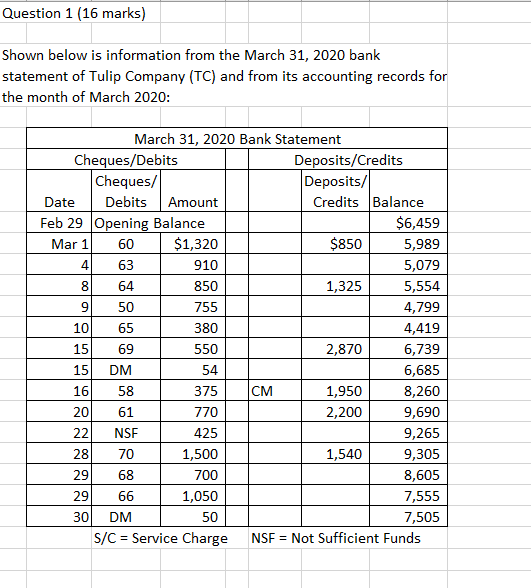

Question: Question 1 (16 marks) Shown below is information from the March 31, 2020 bank statement of Tulip Company (TC) and from its accounting records for

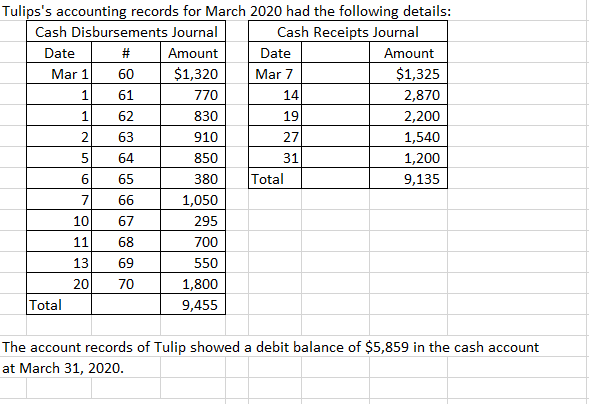

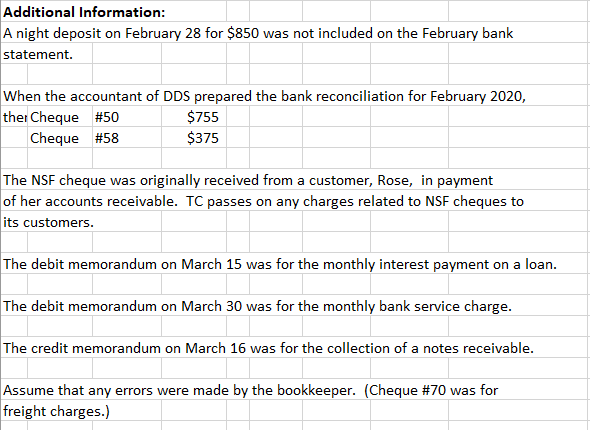

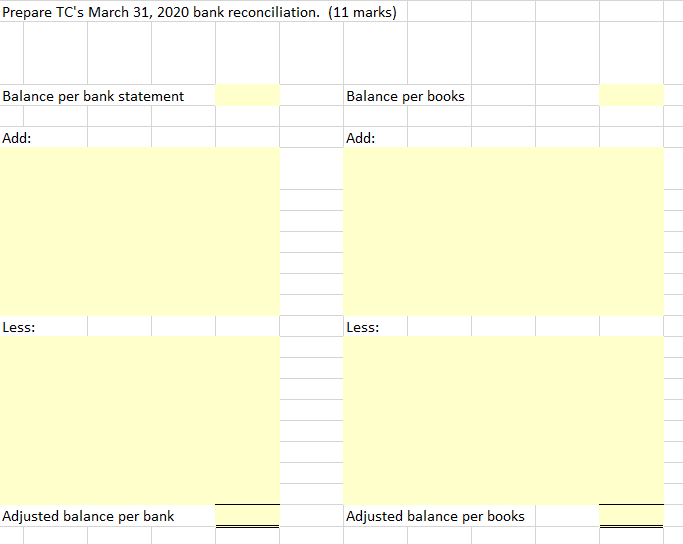

Question 1 (16 marks) Shown below is information from the March 31, 2020 bank statement of Tulip Company (TC) and from its accounting records for the month of March 2020: March 31, 2020 Bank Statement Cheques/Debits Deposits/Credits Cheques/ Deposits/ Date Debits Amount Credits Balance Feb 29 Opening Balance $6,459 Mar 1 60 $1,320 $850 5,989 4 63 910 5,079 64 850 1,325 5,554 9 50 755 4,799 10 65 380 4,419 15 69 550 2,870 6,739 15 DM 54 6,685 16 58 375 CM 1,950 8,260 20 61 770 2,200 9,690 22 NSE 425 9,265 28 70 1,500 1,540 9,305 29 68 700 8,605 29 66 1,050 7,555 30 DM 50 7,505 S/C = Service Charge NSF = Not Sufficient Funds Tulips's accounting records for March 2020 had the following details: Cash Disbursements Journal Cash Receipts Journal Date # Amount Date Amount Mar 1 60 $1,320 Mar 7 $1,325 1 61 770 14 2,870 1 62 830 19 2,200 2 63 910 27 1,540 64 850 31 1,200 6 65 380 Total 9,135 7 66 1,050 10 67 295 11 68 700 13 69 550 20 70 1,800 Total 9,455 The account records of Tulip showed a debit balance of $5,859 in the cash account at March 31, 2020. Additional Information: A night deposit on February 28 for $850 was not included on the February bank statement. When the accountant of DDS prepared the bank reconciliation for February 2020, ther Cheque #50 $755 Cheque #58 $375 The NSF cheque was originally received from a customer, Rose, in payment of her accounts receivable. TC passes on any charges related to NSF cheques to its customers. The debit memorandum on March 15 was for the monthly interest payment on a loan. The debit memorandum on March 30 was for the monthly bank service charge. The credit memorandum on March 16 was for the collection of a notes receivable. Assume that any errors were made by the bookkeeper. (Cheque #70 was for freight charges.) Prepare TC's March 31, 2020 bank reconciliation. (11 marks) Balance per bank statement Balance per books Add: Add: Less: Less: Adjusted balance per bank Adjusted balance per books Prepare the March 31 adjusting entries necessary based on your reconciliation above. (5 marks) Date Account Titles Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts