Question: Be sure to explain your answer and show all work. Thanks! Appendix A - TESLA's financial inputs required to answer for questions 1-3 Using the

Be sure to explain your answer and show all work. Thanks!

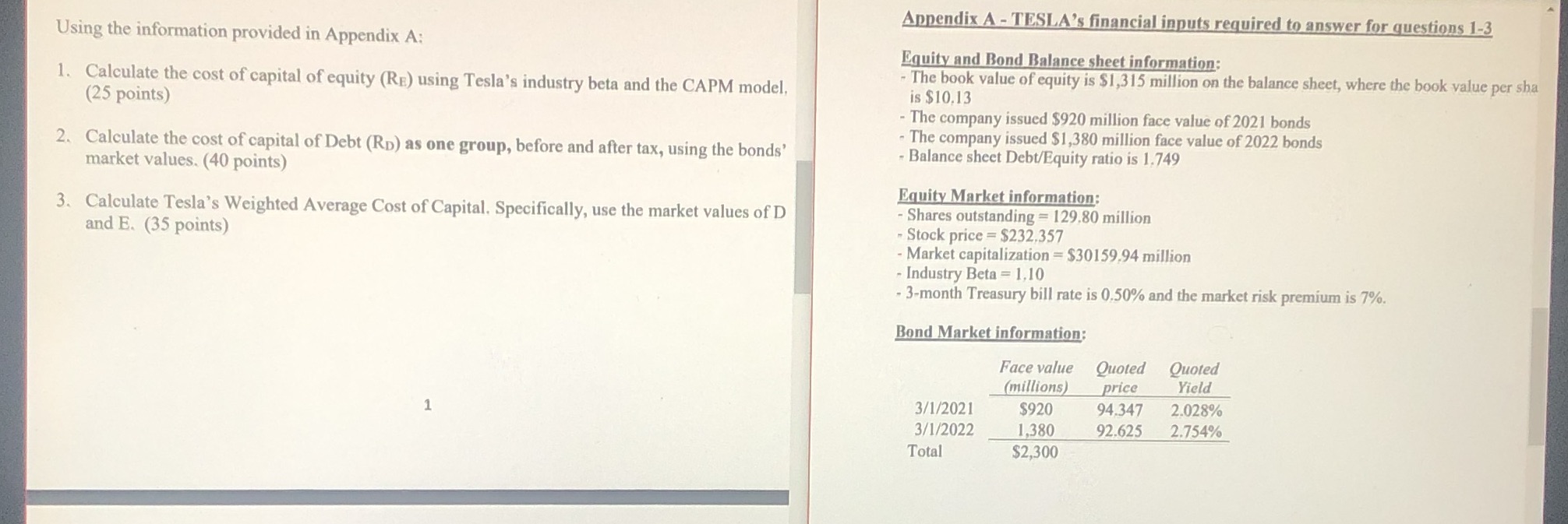

Appendix A - TESLA's financial inputs required to answer for questions 1-3 Using the information provided in Appendix A: Equity and Bond Balance sheet information: 1. Calculate the cost of capital of equity (RE) using Tesla's industry beta and the CAPM model, The book value of equity is $1,315 million on the balance sheet, where the book value per sha (25 points) is $10.13 - The company issued $920 million face value of 2021 bonds - The company issued $1,380 million face value of 2022 bonds 2. Calculate the cost of capital of Debt (RD) as one group, before and after tax, using the bonds' - Balance sheet Debt/Equity ratio is 1.749 market values. (40 points) Equity Market information: 3. Calculate Tesla's Weighted Average Cost of Capital. Specifically, use the market values of D Shares outstanding = 129.80 million and E. (35 points) Stock price = $232,357 - Market capitalization = $30159.94 million - Industry Beta = 1,10 - 3-month Treasury bill rate is 0.50% and the market risk premium is 7%. Bond Market information: Face value Quoted Quoted (millions price Yield 1 3/1/2021 $920 94.347 2.028% 3/1/2022 1,380 92.625 2.754% Total $2,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts