Question: be in details THMG 310-001, Spring 2022 Assignment 4, Chapters 7 & 8 Total - 64 marks Due: Friday, March 11, 2022 a Question 7

be in details

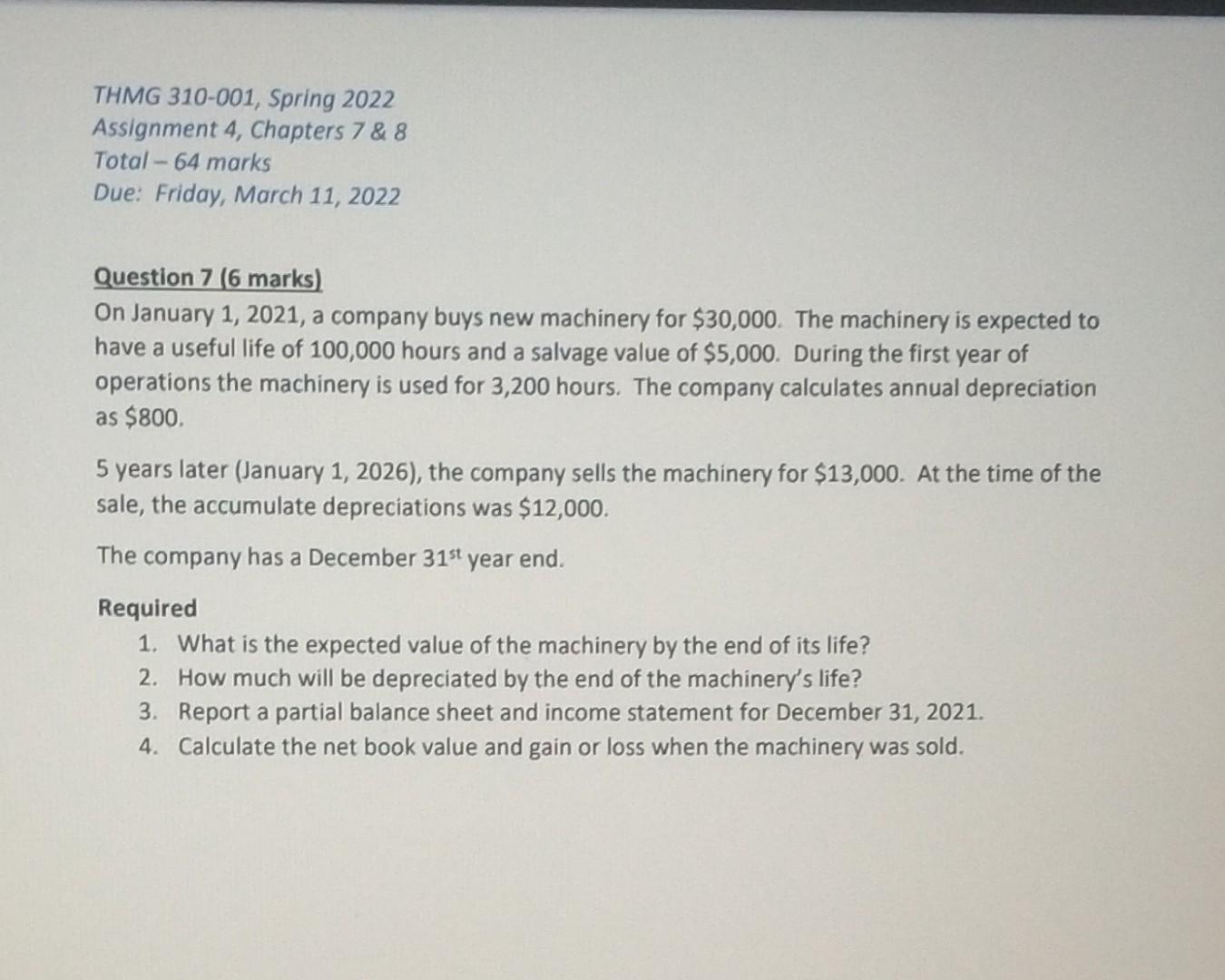

THMG 310-001, Spring 2022 Assignment 4, Chapters 7 & 8 Total - 64 marks Due: Friday, March 11, 2022 a Question 7 (6 marks) On January 1, 2021, a company buys new machinery for $30,000. The machinery is expected to have a useful life of 100,000 hours and a salvage value of $5,000. During the first year of operations the machinery is used for 3,200 hours. The company calculates annual depreciation as $800 5 years later (January 1, 2026), the company sells the machinery for $13,000. At the time of the sale, the accumulate depreciations was $12,000. The company has a December 31st year end. Required 1. What is the expected value of the machinery by the end of its life? 2. How much will be depreciated by the end of the machinery's life? 3. Report a partial balance sheet and income statement for December 31, 2021. 4. Calculate the net book value and gain or loss when the machinery was sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts