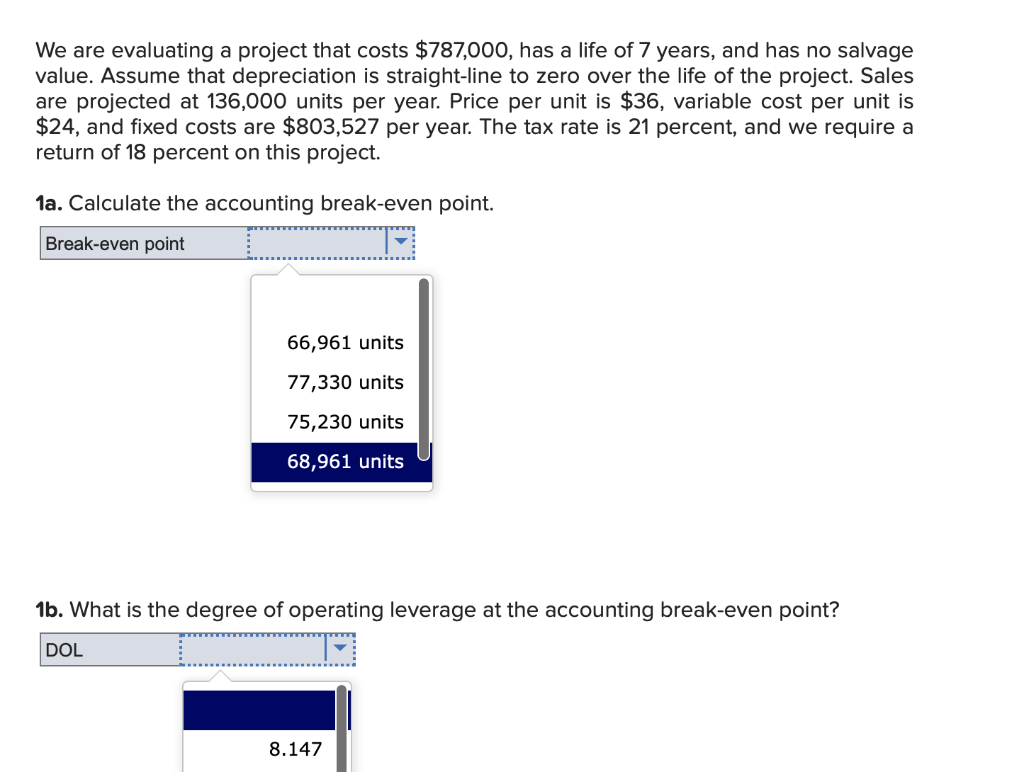

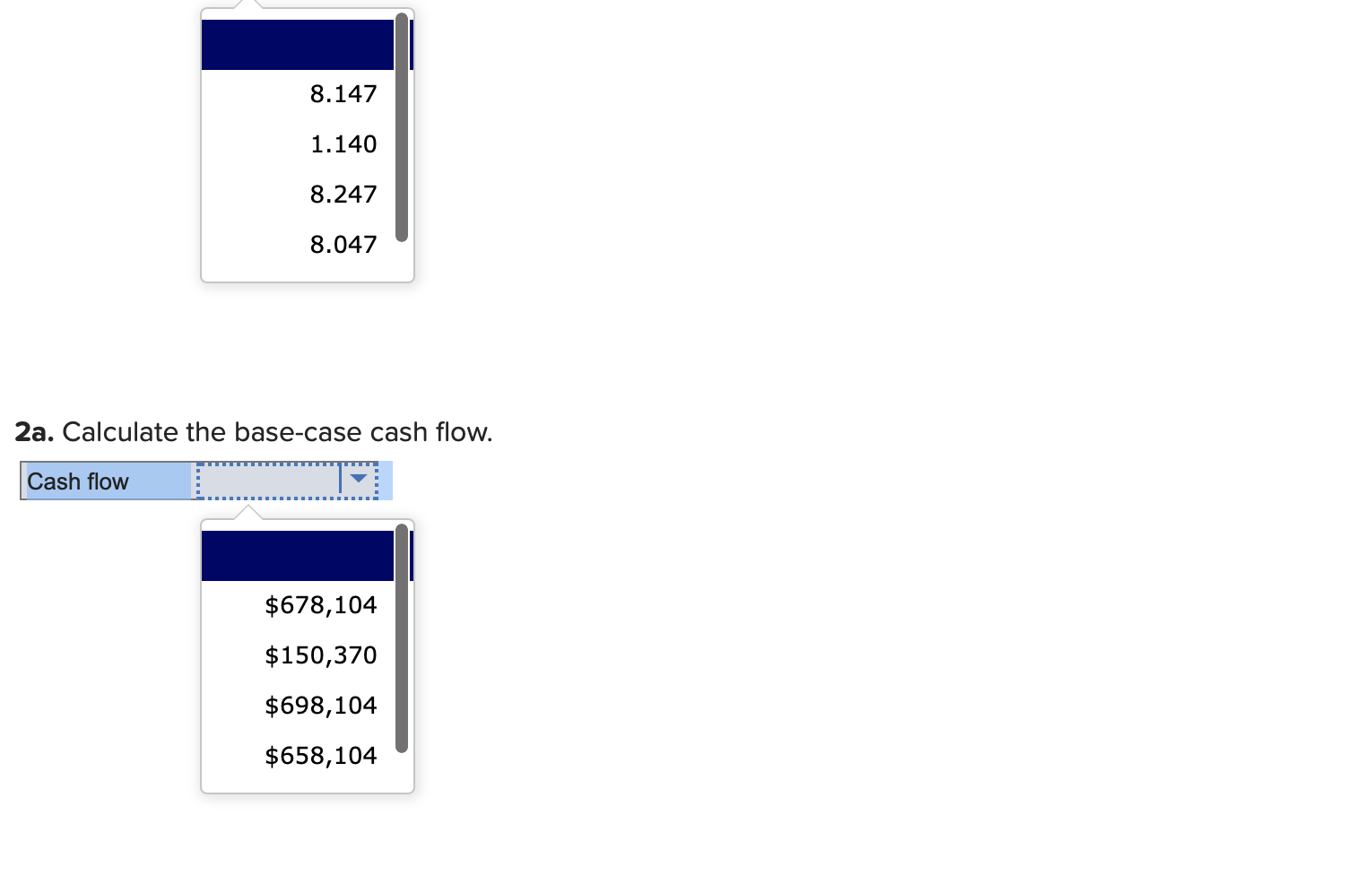

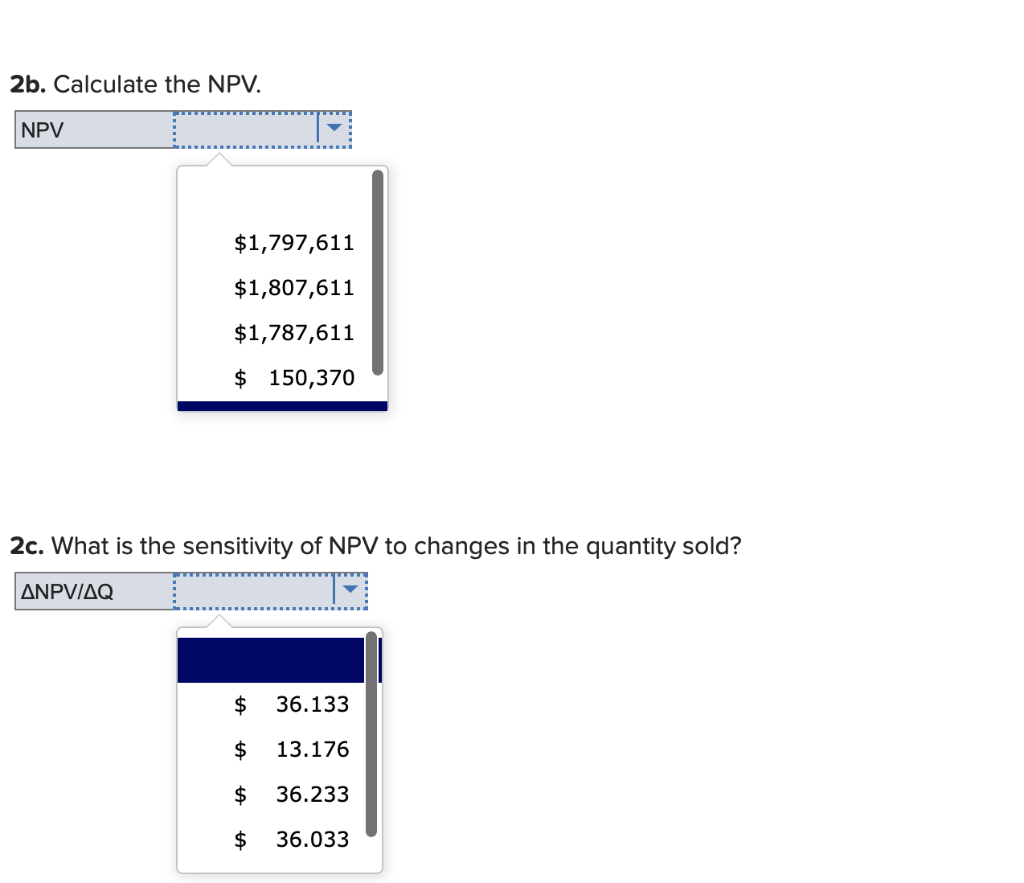

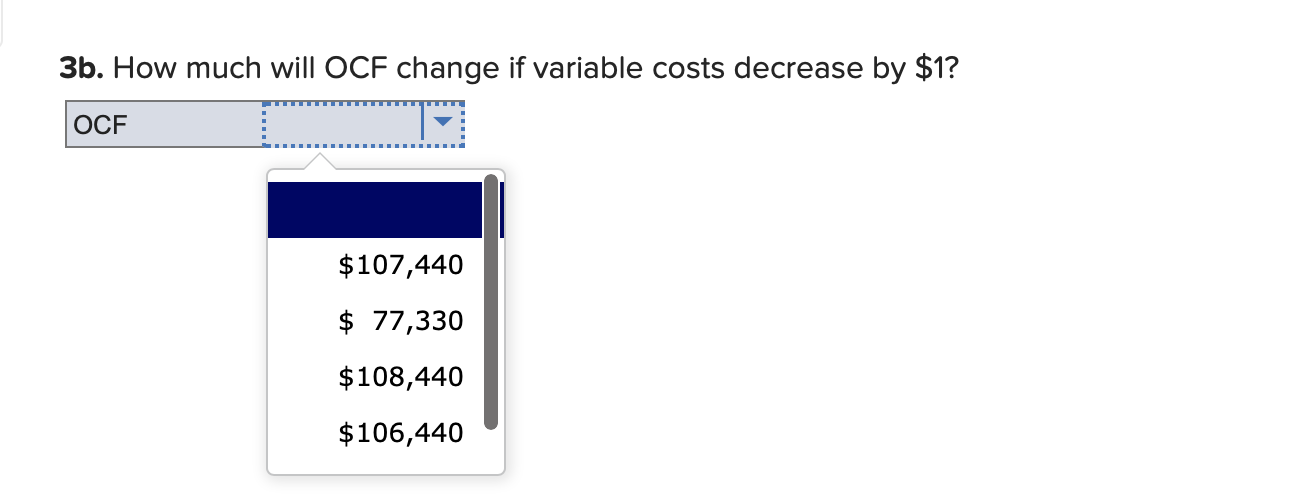

We are evaluating a project that costs $787,000, has a life of 7 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 136,000 units per year. Price per unit is $36, variable cost per unit is $24, and fixed costs are $803,527 per year. The tax rate is 21 percent, and we require a return of 18 percent on this project. 1a. Calculate the accounting break-even point. Break-even point 66,961 units 77,330 units 75,230 units 68,961 units 1b. What is the degree of operating leverage at the accounting break-even point? DOL 8.147 8.147 1.140 8.247 8.047 2a. Calculate the base-case cash flow. Cash flow $678,104 $150,370 $698,104 $658,104 2b. Calculate the NPV. NPV $1,797,611 $1,807,611 $1,787,611 $ 150,370 2c. What is the sensitivity of NPV to changes in the quantity sold? ANPVIAQ $ 36.133 $ 13.176 $ 36.233 $ 36.033 2d. What your answer tells you about a 500-unit decrease in the quantity sold? NPV drop $ -18,066.64 $-150,370.00 $ -19,066.64 $ -17,066.64 3a. What is the sensitivity of OCF to changes in the variable cost figure? AOCFIAVC $-107,440 $ -77,330 $ -76,330 $-108,440 3b. How much will OCF change if variable costs decrease by $1? OCF $107,440 $ 77,330 $108,440 $106,440

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts